What Happened Last Week and What It Means to You: Week Ending October 27, 2023

Week Ending October 27, 2023

GDP up 4.9%…Driven by consumer spending. GDP provided a real surprise for Halloween.

What does it mean – It must be “retail therapy”. While the world is squeezing in from every direction, and life gets a bit rough, Americans go shopping. The current GDP report looks like the American consumers are fully employed and feel flush with cash even though their savings are at historically low levels. In fact, you have to go back to just before the 2008 correction to find savings rates this low. Not to mention their credit cards in many cases are nearly maxed out.

The facts about GDP… The United States Economy grew by 4.9 percent in the third quarter according to the advance estimate for real GDP released by the U.S. Bureau of Economic Analysis on Thursday morning. This beat the consensus expectation of 4.3 percent by .6%.

What does it mean – Wow. How did this happen? First, you need to know how they measure GDP and how the components work. Let’s remember, it’s measured by the government and often gets confused with reality and how they would love for you to feel.

So, what is GDP? GDP = consumption plus investment plus government spending plus net exports.

How did we get 4.9% growth when the world seems to be struggling to pay its bills?

- American consumer went on a shopping spree.

- American consumers are in debt – American credit card debt hits a record $1 trillion in this year’s third quarter.

- The annual interest charge for retail credit cards is at a record 29% this year.

- Americans’ personal savings rate registered 3.9% this past quarter. The long-term average is roughly 9%.

- Government spending is out of control and growing. Your government racked up a $1.7 trillion deficit this past year.

- This report highlighted the power of the consumer. But know this. The consumer does not represent 68% of GDP. According to economist Mark Skousen, “GDP only measures the value of final output. It deliberately leaves out a big chunk of the economy – intermediate production or goods-in-process at the commodity, manufacturing, and wholesale stages – to avoid double counting.”

Skousen goes on to say, “that consumer consumption merely constitutes perhaps 30% of GDP.” He went on to say, “I calculated total spending (sales or receipts) in the economy at all stages to be more than double GDP… By this measure — which I have dubbed gross domestic expenditures, or GDE – consumption represents only about 30% of the economy, while business investment (including intermediate output) represents over 50%.”

41.2% of adults are having difficulties paying household bills…The Census Bureau found that almost half of our adult population is struggling to keep up with paying household expenses.

What does it mean – While this is the highest level on record since the Census Bureau has been asking this question, what is most concerning is that this number is concentrated in the most educated part of the population.

According to Torsten Slok, chief economist of Apollo Global Management, “the difficulties with paying household expenses were concentrated among households with a college degree, making between $50,000 and $150,000.

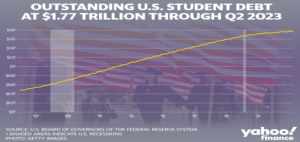

This is causing many to ask not only how, but why. Some are saying it is because of the student loan holiday the government gave to borrowers during Covid. This allowed them to redirect those funds meant for paying their student loans to other fixed expenses like new cars and boats. Someone should have told all those college graduates that nothing is free. Actually, taxpayers should demand a fiscally responsible Congress that would have never allowed this.

Since the government took over ALL Lending in 2010 and banks no longer are lending to students, the exact opposite has happened. Taxpayers were promised that they would not lend to anyone who could breathe only to find out that they lent to future graduates who subscribe to “retail therapy” when they are broke.

Here is a look at the current loans owned by the taxpayer. Up more than $1 trillion since 2010. No longer are responsible private lenders making sure the student can repay a loan based on their degree, but now, the credit check is much like that of the real estate market in 2006. “If you can fog a mirror, you can get a lone.” No wonder our universities no longer champion debate and free speech but demand safe spaces and therapy dogs.

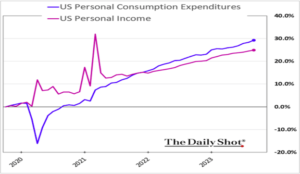

Household incomes continue to grow…While forced increasing of minimum wage has accounted for much of the increase in household income as the lower income continues to benefit from a rising minimum wage. The UAW is about to get a huge increase further driving up the cost of transportation.

What does it mean – Attention all Kmart Shoppers, “Trouble on aisle 13”. The chart below says it all. Massive bump in personal income due to “COVID Bucks” followed by a lifestyle that is unsustainable and feeling the effects of inflation.

Fuel prices on the way up and so is inflation…Look no further than this administration’s blind eye to reality.

What does it mean – This administration’s continued refusal to drill in the US and open up our pipelines will only continue to contribute to higher fuel prices, more expensive energy, the funding of Iran, and never-ending wars in the Middle East. As prices soar, this administration has allowed Iranian oil embargos to expire. Directly contributing to the funding of Iran and its proxies.

Worst of all, you, the taxpayer, is now going to have to pay an exorbitant premium to replenish the Strategic Petroleum Reserve (SPR) because this administration drained it in 2022 for political purposes and has yet to refill it leaving us at the lowest levels in modern history.

What is amazing, is Democrats slammed the Trump administration in 2020 for attempting to top off the SPR at a time when prices were around $25 per barrel as COVID-19 lockdowns slashed demand, saying that a replenishment would be a handout for Big Oil. Got to ask who is handing out money now to Big Oil and our enemies in the Middle East and Venezuela? West Texas Crude is now over $86 a barrel.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.