What Happened Last Week and What It Means to You: Week Ending August 18, 2023

Week Ending August 18, 2023

The FOMC minutes showed a hawkish bias…With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risk to inflation, which may require further tightening of monetary policy.

What does it mean – While several FOMC members are becoming concerned about the impact of the increasingly restrictive policy, the FED does not look to be done as the numbers continue to point to a stubborn inflation.

Manufacturing gets big boost by auto industry…While the rest of the manufacturing industry is in a slump, autos had a great bump of 5.2% lifting the July numbers.

What does it mean – Auto industry outperformed while the broader manufacturing industry is in a slump. The Institute of Supply Management (ISM) continues to struggle with continued readings of under 50 and over 2 years of declining numbers.

Factory orders increased 0.2%…On the heels of a 0.4% decline in May. Factory orders got some relief.

What does it mean – Durable goods orders increased 4.6% month-over-month, bolstered by a 69.4% increase in orders for nondefense aircraft and parts. New orders for nondurable goods increased 0.1% month-over-month following a 1.1% decline in May.

The main takeaway from the report is that business spending was on the softer side in June, evidenced by the slight 0.1% increase in new orders for nondefense capital goods excluding aircraft.

China…Desperate for relevance and an economic model we should avoid at all costs.

What does it mean – John Carney from Breitbart reminded us of the character in Earnest Hemingway’s book, “The Sun Also Rises”, when he was asked, “how did you go bankrupt?” His response was, “gradually then suddenly.”

China is in a world of hurt. Evergrande, was the thought to be the largest property developer in China declared bankruptcy under U.S. law last Thursday. It is estimated to have around $28.1 billion of bonds outstanding, most of which come due in 2025. One day later one of China’s other large property developers, Country Garden, missed bond interest payments and suspended trading for its bonds. The company’s shares have been dropped from Hong Kong’s Hang Seng Index and are down more than 70 percent year-to-date.

China’s industrialized command economy that is so envied by corporations in the west due to an addiction to cheap labor and a dream of competing on an equal playing field in China are now only realizing they funded their Chinese based competition though intellectual theft, blackmail, and strong-arm tactics that would make Vito Corleone envious.

While China has moved nearly 100 million people out of poverty, it is now facing massive unemployment among its most educated and youngest workers. Real estate is falling, and the government is forcing companies to support falling assets and using its treasury to support failed communist policies. And for some reason this administration continues to put in place policies that mirror an industrial complex of command and control. We just make it sound pretty and call it Social Capitalism.

Below is another sign that things are going south. When you start to censure information or move the goal posts it is pretty evident things are not going your way. Unfortunately for the Chinese citizens they do not have a free press to hold their government accountable.

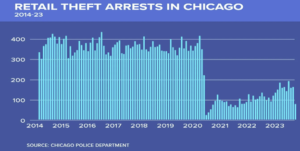

Retail devastated by organized theft…Since late 2019 it somehow became a “right” to loot stores in the name of social justice and this trend to not punish looters has continued to reap havoc on businesses across the country. And even worse, our elected leaders in almost 30 states have increased the felony theft thresholds from $500.00 to $1,000.00. Further incentivizing bad behavior. It is no wonder businesses are leaving large cities where crime is allowed and left unpunished by corrupt DA’s and city officials.

What does it mean – According to Yahoo Finance, the trend has nearly doubled in the last couple of years and continues to rise. The cost to protect these stores hurts the very citizens who shop and obey the law. This lawlessness is inflationary, destroys business, suffocates entrepreneurism, ruins the very fabric of society. Below is a look at the numbers. The cost and lack of arrests.

Below is a look at retail theft arrests in Chicago. Unfortunately for us all, the numbers are relatively the same and even worse in cities like LA, San Francisco, Chicago, NY, and Portland.

Mortgage applications are likely to keep slowing…As rates continue to move up the average home loan continues to price the average family out of the housing market.

What does it mean – With the current National Avg. for a 30 Year Fixed Mortgage at 7.58% per the chart below by Bankrate.com, many households are being priced out of the market. For example, in August of 2021 you could have refinanced your home or purchase a new home with a mortgage of close to 2.78%. Today, exactly 2 years later, that same rate is 7.58% for a 30-year fixed mortgage. This would mean your monthly mortgage payment would go from $3,278.66 to $5,637.61 per month for an increase of $2,358.95. Something has to give.

The Sirens are beautiful but deadly…The Fed and our elected officials are addicted to the sweet sound of their voices. It forms a schism between those who are grounded in principles of individual liberty and those willing to trade that liberty for the quick fix of a government program that they cannot afford anchoring the citizenry in a quagmire of uncertainty and future dependency on a handout.

What does it mean – The chart below is as ominous as the Sirens in Hommer’s Odyssey. When the government shut the country down and instituted massive spending programs based on debt our country could not afford. The sirens sprang their trap. We traded more of our individual liberty and financial freedom for a quick fix to a problem created by bad policy and fear. As a nation we slid deeper, captivated by the sweet sound of “free” and the trappings of dependency.

Per the Chart below, you can see in yellow the massive increase in government spending leading to the increased tax revenue in blue. Essentially, we accelerated huge growth in equities, real estate and almost every asset due to government handouts that lead to massive spending by folks who took their COVID bucks and turned it into COVID houses, boats, RV’s, cars, iPhones, etc., creating record inflation. This quick fix accelerated massive demand, putting huge pressure on our debt, and creating a false sense of economic security.

As you can see, the government’s response to now falling tax revenue due to accelerated spending caused by the COVID response has led to more government spending. Our elected officials, the demands of a bloated government, and citizenry that is now addicted to the quick fix of government stimulus continues to fall for the easy way out. The sweet sound of debt and even easier acceptance of a quick fix, like a drug addict, is more government dependency.

I hope this chart is a sobering reality to those desperately clinging to their perceived power that we citizens have unfortunately given with little fight or discussion. Like our founding fathers, we should be guarding our Constitution with our sacred honor and with a fundamental understanding of the role our elected officials and the agencies that serve the American Citizens are limited to by our constitution.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.