What Happened Last Week and What It Means to You: Week Ending October 20, 2023

Week Ending October 20, 2023

Consumer sentiment declines…The October U of Michigan consumer sentiment indicator declined more than anticipated.

What does it mean – October reading came in at 63 down from 68.1 in the prior month. This is the lowest drop since May while inflation expectations rose to the highest level in six months. According to Joanne Hsu, director of U of Mich consumer surveys, “Assessments of personal finances declined about 15%, primarily on a substantial increase in concerns over inflation, and one-year expected business conditions plunged about 19%.”

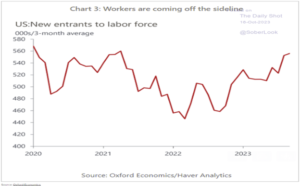

More new entrants into the labor force are capping wage growth…As cost of living skyrockets with inflation more people are coming out of retirement or are seeking full time work.

What does it mean – No longer can the government subsidize or facilitate bad behavior. Government overreach led to massive inflation, job shortages, huge increases in the minimum wage, and direct competition to employers forcing many small businesses to shut or reduce hours to increase wages to compete with the government handouts creating massive inflation and increasing the cost of goods sold. Otherwise know as inflation.

Are people willing to take less to work at home…Wage growth among non-supervisory workers is back at pre-COVID levels.

What does it mean – According to Deutsche Bank and Havner Analytics, the chart below shows nonsupervisory rolls are now back to pre-COVID levels. Bottom line, more and more employers realize that productivity increases when you are in the office.

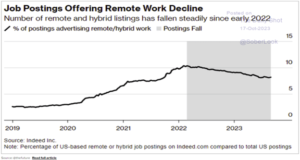

Remote work job postings decline…As more people seek work, remote job postings decline.

What does it mean – Employers are tightening up. Signs of a tighter job market are increasing throughout the country.

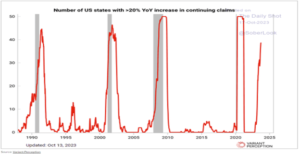

The number of states with significant increases in continuing jobless claims keeps rising…In the last six months since we last pointed this out it has more than doubled.

What does it mean – States are seeing a huge increase in jobless claims. Yet, the Bureau of Labor Statistics still shows a very tight labor market.

Record growth…Big government grows while the economy stumbles.

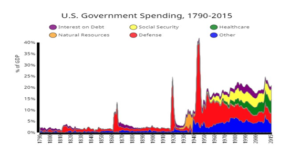

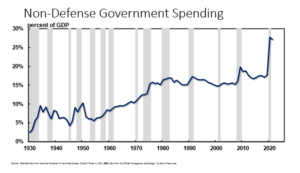

What does it mean – According to the Congressional Budget Office, federal spending should total $6.131 trillion in the fiscal year that ended on September 30. That is over $$2 trillion more than the government brings in with record low unemployment. That number also includes the effects of the Supreme Court striking down much of President Biden’s plan to forgive student loans. That decision created a $333 billion “negative outlay” for Fiscal Year 2023. Without that decision the total federal spending would have been $6.464 trillion. First Trust estimates that would translate to 24.0% of GDP, in a year when the jobless rate averaged 3.6%.

First Trust does an incredible job providing some historical perspective. In fiscal year 2019, the last year prior to COVID, the jobless rate averaged 3.7% and federal spending was 21.0% of GDP. Back in 2000, at the peak of the first internet boom, federal spending was 17.7% of GDP.

Think about the above statement. We had record unemployment at 3.7% in 2019 which should and did translate into record tax revenue. Yet, our government was still running a deficit in one of the best years for GDP growth in the last 20 years. One should ask three simple questions. First, on what did the government spend your money on? Second, is the government more efficient than you? Third, can you do better with your money? In other words, are we an informed and educated voter/consumer?

Below shows the massive increase in spending that has ballooned to record levels and is growing every day. This also corelates with when our nation started to see slowing economic growth as we took on the behavior and identity of a nation more dependent on government and less on oneself.

The proof is in the pudding. We saw government spending decline in the 80’s and 90’s as a percent of GDP and saw GDP growth return to an average between 4% and 5% during that time. These numbers validate that as the Government grows, GDP growth slows. Meaning there is an adverse relationship to big government and economic growth.

Unfortunately, from 2010 when government health care exploded with Obamacare and the public takeover of student loans, the government has proven that the more they get involved in your life the more their services cost and the more debt our citizens acquire individually and as a nation. Health care costs have exploded. Just look at your health insurance bill. Student loans have gone from 800 billion in the private sector to nearly $1.8 trillion as of June 2022. Yet the very universities that increase costs and mandate tenure are creating a society of dependence.

Brian Wesbury says it best. “Imagine ten people stranded on an island, living at subsistence, each person using a spear or even her hands to catch two fish each per day, barely surviving. Then two of them decide to risk it all and build a boat. They go out one day and bring home twenty fish. Hallelujah! Enough to feed everyone.

With this bounty, the others use their talents to find easier ways to get their two fish. Some of them climb the trees, bring down coconuts, and trade for fish. Others build fires to cook the fish just right. Others build better huts. And so on and so forth. In other words, the innovation of making that boat and net didn’t just help those original two; it helped everyone. Life is better.

But one of those islanders isn’t happy. He watches all that trading and realizes that the two owners of the boat and net who took the big risk are better off than the rest. It wasn’t like it was before, where all everyone had was two fish per day, barely eking out survival, but at least they were equal.

The unhappy islander – let’s call him Sernie Banders – comes up with a plan to bring “equity” to the island. He gets them to impose an 80% tax on the “rich” boat/netmakers! That way when the boaters bring in their haul of twenty fish, the rest of them get their “fair share” of sixteen (two fish per person, eight other people), with no extra work.

Common sense tells us what happens next. The inventors have little incentive to maintain or repair the boat or fix the net. Why waste your time or take a risk when the rest of the islanders are just going to seize the extra value you’ve created? In the end, the islanders are eventually back to where they started. Or maybe worse because they forgot how to fish.”

Bigger government means less innovation, less investment in and maintenance of capital, and less economic growth. Along with many of our elected officials and what is taught in our universities are promoting the very dependence on government that destroys a philosophy of self-determination and the pride that goes with living a life of gratitude vs. one of envy. They just have not figured out that Socialism Sucks!!!

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.