What Happened Last Week and What It Means to You: Week Ending July 21, 2023

Week Ending July 21, 2023

Retail Sales report came in weaker than expected…Retail sales increased 0.2% month over month versus forecasts for an increase of 0.5%.

What does it mean – Not only was the June report mostly weaker than expected, but May’s report was also revised lower across the board. Could you imagine what things would look like had congress not increased the debt by $4 Trillion. Consumer is feeling the pinch, but government has no restraint and is spending like a drunken sailor.

Credit expansion is the slowest since November of 2020…Revolving credit continues to slow.

What does it mean – The key takeaway from the report is as rates rise and banks increase or tighten lending requirements, the pace of credit expansion in May was the slowest since November 2020. Hard not to see how this does not contribute to slowing down the economy or hurt the consumer or small businesses.

Government handouts increase .3% for the month…Personal current transfer receipts(welfare) rose 0.3% month-over-month.

What does it mean – Government welfare or handouts continues to grow. If the economy was truly improving this number would be a negative. Yet, it continues to grow. Who do you believe?

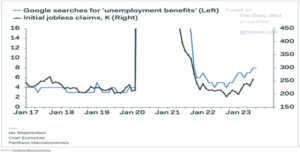

Unemployment numbers continue to create confusion…Even google analytics tell us things are worse than reported.

What does it mean – It must be Russian interference. Google searches for unemployment assistance continue to climb to levels not seen since the pandemic and those searches are at record levels dating back to before the mandated shut down for COVID.

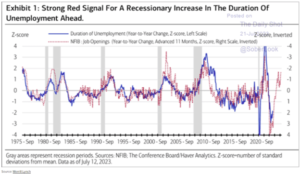

Small businesses are the engine of our economy…Small-business surveys suggest that the duration of unemployment is about to rise.

What does it mean – Small businesses are feeling the expense of capital. Small business expansion and growth are in danger due to the cost of capital and increasing regulation from the government. Yet, for great employees and the idea of meritocracy, great employees are being recognized and are seeing wage growth. Employers are realizing it is less expensive to recognize great performance and loyalty instead of hiring unproven talent. Bottom line, work hard and be accountable. Your employer is watching. See chart below.

The Philly Fed’s manufacturing index continues to show weakness…Manufacturing continues to slow in the region.

What does it mean – More of the same. Manufacturing weakness continues.

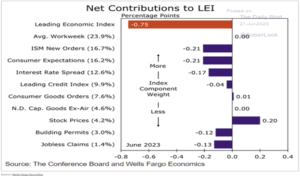

The Conference Board’s index of leading economic indicators (LEI) continues to signal a rough time ahead…Leading indicators are not inline with what is coming out of DC or the cable networks.

What does it mean – The stock market and consumer prices are the only contributors to the LEI that are positive. And consumer prices going up means inflation. Here are the contributions to last month’s changes.

It’s not just your gas stoves they want to ban…Reagan once said, the nine most terrifying words in the English language are, “I am from the government, and I am here to help.” He could not have been more right. We should all be terrified. We need to ask ourselves, “when will they leave us alone?

What does it mean – You just can’t make this stuff up. If these recommendations by the dysfunctional Department of Energy, that was originally set up to make sure we became and stayed energy independent, becomes a reality, expect your pocketbook and economic freedom to be substantially reduced when you need a new stove and must rewire your home for an inefficient electric stove or water heater that cannot be supported by our current electric grid.

When first reported that the Biden Administration wanted to replace gas stoves with electric and mandate it through regulation, the media defended them and said that this was a conspiracy theory. Yet, like other claims of conspiracy theories coming from the media and this administration, this too was proven true. When the Department of Energy released its proposal, it not only went after gas stoves, but now we are finding out that buried deep within the report the Department of Energy is now going after almost every gas product in your home. You have got to ask, why? I could tell you, but that would be no fun.

While China increases its carbon footprint daily with new coal plants, the U.S. with innovative technology developed by the private sector to make gas safe, efficient, and affordable has allowed the U.S. to decrease its carbon footprint by 20% over the last 30 years while our population has increased by nearly 30%. Yet our government wants to roll back time and force massive regulations leading to direct economic warfare on the American Citizen forcing you to pay for the world’s wrongs.

With out any consideration to the citizens of the United States or understanding of the cost associated with these decisions or mandates by the Department of Energy, your elected officials who have complete oversight over these unelected over paid environmental bureaucrats, have nearly allowed them to unilaterally put in place rules that will dictate our economy and how we live for years to come. Thanks to a few in congress that listened to people who actually read the report, congress started a hearing to determine why the change in policy and the necessity to mandate the purchase of electric appliances.

When asked about this in the congressional hearings this past week, the DOE Secretary Jennifer Granholm had no response or idea how this would be accomplished. In fact, the department of Energy first refused to let any of the so-called experts appear in front of congress. What do they have to hide? What are they afraid of, “the science” or the “facts?” After months of pressure by congress and the threat of subpoena, the DOE finally relented, and it was not pretty. Secretary Granholm testified that this mandate would save the planet and would be good for consumers in the “long run.” I guess she is not aware that China increases its carbon footprint daily and produces a carbon footprint faster than the Department of Energy can mandate us back to the stone age.

Maybe she should look up the facts on how affordable, clean, safe, and efficient gas is and maybe, be reminded that gas powers most of the power plants in the United States leading to the economic success that has freed generations and attracted people from all over the world.

If this is not stopped expect the government to tell you not to cook or do your laundry on hot days or take a hot shower or jump in the jacuzzi or charge your tesla or electric vehicle during peak times due to the stress on our inefficient and deteriorating electric grid.

Stop the madness in DC. It is ruining our economic future.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.