What Happened Last Week and What It Means to You: Week Ending December 15, 2023

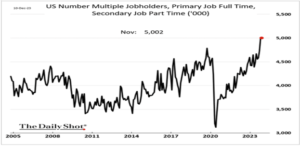

Durable goods orders fell 5.4% month-over-month…Factory orders fell 3.6% month-over-month in October. All signs continue to point to a slowdown.

What does it mean – The Fed and the markets are hoping for a soft landing. Yet, the October decrease was the largest month-over-month contraction since April 2020, when factory orders plunged 13.5% as coronavirus-related lockdowns spread. The October report also featured a downward revision to September figures, including orders for nondefense capital goods excluding aircraft, indicating that business spending in September was weaker than originally estimated.

Interest rate excitement…Why all the excitement? Markets have rallied on expectations of falling interest rates.

What does it mean – We all are wondering if rates go down? “If all the if’s and but’s where candies and nuts we would all have a Merry Christmas.” Lots of what ifs, but here is the major one.

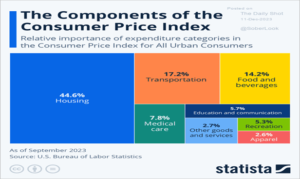

According to my good friend Joel Ross of Citadel Realty Advisors, the way the Bureau of Labor Statistics (BLS) calculates housing costs is flawed. The calculation is lagging, and it does not capture current new lease rents accurately. It also uses a rent equivalent for single family home prices and that is also a lagging and generally inaccurate number. Real estate is currently 44.6% of CPI, an all-time high. Thanks to current fiscal and monetary policy, this makes housing out of reach for much of America. Yet now that rents in some markets are declining, like in Seattle, and some parts of the south, the CPI is not yet picking that up. This is why the Fed was able to halt increases in December and signal that rates may start to come down. Unfortunately like much of the fiscal and monetary policies that created the chaos in the 1970’s is back in vogue and this lag in housing and true rent levels will not show up for a couple of more months, you will likely see CPI decline further creating the very environment that lead the Federal Reserve to lower rates prematurely in the 1970’s creating massive confusion and a whip saw effect that destroyed the trust of investors in our elected officials and the Federal Reserve’s ability to manage monetary policy in the 1970’s.

According to Joel and many experts across the real estate industry, sometime in late 2024, or early 2025, they predict that rents are going to start to increase again as the excess supply gets occupied and new supply dries up. The eventual decline in mortgage rates will not be enough in the early months to stimulate enough new house buying to push apartment occupies down. If the ten-year stays around 4%, which many expect, then mortgage rates will remain above the level that would bring a rush of new loans, especially if the economy slows more in 2024.

Get worried!! US sets policy to seize patents of government-funded drugs if prices deemed to high…On December 7th, the anniversary of Pearl Harbor, The Biden administration pulled its own sneak attack. Our government has just attacked the very philosophy that created the wealth that has freed more people and countries than any other form of government.

What does it mean – Free markets, our democracy, and the U.S. Constitution suffered a blow. Replace the word “drugs” with “research” and one day we may wake up looking like Cuba, Russia or China and wandering how we compromised our way to socialism and communism. Fortunately, you have the U.S. Constitution that protects U.S citizens and limits the power of the government.

The Word Right – Only appears in Constitution Once.

- Article 1, Section 8, Claus 8 –

- Gives Authors and inventors exclusive rights to their respective writings and discoveries.

Article 1, Section 8, Clause 8 is the hockey stick of western civilization. It has freed more people from indentured servitude and more nations than any other economic system on God’s Green Earth. It is the very reason most immigrants come here legally so that they can participate in a system that frees you from economic slavery and is the greatest wealth creator in the history of the world. Abraham Lincoln said that this clause or word right – “added the fuel of interest to the fire of genius.”

I originally saw a version of this in 2009 and was so excited that economist Brian Wesbury sent this out again. His timing could not be better as fiscal and monetary policy continue to collide with free markets and capitalism. We just saw that the government and this tyrannical move by the Biden administration clearly violates our constitution and puts in place laws never seen or used in our country. These rules move us closer to tyranny and socialism. It allows the government to violate contract law and decide if your work and your words are yours or because it invested in the research it can now take ownership. Sounds a bit like Russia and China. I hope you enjoy. It is powerful.

Greedy Innkeeper or Generous Capitalist

By First Trust – Originally published in 2009.

The Bible story of the virgin birth is at the center of much of the holiday cheer this time of year. The book of Luke tells us that Mary and Joseph traveled to Bethlehem because Caesar Augustus decreed a census should be taken.

Mary gave birth after arriving in Bethlehem and placed baby Jesus in a manger because there was “no room for them in the inn.”

Some people think Mary and Joseph were mistreated by a greedy innkeeper, who only cared about profits and decided the couple was not “worth” his normal accommodations. This version of the story (narrative) has been repeated many times in plays, skits, and sermons. It fits an anti-capitalist mentality that paints business owners as greedy, or even evil.

It persists even though the Bible records no complaints and there was apparently no charge for the stable. It may be the stable was the only place available. Bethlehem was over-crowded with people forced to return to their ancestral home for a census – ordered by the Romans – for the purpose of levying taxes. If there was a problem, it was due to unintended consequences of government policy. In this narrative, the government caused the problem.

The innkeeper was generous to a fault – a hero even. He was over-booked, but he charitably offered his stable, a facility he built with unknowing foresight. The innkeeper was willing and able to offer this facility even as government officials, who ordered and administered the census, slept in their own beds with little care for the well-being of those who had to travel regardless of their difficult life circumstances.

If you must find “evil” in either of these narratives, remember that evil is ultimately perpetrated by individuals, not the institutions in which they operate. And this is why it’s important to favor economic and political systems that limit the use and abuse of power over others. In the story of baby Jesus, a government law that requires innkeepers to always have extra rooms, or to take in anyone who asks, would “fix” the problem.

But these laws would also have unintended consequences. Fewer investors would back hotels because the cost of the regulations would reduce returns on investment. A hotel big enough to handle the rare census would be way too big in normal times. Even a bed and breakfast would face the potential of being sued. There would be fewer hotel rooms, prices would rise, and innkeepers would once again be called greedy. And if history is our guide, government would chastise them for price-gouging and then try to regulate prices.

This does not mean free markets are perfect or create utopia; they aren’t and they don’t. But businesses can’t force you to buy a service or product. You have a choice – even if it’s not exactly what you want. And good business people try to make you happy in creative and industrious ways.

Government doesn’t always care. In fact, if you happen to live in North Korea or Cuba and are not happy about the way things are going, you can’t leave. And just in case you try, armed guards will help you think things through. This is why the Framers of the US Constitution made sure there were “checks and balances” in our system of government. These checks and balances don’t always lead to good outcomes; we can think of many times when some wanted to ignore these safeguards. But, over time, the checks and balances help prevent the kinds of despotism we’ve seen develop elsewhere.

Neither free market capitalism, nor the checks and balances of the Constitution are the equivalent of having a true Savior. But they should give us all hope that the future will be brighter than many seem to think.

Merry Christmas and Happy Hanukkah.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.