What Happened Last Week and What It Means to You: Week Ending October 6, 2023

Week Ending October 6, 2023

U.S. Government fiscal year ended last week…And like clockwork, leadership bowed to fear and voted to keep out of control spending going for another 45 days. No wonder there is a leadership vacuum in DC.

What does it mean – Here are the facts. Unemployment is at 3.6%. The deficit for fiscal year 2023 will come in at a bit over $1.7 trillion. Considering that we are at record low unemployment based on how the numbers are now measured, the results of this monetary and fiscal policy are terrible. Almost anyone who wants a job has one. If you believe the numbers, then payroll tax revenue should be at record levels paying down debt not adding to it. This should be a huge warning sign to leadership, investors, and companies that something is horribly wrong. It starts with fiscal policy!! Could you imagine what the numbers would have looked like if the Supreme Court allowed student loan forgiveness? At a minimum, add an additional $1 trillion to the $1.7 trillion.

The light at the end of the tunnel is a freight train heading right at you. In short-order, the U.S. will be forced to get its fiscal house in order. It will need to either reduce future spending or find more revenue. I am rooting for reducing spending because you can’t squeeze blood from a turnip. Not to mention the Trump tax cuts do not run out until the end of 2025. So, congress will likely do nothing and wait for the tax cuts to expire (kick the can down the road). Someone should remind this administration what Margaret Thatcher said, “The problem with socialism is that you eventually run out of other people’s money.” The deficit is nearly $34 trillion and climbing.

Consumer confidence is struggling…With inflation expectations still at 5.7% and weakening business expectations, the consumer sees trouble ahead.

What does it mean – Key takeaway from this report is that the drop in consumer confidence was driven by consumers’ weakening expectations for future business conditions, job availability, and incomes, all of which has the potential to translate into softer spending activity. With the slide in the Expectations Index to 73.7 from 83.3 is ominous, as below the 80.0 level has historically signaled a recession within the next year.

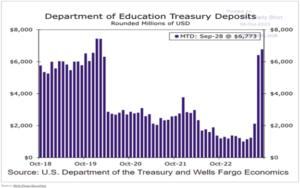

Student loan payments…Student loan payments are running at pre-COVID levels.

What does it mean – Now that student debt relief is off the table and folks are back to paying their debt, this will affect consumer spending and future savings for many folks who have loans. This may be why the above numbers fell as consumers with student loans begin to feel the pinch. Here is a visual to go with the numbers.

Jobs report…ADP says only 89,000 private jobs were created in September. That’s way below forecast.

What does it mean – We still can’t figure out the disconnect between ADP and what the Bureau of Labor Statistics continues to report. BLS reported that private sector payrolls rose 263,000 in September but were revised down by 12,000 in prior months. The largest increases in September were for leisure & hospitality (+96,000) and health care & social assistance (+66,000). Manufacturing increased 17,000 while government rose 73,000. One thing that is consistent – large companies continue to shed jobs. Large companies shed over 83,000 jobs while small businesses did most of the hiring in the private sector led by leisure and hospitality, adding 96,000 jobs.

Real disposable income down…For three months in a row real disposable income has fallen.

What does it mean – Adjusted for inflation, the after-tax income available to spend or save is falling. Inflation is not transitory, and regulations and taxes continue to add more costs to the consumer. Especially at the pump.

The sky is falling…Replace your appliances now!! Or the planet will implode. Fear mongering, more regulation, and higher costs to individuals, businesses and to our economy from this administration and the Department of Energy (DOE).

What does it mean – First it was gas stoves, then it was water heaters… now it’s ceiling fans. The Biden Administration seems bound and determined to literally regulate everything but the kitchen sink.

Ignoring the blatant government overreach. The newest regulation could force small businesses to shutter.

It’s estimated that complying with the DOE’s rule would cost the industry $86.6 million per year – small manufacturers can’t absorb this regulation nor can the American consumer…The American Citizen.

Core CPI increased .6% in August… The energy index was up 5.6% month-over-month.

What it means – The key takeaway from the report is that core inflation, which is what the Fed monitors more closely, showed ongoing improvement on a year-over-year basis; however, it is still well above the Fed’s 2.0% target. This may keep the Fed in a “higher for longer” mindset.

The unaffordable housing market… Average Americans cannot afford to buy a home in a growing number of communities across the United States, according to a report released Thursday by real estate data provider ATTOM.

What does it mean – As rates continue to go up and inflation continues to eat into the cost of living, more and more people are being priced out of the housing market. Ultimately something has to give.

CBS News showed how researchers analyzed 575 United States counties last year and found that 99 percent of those areas have home prices that are out of reach for “the average income earner” making $71,214 a year.

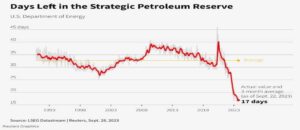

Expect oil and energy costs to go up…Strategic Petroleum Reserve is at all time low thanks to this administration.

What does it mean – Selling our strategic oil reserves has left our country less safe and will affect every American. We are now forced to pay higher prices due to drilling and pipeline regulations and compete with our government as they are forced to replenish our reserves at higher prices than when they sold your oil to China.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.