What Happened Last Week and What It Means to You: Week Ending July 14, 2023

Week Ending July 14, 2023

The rate of inflation is slowing…On a year-over-year basis, total CPI decelerated to 3.0% from 4.0% in May, marking its smallest increase since March 2021. Core CPI decelerated to 4.8% from 5.3% in May.

What does it mean – Several key factors continue to contribute to slowing the rate of inflation. Regardless, this is moving in the right direction and is good news for the consumer. Yet, expect rates to continue to increase per the last report from the Federal Reserve.

Job numbers continue to cast confusion…The total number of continued weeks claimed for benefits in all programs for the week ending June 24 was 1,764,005, an increase of 64,431 from the previous week. In the same week a year ago, there were 1,397,976 weekly claims filed for benefits in all programs.

What does it mean – This report does not jive with the reports from the media or government.

A deeper dive tells the real story. According to the Bureau of Labor Statistics, over half of the gain was hospitality and leisure. The rest was healthcare, and government. According to the hotel industry, most hotels have been running 20% short of labor for a long time, so they are hiring lots of part time labor to do the menial jobs needed in hotels and restaurants. That is not the same as economic growth in a widespread economy. These are not jobs that contribute to productivity, so the impact is higher inflation when you look at real numbers and not the numbers the government reports when they subtract out energy and food. The real number is probably at around 3.5% and is a reason why the Fed has signaled at least two more increases this year.

Unfortunately, due to the real rate of inflation, many lower income people can’t make it, so they are taking a second part time job to pay the rent. As I have pointed out in the past, we can’t take the BLS numbers as accurate. They are not. The BLS numbers were less than half the ADP numbers, which tells you none of the numbers are really accurate.

So which ones do we believe? Neither. They decreased in the prior two months by 100,000, which again tells you the initial monthly report is never accurate. The participation rate remained relatively low, which tells us the jobs are probably a lot of second part time jobs. Job growth is clearly slowing.

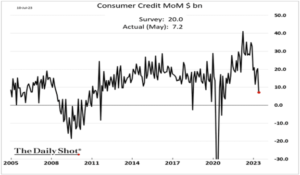

Consumer credit growth slowed sharply in May…Consumers are seeing the interest paid on their credit card debt skyrocket.

What does it mean – This means less spending. Roughly 13 billion less for the month of May. You can see this in the retail reports as inventories continue to increase and stores are starting to discount to move volume. Traditional back to school spending spree may be a tough one for retail this year.

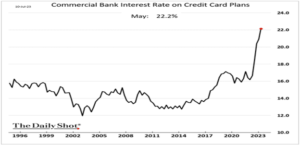

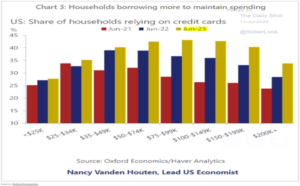

The average credit card rate climbed above 22%…A new high so does the average household balance.

What does it mean – The average American family continue to struggle with cutting back as they continue to add more debt in the face of increasing costs of capital. As households increasingly rely on plastic to maintain their spending.

Oil up 14% in last two weeks…Adding more pressure to the consumer and contradicting the real inflation numbers, oil is on an upward march.

What does it mean – Inventories of crude and refined oil are shrinking. Again, this administration sold off our strategic reserves to China and now they are in dire need of replacing and building up our strategic petroleum reserve. This will lead to direct competition with consumers and will contribute to rising energy prices as the government moves to build back the reserves. Real inflation is still here.

Higher interest rates mean the taxpayer is paying the banks more to sit on reserves and do nothing to help their clients or grow their business…Have you ever looked at a chart and asked what happened? Worse, realizing you have been duped by your elected officials and the banks who hold your money. The banks can do nothing and collect $185 billion from the American taxpayer.

What does it mean – The chart below signals a change in the law and a policy shift that allowed the Federal Reserve that is controlled by the largest banks to get paid on their reserves by the taxpayer. Got to wonder why the taxpayer is subsidizing banks? Worse, you have got to ask yourself, why are we allowing our elected officials to get millions in campaign donations from the banks that benefit from a bill that they voted on to allow the Fed to pay interest on the reserves? Wake up. The big banks are taking over. There are now over 8,000 less banking brands than there were in the year 2,000 and this is driving up the real cost of capital and destroying business creation. By the way, those bank earnings and failures are being subsidized by you. What is the actual cost? Why are we allowing the government to pick winners and losers? See the Chart below.

When interest rates where at .25% it only cost taxpayers a few billion now at 5.25% it is costing the American taxpayers nearly $185 billion to subsidize banks at the expense of the American citizen.

This is a perfect example of why we need single issue bills and not these 1,500-page monstrosities that, “we have to pass to see what’s in them.” Your elected leaders are failing at making sure they are good stewards of your money and our treasure and talent. Call your congressman. It’s your money.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.