What Happened Last Week and What It Means to You: Week Ending September 8, 2023

Week Ending September 8, 2023

Today is September 11, 2023…Please take a moment to pray for our country and remember all of those who passed on 9/11 and the Men and Women who sacrificed all to protect our country and keep us free.

“Let’s Roll”…Todd Beamer 9/11/2001

The Wall Street and the Fed quietly root for more unemployment… Don’t be fooled by wishful thinking. Believe your eyes and ears. Ignore the noise. The so-called unaccountable experts in government created this. I will bet on the awakening of the American citizen to get this right.

What does it mean – As they say in DC, never let a crisis go to waste. There are clear signs of softening in the employment situation, including a decline in temporary positions, an uptick in the percentage of workers unemployed for 27 weeks or more, and a pickup in the U6 unemployment rate, which accounts for underemployed workers. According to Briefing.com “That softening is exactly what the Fed has been expecting to see — and hoping to see — in response to its campaign to get inflation back down to its 2.0% target.” The problem is. $4 Trillion more in spending and a President committed to raising energy prices regardless of the cost to our economy will lead to more inflation and without the rule of law more organized shoplifting further driving up the cost to the consumer and the American citizen.

Typical government. Where and when has a centralized government ever fixed main street? Instead of fostering growth, protecting the rule of law, cutting taxes, reducing regulation, and freeing the entrepreneur engine that built this nation, the socialist in DC increase regulation, increase fees, taxes, and limit access to energy and capital and create a larger dependency on government programs further entrapping our citizens to a life of squalor. Expect more difficulty to come.

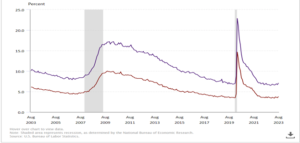

U-6 Unemployment vs. U-3…The government has 6 different ways it reports unemployment. And still can’t get reality right. U-6 is 7.1% vs U-3 at 3.8%.

What does it mean – Depending on what you want to know or how you hope it looks, statistics can be manipulated and are every day when it comes to the administrative state. On Main Street you are either fully employed, retired, going to school, working part time, or unemployed and or under employed and looking for more work or a better job. In the Chart below U-6 in purple measures the percentage of the U.S. labor force that is unemployed, plus those who are underemployed, marginally attached to the workforce, and have given up looking for work. While the red line is what the government reports as the unemployment rate. What really should matter is how many people are unemployed and want to work. Today that number is over 5.4 million Americans. In September of 2016 it was over 6 million Americans looking for work and prior to the forced shutdown by so-called experts it was 4,760,000 Americans seeking employment and almost back to the numbers prior to the 2008 recession.

Inflation could be on the rise…On a year-over-year basis, total CPI was up 3.2%, versus 3.0% in June, and core CPI was up 4.7%, versus 4.8% in June.

What does it mean – Expect to see the pain at the pump reflected in the July and August reports. Given the jump in oil and gas prices in July and August expect the pain to be felt on main street while the pundits on Wall Street and the media go into hyper drive to talk the fed down.

The Conference Board’s Consumer Confidence Index slumped to 106.1 in August…Revised down from expectations of 117.0 in July according to The Consumer Conference Board and Briefing.Com estimates.

What does it mean – optimism about employment conditions and inflation negatively affected consumers’ view of the present situation and outlook. The same report shows inflation expectations are heading back up from a current expectation in June of 5.7% to 5.8% in July. Mostly due to rising energy costs.

Reuters reports, “U.S. manufacturing sector stabilizing at weaker levels in August”… With headlines like this, it is no wonder people scratch their heads.

What does it mean – What Reuters meant to say is we are just not falling as fast as we did the last few months.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.