What Happened Last Week and What It Means to You: Week Ending October 13, 2023

Week Ending October 13, 2023

Federal Reserve pays banks $ billions. If this has not made you mad yet, it better…The Federal Reserve is using your tax dollars to pay banks and other financial institutions close to $300 billion this year at current interest rates to just hold reserves and to do absolutely nothing.

What does it mean – The taxpayer, you, are on the hook for nearly $300 billion while banks make record profits doing nothing, squat, zilch, not a Dam thing to earn it!!! Too big to fail – BS!! This is too much money in the hands of the swamp creatures running your government.

Let’s put this in perspective. In 2023 the Federal Government will bring in $3.97 trillion in tax revenue. Before the costs to manage the IRS, to collect, audit, manage and distribute, your government will hand over nearly 7.6% of all revenue from taxpayers to giant financial institutions that continually abuses its customers with fake accounts, fees, and insurance scams. HMMM. Can you say morally bankrupt?

Together with bad fiscal and monetary policy, the unholy alliance between big banks and big government is destroying entrepreneurism, small businesses, small banks, and increasing the cost of capital to everyday Americans creating a less competitive environment, higher costs, more regulation leading to more inflation all to protect their fiefdoms.

Follow the money. Through the first half of 2023, banks have already received $141.8 billion in risk-free income, more than the $102.3 billion they received for all of 2022 that I have been complaining about for the last 18 months.

With friends like this, who needs enemies? Along with a destructive fiscal policy and an accommodating monetary policy propagated by fear mongers clinging to the little control they think they have. We are witnessing in real time a transformation to a European style socialism structured around the few. This is also known as an oligarchy. Specifically in the financial, drug/pharma, medical, and media industries.

Eisenhower warned us of the industrial military complex.

Will, take heed, we are seeing the formation of oligarchies in the financial, pharma/drug, medical, and media forming through the help of big tech backed by Big Government. Policies are being passed in DC that increase regulation and suffocate the flow of capital making it more difficult to start and fund businesses and create new wealth. Unfortunately, this is backed by the largest of American companies in these sectors. Makes sense if you can control the people making the policy. Wouldn’t it be nice to have the government reduce competition by increasing the barrier to entry. In business, this creates a competitive advantage and is called a moat. Unfortunately, when the government gets involved, it becomes an utility that ceases to create shareholder value, new products, or invents new technology. It loses its competitive soul and relies on its sheer size and becomes dependent on government to make sure it can continue to exist as it no longer can compete in the free markets. I.E. socialism.

Like I said follow the money. Banks no longer have to compete for loans when you are sucking the taxpayer dry and pocketing billions with no risk at all. If you work for these institutions or bank with them, get ready for some life-changing events. History is littered with examples.

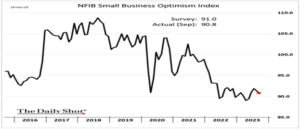

Small Businesses are not feeling the love…According to the NFIB, small business sentiment indicator declined last month.

What does it mean – See above. Regulations, bureaucracy, and fewer small banks equals less competition and an increase in the cost of capital. The great news is small business owners have grit. They don’t give up.

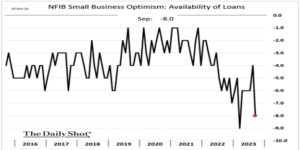

Increasing cost of capital…Businesses are reporting tighter credit conditions and rising rates on loans.

What does it mean – Like we discussed above, business owners need access to capital to create, grow, and invest in their businesses. If it gets too expensive something has to give.

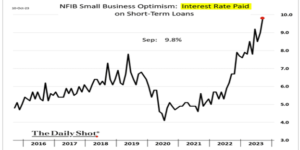

Short-term business loans 9.8%…Short-term loans for small businesses has nearly doubled this year.

What does it mean – Under the current fiscal and monetary policies expect the cost of capital to continue to go up.

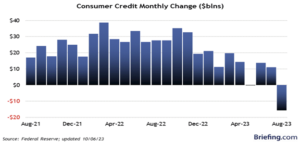

While Revolving credit increased by $14.7 billion in August to $1.285 trillion…Yet Consumer credit decreased by $30.0 billion to $3.684 trillion.

What does it mean – The key takeaway is that nonrevolving credit saw the biggest drop since December 2015, reflecting the tighter lending standards and reduced borrowing needs in the face of higher interest rates. Consumers maybe starting to tighten their built as consumer credit decreased at a seasonally adjusted annual rate of 3.8% in August per the graph below.

Too big to fail…The Federal Reserve might be transforming itself into the next institution that is too big to fail. Saving the banks, propping up assets, and creating a false sense of security is costing you a fortune.

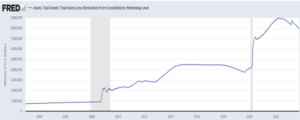

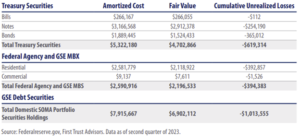

What does it mean – The Fed is down about 12.8% for the first half of 2023. Not to worry its not their money…Its yours. With a bloated balance sheet that has gone from $700 billion in 2004 to nearly $8 trillion in assets, you have to ask yourself why? What changed in 2009? Take a look at the two charts below.

Inflation on a roll…A fiscal policy that keeps doubling down and refuses to cut spending.

What does it mean – This administration can’t seem to put the brakes on spending. First it was the American Rescue Plan that was signed in March 2021 that authorized $1.9 trillion in new stimulus spending to provide relief during the COVID-19 pandemic. Then it was the Inflation Reduction Act in August 2022, which was anything but an Inflation Reduction Act that approved $750 billion in new spending, with $370 billion of that going to green initiatives aimed at combating climate change driving up the cost of energy for every American.

Finally, an economist says it. Michael Faulkender, chief economist and senior advisor for the Center for American Prosperity, told the DCNF. “We must continue to remember that it is not only monetary policy that determines inflation,” “It is also fiscal and regulatory policy. Yes, monetary policy can get us back to 2% if the Fed keeps raising interest rates high enough. The problem is that the Biden Administration keeps pouring gasoline on the inflation fire by running $2 trillion deficits while imposing costly regulations that take supply offline.”

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.