What Happened Last Week and What It Means to You: June 17th, 2022

Week Ending June 17th, 2022

Excuse the movie titles. It is the first time I have been to a theater since COVID and yes, Top Gun was awesome!!!

Buzz Light Year, I mean Inflation…

To infinity and beyond. Both bad for business. Ask Disney. Inflation is now pricing the average family out of the parks. A one-day park hopper Tier 6 pass is $215 for kids 3-9 and $224 for ages 10 and up.

What does it mean – Inflation beyond anything we have seen in this country since the 1970’s if we do not get energy back under control and regain our energy independence. In the late 70’s, energy independence was the sole reason for creating the Department of Energy. It has done nothing but create more rules and regulations and has provided the federal government nearly 50 years of excuses to mess with American energy independence. Another example of, “I am from the government, and I am here to help.” Yikes. How’s that working for us?

Here is what really matters to most Americans:

• The food index was up 1.2% month-over-month in May and up 10.1% year-over-year. A heck of a lot worse if you actually eat real meat and vegetables and fruit.

• The energy index was up 3.9% month-over-month in May and up 34.6% year-over-year. Just wait until you start seeing your regulated electric bill start going up at record levels.

The Hangover…

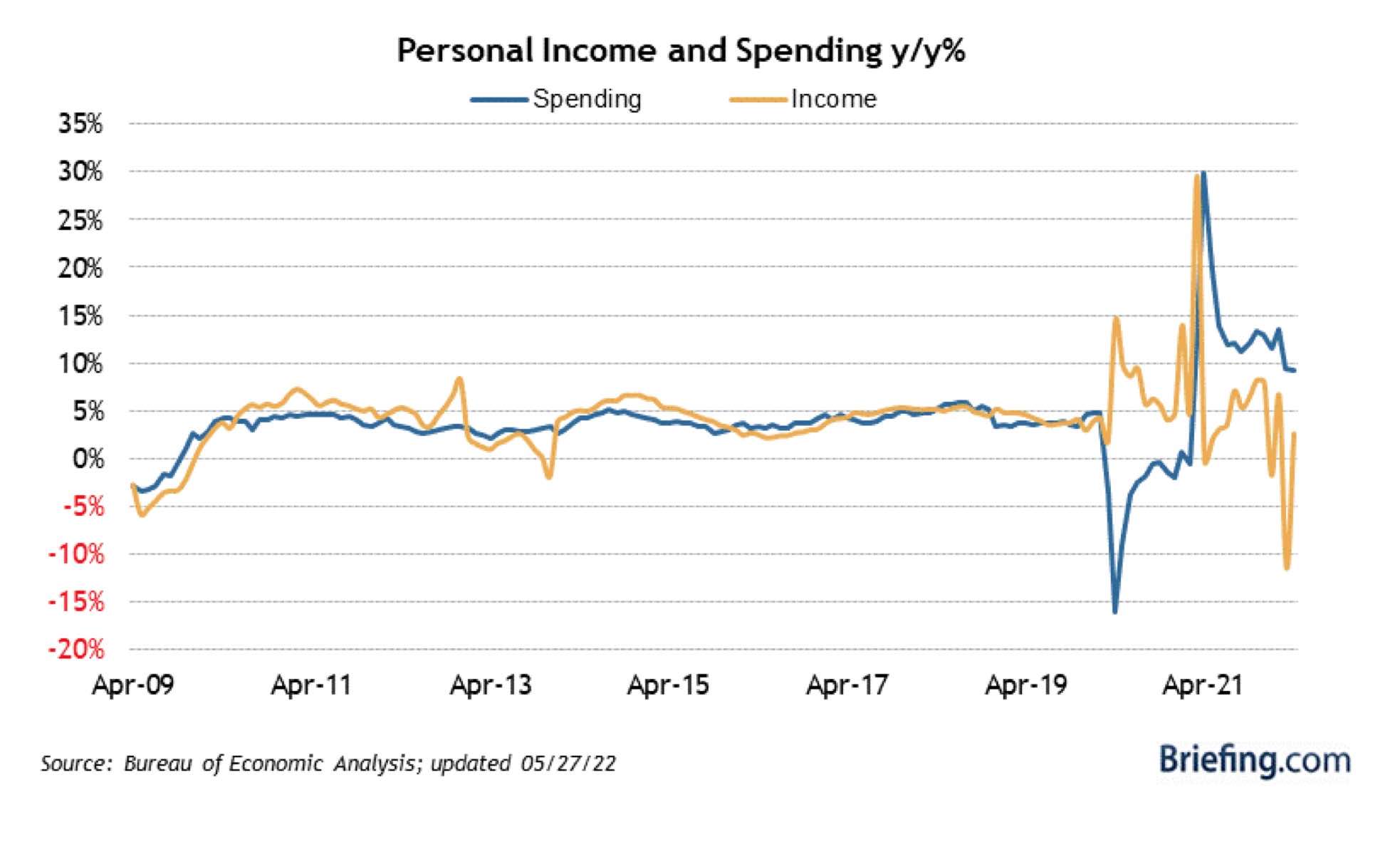

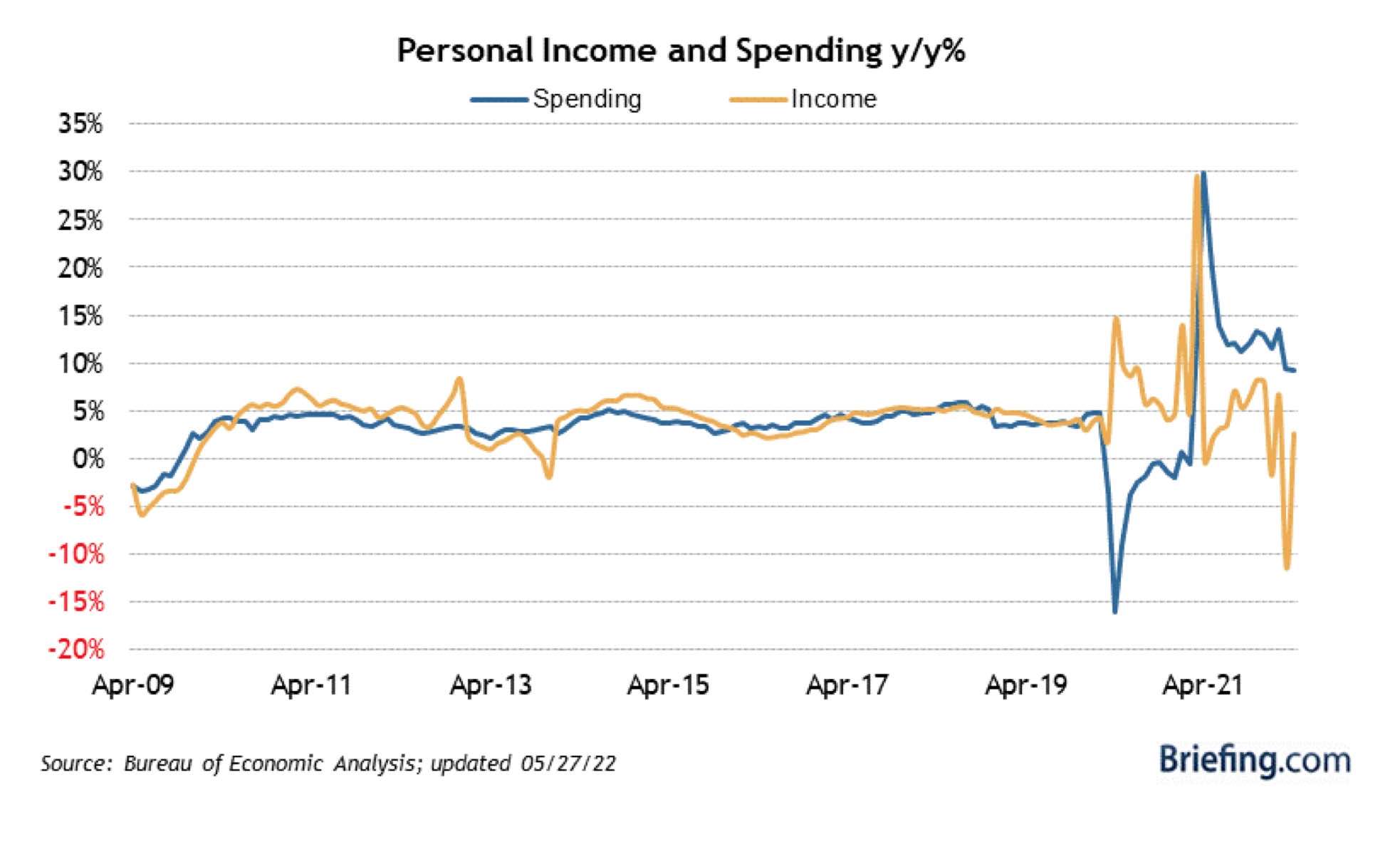

Personal spending is falling off after an amazing time online. Stimy-boats, stimy-flatscreens, stimy-phones, stimy-RV’s, stimy too much money?

What does it mean – An Amazon life for me. See the chart below – The yellow spikes are the stimulus checks. Our government handed out $ trillions on behalf of you, the taxpayer, to many of your fellow citizens who went online and ordered trillions of goods from Amazon, Walmart, etc. While it was great for many companies it accelerated the adoption of new fitness equipment, technology and leisure equipment like boats, RV’s, and outdoor equipment. Now the stimulus checks have come home to roost and real wages are falling. Free money from the government is slowing or gone unless you live in CA and are addicted to drugs. Our current administrations solution is to spend trillions more on handouts. How do you think that will turn out?

First comes record inflation…

Then comes record interest rate hikes.

What does it mean – The highest increase in interest rates since 1994. After record increase in inflation the Fed was forced to meet the pain with more pain for consumers. Only issue is they are still behind the “8” ball and will need to continue to catch up if they can not get this under control. One solution would be for our current leaders to abandon their flawed ideology. The other is a hard landing and a recession. Both will be painful, but one will lead to less government and bureaucracy, which got us here in the first place. The question is, will the government save you or will you save yourself and by doing so help the ones you love? Understand cash flow. For many it will change rapidly.

Target…Targets CEO says, “We are in an environment many of us have never seen before”.

What does it mean – Study history. Mark Twain once reminded us that, “History never repeats itself, but it does often rhyme”. Due to inflation, Inventories are way up. We are seeing price destruction. People are walking into stores and looking at the prices and walking out. Target plans to aggressively sell off inventory to get it out the store. This is going to hit margins hard and this is great for large corporations but will destroy the mom and pop stores that can not afford to sell off inventory to compete with companies that are large enough to handle the losses.

Just another case of the government trying to help. Will someone please tell our elected and unelected bureaucrats to study history. We have been here, done it, and got the shirt. President Biden should know this; he was in congress when the Carter administration tried this in the 70’s.

The noise is loud…

Economists and prognosticators are filling the airwaves with noise. Most of it useless.

What does it mean – Remember about 4 months ago nearly every prognosticator and market analyst was telling you we would see at most four .25% increases by the Fed? Remember about 18 months ago the Biden administration, the Fed, presidential economic advisor, Mark Zandi and Janet Yellen, all told us that inflation would be transitory or would fade as the Chinese virus fades? Not so true. Inflation does not fade, nor does it just show up. It is usually the result of bad fiscal and monetary policy.

Businesses can not survive with out the rule of law…

Across the country the rising cost of living, lack of accountability, threats to our legal system and to judges families, doxing of people that you may not agree with.

What does it mean – All of the above is leading to chaos and the destruction of society.

Daymond Jon, the founder of FUBU and member of The Shark Tank and an entrepreneurial legend, sent this video out on LinkedIn. It says it all, Dad’s we can all do a bit more. Love is time. Dads, our countries future depends on your time.

Enjoy the video and hope you all had a great Father’s Day. https://www.youtube.com/watch?v=OdPaqt6RY_Q

Let’s roll America,

Doug De Groote, CFP®, MBA, CTC

Managing Director