What Happened Last Week and What It Means to You: Week Ending August 25, 2023

Week Ending August 25, 2023

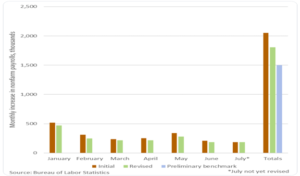

Bureau of Labor Statistics (BLS) revises year over year jobs numbers down by 306,000…The U.S. added fewer jobs from March 2022 to March 2023 than was previously announced, according to a preliminary revised estimate on Wednesday.

What does it mean – The BLS has an amazing record for overshooting the numbers over the last couple of years. Job gains this year have already been revised down heavily, Jan – Jun have all been revised lower (unusual) by an aggregate of 245k jobs.

According to the BLS, these counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file,” the release from the BLS reads. “For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus one-tenth of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates a downward adjustment to March 2023 total nonfarm employment of −306,000 (−0.2 percent).” Not that we are counting, but the downward revision is consistently almost double reality to the downside causing many to wonder if this government agency has also become a political tool of this administration. In fact, nearly 25% of the jobs we thought we created were not real.

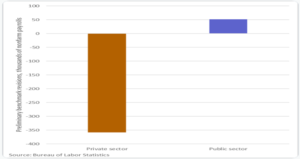

One thing that is growing is your government and what you will have to pay for it. Government jobs increased by 50,000, while the private sector actually loss 356,000 jobs.

Not to mention, on Thursday the 24th, our US Justice Department filed a lawsuit against Elon Musk’s SpaceX on Thursday over its hiring practices, accusing Elon Musk’s rocket company of discriminating against asylum seekers and refugees. You just can’t make this stuff up. You have to ask yourself why would the DOJ go after Elon Musk and his companies?

Durable goods orders dropped sharply last month…Durable goods orders declined 5.2% month-over-month in July.

What does it mean – Weakness was driven by transportation. Business spending was slow. Excluding aircraft, it came in at 0.1% increase for new orders for nondefense capital goods. Durable goods orders continued to struggle as inflation remains stubborn and interest rates continue to go up.

August US PMI report from S&P Global showed growth stalling in services…As manufacturing orders continue to contract at a faster pace, both measures were below consensus estimates.

What does it mean – Both the reports continue to show contraction in the economy.

Philly Fed’s non-manufacturing survey shows deteriorating sales…Yet costs are going up and prices charged have moved higher.

What does it mean – Manufacturers expect a reacceleration in inflation.

Mortgage rates continue their climb…I Googled Up Up, and Away and the first thing that hit was the song Up Up and Away by Juice WRLD. I read the lyrics and while the song is clearly about drug abuse, it captures the desperation of the trappings of society. Speaking from an economic perspective it captures the numbing effect and benefit that “cheap money” has had on consumers, our government, asset prices and the perception of being able to spend without fear. This façade is now at every dinner table as every family is discussing the reality of inflation and rising interest rates. For nearly 20 years the Federal Reserve has artificially kept rates unrealistically low, sheltering many from reality and creating a perception of wealth that can easily be taken by the sudden removal of a dependency. Cheap money has numbed and created an environment that has concealed the truth and like the lyrics in the song we are left to –

“realize that my life is a ride

Buckle up, hold tight, take a left, turn right

GPS don’t work, can’t see at night

So it’s getting hard to drive, anxiety at a stoplight

Hard to think, easy to cry, that’s how I know something’s not right

Numb the pain with fun times.”

As my favorite football coach and Ferris Bueller said, “It’s time to buckle up butter cup!!”

What does it mean – Per the chart below, rates have more than double over the last year 18 months. While Wall Street is clamoring for lower rates, the recent economic news, comments from Fed Chairman Powell, and the lack of fiscal leadership from DC all point to rates going up in the short-run. Expect an increase in rates and a bit of a bumpy ride for the foreseeable future.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.