What Happened Last Week and What It Means to You: August 26th, 2022

Week Ending August 26th, 2022

Initial jobless claims below 250,000…

Labor market conditions remain tight.

What does it mean – This number will not help the fed out as they continue to fight inflation with higher interest rates.

Strong labor market…

While the numbers do not reflect the labor participation rate, payrolls in red states continue to outpace the fallout or contraction from blue states.

What does it mean – If you want a job and opportunity to earn more, low-tax states that shrink the government and protect the rule of law are attracting employers and employees as fast as CA, NY, NJ, IL, MD, MA and others can push them out. Policy truly does matter. This is adding to the Feds problem of wage-based inflation. Demand for labor in growing states continues to befuddle proponents of “Big Government”. Florida was just named Number One in fiscal and economic freedom. It goes without saying it is also at the top in overall freedom. I guess that throws wrench in to the media and this administration thoughts about fascism. Free people truly do flourish.

As China falls…

Reshoring continues in the manufacturing sector and across multiple industries.

What does it mean – Let them know you are glad they are back. Manufacturing continues to come back as China loses its luster and becomes more of a risk for many companies than a benefit. According to the Reshoring Initiative, 2022 could lead to a record 350,000 jobs coming back to the US due to China’s behavior, but most importantly, tax policy that was put in place in 2017 to bring companies back to the US and to make it easier to repatriate funds from overseas business activity.

Yet, with the signing of Manchin bill, our elected leaders risk making this more difficult by mandating a higher minimum wage, increasing corporate taxes from 21% to 28%, inefficient and less dependable energy needed for manufacturing, higher local transportation costs and increasing bureaucracy on businesses trying to come back to the US. Let’s not let governments greed and envy of the private sector squeeze the American dream.

New home sales down 29.6%…

Year-over-year new home sales continue to fall.

What does that mean – The adverse impact of rising mortgage rates and high home prices on overall demand is evident in the increased supply of new homes for sale.

Existing home sales across regions falls 5.9% month-over-month…

The numbers across all regions where down. Northeast (-7.5%); Midwest (-3.3%); South (-5.3%); and West (-9.4%).

What does it mean – Like new home sales, existing home sales are also getting hit with rising interest rates. Existing home sales also saw inventory of homes for sale at the end of July up 4.8% month-over-month. Yet, existing home prices for all housing types increased 10.8% year-over-year for the 125th consecutive month.

ESG’s are destroying Europe and the US will follow…

ESG’s (Environmental Social and Governance) have forced Europe to shut down efficient and clean nuclear and natural gas power plants and now they are being held hostage by Russia and China. This has caused Germany to reopen less efficient coal fired energy plants and for its citizens head to the forests to gather wood for the winter to stay warm and heat their homes. Sharpen your ax folks.

What does it mean – Europe is headed to the Dark ages in the name of controlling what it cannot. All of Europe is warning of higher natural gas prices, higher oil prices, higher energy prices which mean higher utility prices, higher fertilizer prices, food shortages and massive inflation. Utility prices in Europe are expected to rise 80% in just the month of October. And this started way before Russia invaded Ukraine.

Can you imagine the audacity it must take to tell your grandma she can’t heat her home or keep her food from rotting because the climate is changing. If the current leadership believes that they can control a planet that has fostered life through volcanoes, floods, and natural disasters of Biblical proportion since the beginning of time.

Europe is headed backwards and dragging western civilization with it. It is leading its people down a path of servitude. The German Chancellor and President Macron want more power in the hands of unelected bureaucrats and more control for the European Union and less for its member states including their own countries. The scary part is they are achieving it through environmental fear mongering, illegal immigration, never-ending fear of the next new “COVID” worry, and the constant destruction of the nuclear family and out of control crime. Sound familiar?

The ruling class elite are so bold, they are telling you to stop worrying about grandma or your kids. In fact, President Biden recently said, “Get used to it.” I guess we all need to just stop looking at reality and listen to our Fuhrer. After all, they are from the government, and they are here to help. Here is a perfect example of unelected German representatives to the UN during a speech warning them about their unholy alliance with Russia. https://www.youtube.com/watch?v=FfJv9QYrlwg

20 million Americans are behind on their utility bills…

According to NY comptroller 1 in 8 New Yorkers are behind in their electric bill.

What does it mean – What did you think would happen when you cut the production of natural gas, nuclear, and coal for the sake of global warming? Prices skyrocketed and now the utility companies are forced to raise rates beyond the average American’s ability to pay. Without dependable low-cost energy your fellow American’s are more likely to freeze this winter than die from global warming.

Saudi lied and United Arab Emirates (UAE) is at capacity…

Caught in a lie, Saudi Arabia’s real reserves may be closer to 80 billion barrels. UAE tells Macron they are at capacity. “No more excess oil.”

What does it mean – Saudi Arabia’s comments about its hydrocarbons industry have long been regarded by industry experts as being as believable as China’s comments about its economic growth. Regardless, in the short-run, oil prices are going up.

There is good news. We have a solution. The safest, cleanest drillers on the planet are available. Miles upon miles of on-shore and off-shore oil fields filled with oil and natural gas. Mountains of coal ready for the taking. The manpower is ready, the equipment is available. It is our very own country. Yes, the United States of America is the solution.

The problem. The current administration has shut down refining capacity, stopped issuing leases to drill on federal land, encouraging citizens to drive electric cars they can not afford whose charging stations are powered by non-existent solar and wind farms that kill the insects, birds (what will that do to food production and the environment?), and make the planet hotter and are built by inefficient and dirty coal burning plants in China.

The great give away…

Nothing worthwhile is free. Just look at higher education. It has become a disaster. Eisenhower warned us of the industrial military complex and Reagan issued his famous warning about education and the teaching of our youth in his farewell speech to the nation. Reagan asked, “Are we doing a good enough job teaching our children what America is and what she represents in the long history of the world?” Eisenhower put it this way, “Our toil, resources, and livelihood are all involved. So is the very structure of our society. In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex. What we should be worried about is our children’s education and the indoctrination of our children by the education-industrial complex.

What it means – Biden is going back to the Hero’s Act designed for helping soldiers when we were attacked on 9-11. There is no standing or ability for the President to allow the government to cancel $500 billion in student loans. This is illegal and adds up to buying votes at the cost of investors and taxpayers. Remember too big to fail… This administration is trying it again. This time it is not the auto industry but people investing in degrees that will never earn enough to pay for the loans.

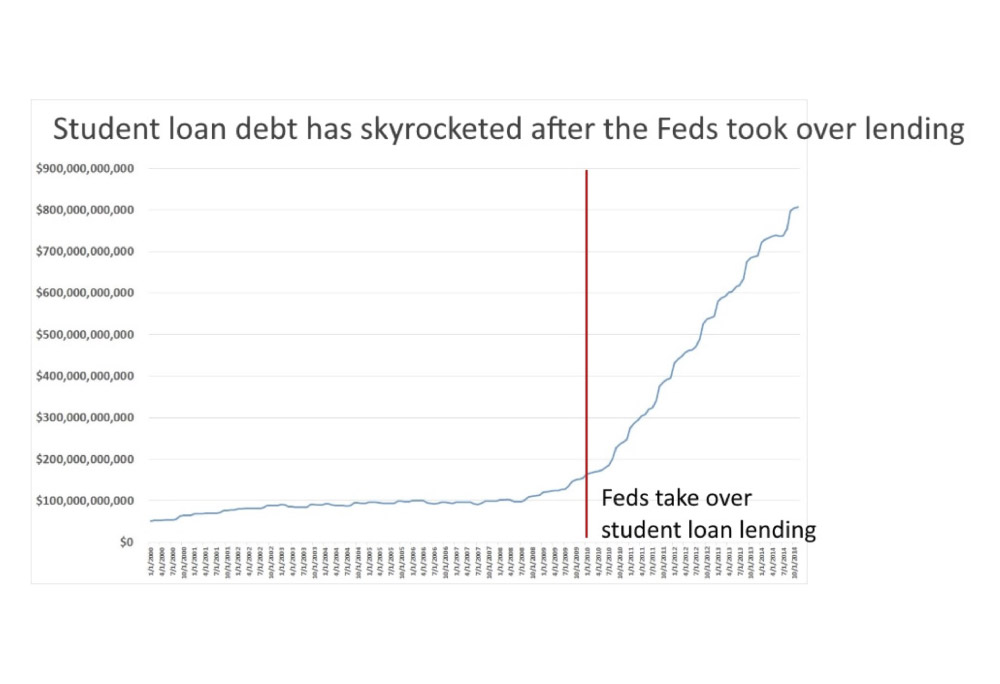

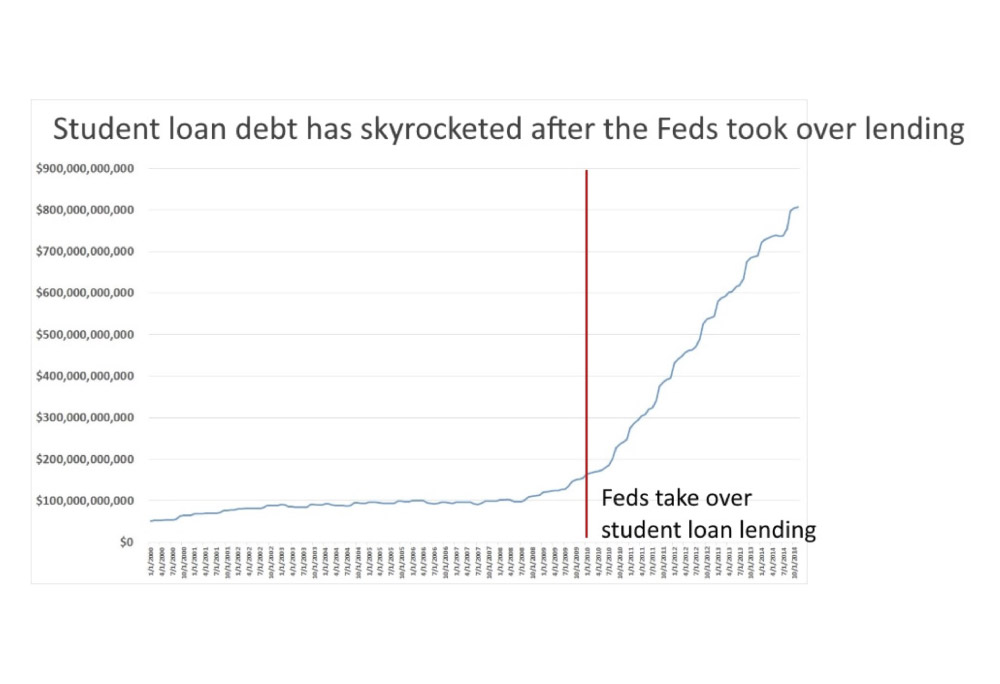

How it happened – In 2010 under the Obama administration and the excuse that education was too expensive, and the private lending done under banks was unfair. Obama and the democratic congress nationalized the entire education lending sector. No longer did banks lend on one’s ability to pay back the loan based on the potential that could be earned with achieving a degree in a particular field of study. For example, students who earn degrees in engineering will make more money so the banks were willing to lend more vs. a degree in gender studies. Now the government lends regardless of what you are getting your degree in. With such moral hazard why wouldn’t Harvard raise tuition by 30% or the UC system more than double tuition over the last 12 years? Here is what happened to student debt after the government took over.

The Scam – The universities spent $130 million lobbying to get this loan forgiveness done. You must ask yourself why?

What is DEI – Diversity, Equity and Inclusion. In the name of “ism’s” schools must make life fair. They created DEI departments. The universities needed the money to pay for the bloated overhead created by all the costs of the new DEI departments, staffs, and the high operating overhead of all the amenities they now offer.

- So, they raise tuition, and then convince students to take out loans to cover the tuition which is really to cover their inflated operating budget.

- The question turned from what are you going to study? To, where are you going to college? No one wants to be left out of the fun, so students want to attend the very best your government can afford. So, they borrow, not understanding the economics of what they are doing.

- Unlike the banks before 2010, the government makes the loan with no assessment of ability to repay, or if the course of study is one that will provide a job paying enough to cover repayment.

- Harvard, Yale, USC, Stanford, and every school in between get its operating costs covered by getting the students to borrow the needed working capital to operate the school.

Uninformed donors – My favorite part (full disclosure – I am guilty of this). Wealthy donors who want their kid or grandkids admitted donate into the school’s huge endowment which is just a giant investment portfolio.

- So now the university has gotten the student and the government to cover their operating costs, with zero liability to the university for the borrowed funds.

- Meantime they have courses like gender studies, or others that have zero value to the student or employers when they graduate.

Total scam. As of 2019 there are now over 500 bachelor’s degree programs. Over half evolved or were created in the last 15 years. And to add insult to injury, if you do not like the degree program at your university some schools will allow students to create their “own path”. Oh, did I tell you that the DEI departments are throwing out civil rights and now encouraging and allowing black only housing and graduations. Forcing complete areas on campuses at Cal, UCLA, and many other universities where white kids are not allowed. Yes, your tax dollars hard at work destroying civil rights.

If this payoff is allowed it will change how you invest in debt and the cost of capital for businesses, education, housing, everything. This is not a political issue. It is a moral issue that will impact your business how you borrow, and how you invest. It will change the value of a contract. This is bad for America, bad for business, bad for investors and will make it even worse for generations to come.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director