What Happened Last Week and What It Means to You: Week Ending August 11, 2023

Week Ending August 11, 2023

Nonfarm payroll growth is slowing…For the second straight month nonfarm payroll came in below 200,000 even after revisions.

What does it mean – While labor supply is still relatively tight, and we are starting to see a softening in employment. Employers are still competing with government programs and many employers are their own worst nightmare as they have allowed work from home to dictate employment policy further dividing or separating employees from the office and culture.

Producer prices increased more than expected last month…While starting to slow, inflation has not been tamed.

What does it mean – While Goldman Sachs says rates are heading down next year (2024), we are unfortunately still dealing with the here and now. Energy, specifically gas prices, are still going up. The cost of transportation, cooling and heating your home, travel, food, clothing, etc. all are affected by the cost of energy. This is inflationary.

30-year home mortgage rates hit highest level since 2001…According to Bankrate.com, the 30-year mortgage rate hit the highest level since 2001 and is now at 7.5%.

What does it mean – Affordability is suffering. While housing prices remain stubborn and have not backed off much, the average household is struggling to purchase a first-time home or trade up.

Credit card debt hits $1.03 Trillion…The Federal Reserve Bank of New York reported that U.S. credit card debt stood at a record $1.03 trillion in Q2’23

What does it mean – Yikes. According to Yahoo Finance. The figure represents an increase of 4.6% from the previous record of $986 billion set in Q1’23. According to Transunion, U.S. consumers carried an average bankcard balance of $5,947. This is the highest level in the past ten years while the average U.S. credit card interest rate is now at 24.69% for the week ended 8/7/23.

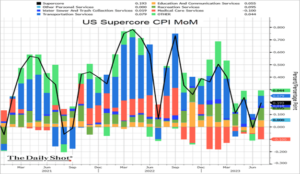

Super core inflation…The governments new favorite way to measure and convince you that shelter, food and energy are not needed in today’s society. As we covered before, core services are now stripped of housing, food, and energy to prove inflation is in check and the Fed and your elected officials have it all under control.

What does it mean – This administration will depend even more on the Fed to make up for its fiscal shortcomings. Get ready for a lot of teeth grinding and redefining of fiscal policy and what economic success looks like.

Below is what the government is now measuring when they strip out Shelter, food, and energy. Not sure what “other personal services” are but the fed has done an amazing job at keeping them at “0” for the last few years. And thanks to the Chinese virus and massive fear mongering by the government and media, most Americans are now getting vaccinated for almost everything for free or at significantly subsidized pricing thanks to the American taxpayer. You can literally walk into most CVS’s get a flu shot, COVID shot, shingles and several others and in many cases only have to pay your co-pay for a medication that is costing the taxpayer thousands. Do you ever wonder why every station on earth is playing a commercial on multiple drugs and vaccinations every 15 minutes? Ask yourself who is paying for these advertisements and why is your doctors being replaced by CNN, ABC, CBS, NBC, FOX, etc.?

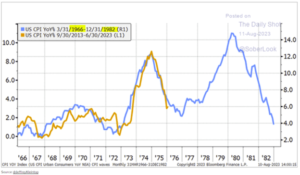

The 1970’s called and asked for their economic policy back…History has a way of repeating.

What does it mean – Have you ever noticed that certain actions always get certain reactions?

Big government solutions continue to lead to big problems for the citizens. Since the Johnson administration and throughout the 1970’s government expanded at a record rate and with it brought higher inflation, less energy independence, more government agencies to be funded by taxpayers, less economic mobility and higher taxes. The list goes on and on. And here we are today experimenting with the same failed policies that led to the 1970’s.

The difference is that voters decided to hold politicians accountable in 1980. Will bad policy and the destruction of small businesses and entrepreneurism lead to another cycle of accountability?

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.