What Happened Last Week and What It Means to You: Week Ending December 8, 2023

Week Ending December 8, 2023

Jobless claims increase…The four-week moving average for continuing jobless claims increased by 7,000 to 1,872,250. This is the highest average since December 11, 2021.

What does it mean – The key takeaway from the report from the Department of Labor is that the labor market is loosening a bit, but it isn’t producing any major shockwaves or coming undone amid a stream of layoff announcements over the last few weeks. The market seems to want to believe we will see a soft landing.

Wages continue to go up…The Bureau of Labor Statistics (BLS) latest report shows wages continued to grow.

What does it mean – On par with the latest employment numbers your government is growing faster than the private sector. Compensation costs for private industry workers rose 4.3% for the 12-month period ending in September 2023. While government employees saw their wages increase by 4.8% for the same 12-month period according to the BLS. More money in the hands of consumers often equals more spending. More spending increases demand for products, services, and resources. Beginning economics tells us if demand increases faster than the supply prices will go up. Currently we still have a situation where there are to many dollars chasing too few products. We are seeing this with food, gas, housing (prices are down but not nearly enough to make up for the higher interest rates…More to com e on this).

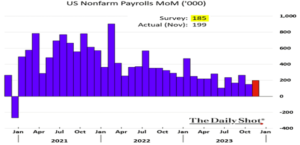

Last month’s job gains topped expectations…Along with education and health services government continues to add more jobs.

What does it mean – Expect the cost of government to continue to go up along with the cost of regulation leading to higher costs, more inflation, and higher taxes and fees.

November’s job gains topped expectations. What would it have been without the help of government, health care and education? See the charts below.

Here is the trend with government, healthcare, and education jobs removed. It points to a weaker breadth in the labor market and is showing signs of weakness as many health care and education jobs are dependent on government programs.

New home sales decreased 5.6% month-over-month in October…The median sales price declined 17.6% yr/yr to $409,300 while the average sales price declined 10.4% to $487,000.

What does it mean – New home sales month-over-month/year-over-year by region: Northeast (+13.2%/+10.3%); Midwest (-16.4%/+8.5%); South (+2.1%/+19.2%); and West (-23.3%/+18.9%). While still up nicely year-over-year prices fell 23.3% out west month-over-month. Leadership in CA continues to preach class warfare and implement policies that further divide and push business creation, citizens and assets away from CA.

November ISM Manufacturing PMI hit 46.7%…Practically unchanged from the October reading.

What does it mean – The dividing line between expansion and contraction is 50.0%. November marked the 13th straight month the PMI reading has been below 50.0%. The November reading indicates an ongoing contraction.

New home costs up 85.89% since January of 2021 …According to the Wall Street Journal, the average monthly new home payment when Biden took office was $1,787. Today that monthly new home payment is $3,322.

What does it mean – The cost of buying a new home no longer makes economic sense for the majority of Americans according to the chart below. Until prices come down or congress addresses the abuse of companies like Blackrock and other investment firms that buy up huge housing tracks rent them out and enjoy massive tax deductions, owning a home in this environment will be very tough for families and young folks starting out as they cannot compete with well-funded institutions chasing fewer and fewer deals.

At the World Economic Forum in 2020 Klaus Schwab said, “you will own nothing. And you will be happy.” Lets prove him and the globalist elites wrong. They either fear or do not understand our deep-seeded belief in individual liberty and a tradition and sacred responsibility of self-determination that dates back to the very first colonies and beginning of our country. Klaus and Blackrock can pound sand!!

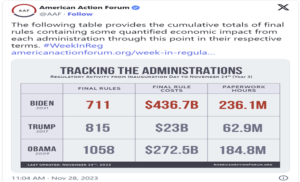

Regulations on the rise…According to a brand-new report from Competitive Enterprise Institute (CEI), President Joe Biden, the federal government completed 89 economically significant rules in 2022, defined as those with at least a $100 million in economic impact, which is higher than any point in the Bush, Obama, and Trump administrations when deregulation is accounted for, according to CEI’s “Ten Thousand Commandments Report.” Regulations resulted in $1.939 trillion in added costs to every American in 2022, exceeding every form of tax except income tax.

What does it mean – As for the current trajectory, Up, up and away. Government regulation and policies that have been passed in the Biden’s Rescue America Act, the Inflation Reduction Act., and executive orders, this administration thinks you are incapable of handling your money, picking up after yourself, caring for yourself, or taking care of your environment (O.K. they have us there…just look at the homeless and streets of big cities…Wait the government runs those and they won’t let the police remove the homeless or illegal alien’s or their tents and trash unless the Chinese President or the Super Bowl is in town) hmm. I guess we get what we vote for.

Bottom line, this is just the tip of the iceberg. According to the report, here are just a few examples American families and businesses will have to deal with. The Biden administration has put in place and proposed several environmental regulations that will ultimately increase average Americans’ home expenses by $9,166 in new costs. The costs stem from several new rules and proposals aimed at reducing carbon emissions from household appliances like gas furnaces, water heaters and more.

Below is a comparison Biden, Trump, and Obama’s first years. Biden has rolled back nearly all of Trumps executive orders to reduce the size of government and freeze spending and Biden nearly doubled Obama’s big government solutions in his first year in office. Yikes, got to ask who the real tyrants are? Just look at the time and money these regulations have cost Americans in 2022. Enough is enough. What else is left to regulate?

Right now, I can hear Capitalism and Freedom asking, “with friends in DC, who needs enemies in Russia, the Middle East, Asia or the rest of the world?” Where is the courage of Adams, Jefferson, Hamilton, Washington, Franklin, and the rest of our founding fathers? Our sacred liberties are being compromised by your elected officials on both sides of the aisle.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.