What Happened Last Week and What It Means to You: Week Ending August 4, 2023

Week Ending August 4, 2023

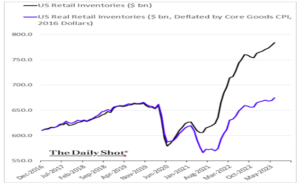

Price reduction on aisle 5…Retail inventories keep climbing.

What does it mean – The good news is that stores will need to work off that excess inventory just in time for back-to-school sales. This will also help bring down prices, helping out the consumer while gas prices hits record highs. While this should help lower the inflation numbers on goods, it comes at the cost of net income for store owners and corp. earnings.

Across the pond…In Great Britain “Firms remain cautious about the retail sector’s near-term outlook as they pare back on orders and brace themselves for continued sales contraction,” said CBI economist Martin Sartorius.

What does it mean – Global retail giants are feeling the pinch. While top line volume has remained strong in the US, profits continue to fall as retailers try to work off inventory and are forced to lower prices to move products in almost every category. As we have discussed in prior letters, manufacturers have been feeling the pain and reacting to the slow grind of reality.

Manufacturing continues to slow…Total industrial production declined 0.5% month-over-month in June (Briefing.com consensus 0.0%) following a downwardly revised 0.5% decline (from -0.2%) in May.

What does it mean – The softening demand for goods continues to plague the economy. Yet, the most recent GDP report seems to be in conflict with “the boots on the ground.”

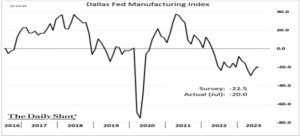

Don’t mess with Texas…Unfortunately even with the massive migration to states like Texas from CA, NY, NJ, Il, MI and now OR and other poorly run states, Texas manufacturing index is not immune to bad fiscal policy from DC.

What does it mean – As retail struggles with inventory as discussed above, Manufacturing will continue to slow. This is also leading to manufacturing wages starting to come down in the fastest growing areas of our country like Texas. As more talent heads to states like TX, FL, and others, folks are seeking economic freedom and driving wages down. See the below charts.

Gas prices soar in 2023…U.S. gas prices are posing another challenge to an inflation problem the Federal Reserve and the fiscal policy coming out of DC can’t seem to agree on.

What does it mean – It seems like we can’t get away from bad fiscal policy and government intervention. In 2022 the Biden administration sold off most of our Strategic Petroleum Reserve (SPR) to China right before the November election flooding the market with oil and temporarily bringing down oil and gas prices. Never mind the fact that the SPR is designed to protect Americas energy and not subsidize Chinas demand or need for energy at the cost of the American taxpayer. And to make matters worse, the US government announces it will now start buying oil at higher prices than it sold to China to replenish the SPR. This not only competes with the American consumer and is inflationary, it is also another great example of how this administration and congress refuses to acknowledge that they work for you!!! Hold them accountable.

Department of Energy…Founded in the 1970’s on the idea of making sure America was energy independent. The DOE is now taking on the responsibility to determine how you cook your food, heat your home and water and clean and dry your clothes. While they may believe they know best, bureaucrats are actually proving Reagan correct when he said the 9 terrifying words in the English language are, “I’m from the government, and I’m here to help.”

The Department of Energy (DOE) quietly reduced its appraisal for how much money consumers will save through its proposed “Gas stove efficiency standards by 2030” otherwise known as “Ban all gas appliances to Americans.”

What does it mean – You just can’t make this stuff up. The updated figures reflect a 30% reduction in the estimated energy savings, with the DOE now approximating that consumers will be able to save an average of 0.09 cents a month on their utility payments. That means people running our government and deciding how you live and the rules you must follow had originally decided to ban your gas stove to save you roughly 0.13 cents per month and found out their study and hatred towards energy independence would actually only save you 0.09 cents. I will bet this study cost us taxpayers millions to produce to find out their crazy recommendation will cost us billions to save 0.09 cents per month per household.

Forcing over 40% of the homes and almost every restaurant in America to convert from gas to electricity will cost Americans untold billions as they are forced to convert their gas appliances to electricity. It means re-wiring your home, your restaurant and place of business and buying new appliances that run on an electric grid powered by gas and are currently unable to meet the nation’s current electric demands in most large cities in times of high heat. Asak everyone in Southern CA that suffers through rolling blackouts and are told not to charge their electric car during high use time periods.

Folks, you Just can’t make this stuff up. Yikes.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.