What Happened Last Week and What It Means to You: Week Ending July 28, 2023

Week Ending July 28, 2023

GDP up 2.4%…Wall Street celebrates. Main Street gets the bill.

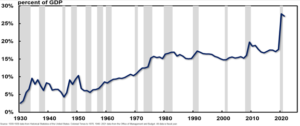

What does it mean – We are celebrating growth that is becoming more dependent on government every quarter. When you subtract out non-defense spending, the economy grew at 1.9%. The U.S. Government is now well over 20% of GDP and is suffocating small business creation due increasing costs of capital over regulation and direct competition for employment.

Historically from the 80’s through 2008 the government as a percentage of GDP was kept relatively in check at around 15% to 16%. Obamacare blew that up and prior to the Chinese virus it moved up to about 17% to 18%. Meaning Government grew by 20% in size in 2010. After the massive spike in government spending in 2020 through 2021, we have seen government expenditures as a percent of GDP per quarter hover over 20% plus. While stable for nearly 30 years, the government is now over 40% larger in just 10 years. No wonder there is a housing crisis in DC and Northern Virginia.

We are either in a constant state of war or there are aliens running the White House, every government agency, and both houses of Congress.

Heck it must be true. For the first time since the investigation into Elvis’s disappearance, there is a by partisan agreement to investigate the DOD’s secrecy around UFO’s. Maybe they will figure out who is actually running the white house and both the Senate and House.

Here is a look at the explosion of Non-Defense Government Spending.

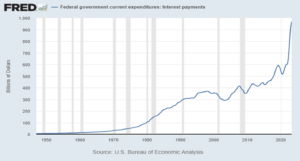

National Debt…Conveniently left out of the GDP report and missed by the media. With $32.6 Trillion in debt as I wrote this. You have to ask, “why bring this up?”

What does it mean – Remember when Washington believed in fiscal responsibility? O.K. 1/2 of DC, I mean 1/3 of DC believed in fiscal responsibility. The American dream was robust and ignored the growing chaos of social programs we now know are suffocating the needed growth to get our financial house back in order.

While the markets celebrate a GDP that looks to be range bound around 2% if lucky. This is a long way from the robust growth of the economic expansions of 3.5% to 4% on average in the 1980s and 1990s. In fact, this 1970’s dismal growth will not keep up with the interest payments and needed revenue to maintain our government. Bottom line, we are not growing anywhere near fast enough to reduce the explosion of debt or sustain the social programs so many Americans have become accustomed to since the days of Lyndon Jonson.

Below is a look at our interest payments alone. Current interest payments are pushing through $1 trillion a year. The U.S. is on track to collect about 4.9 trillion in Revenue, another record. Yet, in $2022 we spent 6.3 trillion and on track for a lot more in 2023 thanks to an increase in the debt ceiling of an additional 4$4 trillion. Yet, the IRS continues to collect more revenue every year, but somehow our elected officials find a way to spend it. Our elected officials approve budgets that are nearly 30% more than we bring in every year. With rising interest rates and massive spending, the American taxpayer and our economy is facing a new reality.

Personal consumption, equipment orders and construction led the way…While small business struggle to get a foothold, large corporate spending on equipment grew nicely.

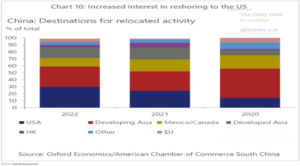

What does it mean – Fixed equipment and equipment ordered by manufacturing saw nice growth as new factories being built here and abroad are starting to come online and demand new equipment. The move away from China continues as manufacturing heads home or relocates to other parts of the world. here are the destinations for US companies relocating activity out of China.

Foreign direct investment in US manufacturing continues…As China becomes too expensive and continues to blackmail and or extort companies of their intellectual property, companies begin to realize it is now to their advantage to be closer to the buyer.

What does it mean – Manufactures are finding out that bad energy policy and overbearing governments like China combine for an unpredictable business environment. So, welcome home.

Let’s Make it in America.

Extra cash tends to burn a hole in Americans’ pockets…I guess that old saying, “you can’t take it with you”, holds true for most Americans.

What does it mean – When looking at the chart below and knowing my natural tendencies, I can pretend that human nature is different in America or recognize the fact that human nature is the same and people are predictable. That their behavior is dependent on the responses they live with or get from loved ones and society.

When you are free of government intervention and not dependent on it, you have a mentality of ownership and are hard wired to produce and be self-sufficient creating growth and benefiting from owning your inventions, words and hard work. We call it the American Dream. America is the only country in the world with a “mission statement” and a “dream”. When asked, “what do you want from America?” People from all over the world instantly say, “the American Dream.” No other country has a “dream or a mission statement.”

Those less fortunate folks are born into a society or country dependent on government, realize from an early age, that a government big enough to give it to you, is big enough to take it away. They are forced to save extra, knowing that one day they will need it. That few have access to capital and in many parts of the world the government does not protect intellectual property. They recognize that their government pension will not be enough to keep up with the cost of government and the taxes it demands to defend and support the entire country with medical care, housing, and food.

Or, maybe the below graph proves our rugged individualism, that we Americans are risk takers and love to live on the edge. I will never forget when I got into this business and my boss told me to go buy a new car. He shared with me the idea of motivation. I got the car and married his daughter. Well worth the risk!!

This graph really has two scenarios or stories to tell. The first, one of newfound dependence on a government growing out of control. The second is in direct conflict with the first. It is the belief that all you need is a dream and hard work for your American Dream to come true. The desire to keep investing in yourself and your future.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.