What Happened Last Week and What It Means to You: Week Ending May 17, 2024

Week Ending May 17, 2024

The economic information released this week by the Bureau of Labor Statistics and the policies signed by executive order border on insanity. If George Orwell was alive today and dropped in to see how things are, he may ask for directions back to the United States. He surely would be confused by the assault on freedom under the niceties of compromise.

I could only imagine he would have thought he was on the “planet of fruits and nuts” or living in a scene from his book “Animal farm”. We are definitely living among the fruits and nuts. Let’s hope we do not go all in on Animal Farm.

Industrial production falls flat in April…Total industrial production was unchanged month-over-month in April following a downwardly revised 0.1% (from 0.4%) in March.

What does it mean – The key takeaway from the report is a lower or slower growth outlook. Weakness in manufacturing output goes hand-in-hand with a weaker economy.

April nonfarm payrolls increased a smaller-than-expected…Big government keeps adding salt to the wound and tells you, “That all is good, and our economy has never been better.”

What does it mean – Reality is more weakness. Nonfarm payrolls increased smaller-than-expected at 175,000, average hourly earnings were up smaller-than-expected at 0.2%, the unemployment rate was up a higher-than-expected 3.9%, and the average workweek was a smaller-than-expected 34.3 hours. The labor market is going the wrong way.

54% of immigrants, legal or illegal, who have arrived since 2022 are unemployed…According to the latest report issued by The Center for Immigration Studies.

What does it mean – Only 46% of immigrants are working. According to our esteemed White House economic team, we have a thriving job market and very low unemployment. Yet, the data above and for some time now, the Bureau of Labor and Statistics contradicts the need or desire by businesses for more workers (legal or illegal). Let’s be real. We know the Koch brothers, Google, FaceBook, and a myriad of industries loves it’s cheap labor, but it is no excuse to destroy the middle class, our youth’s opportunity to earn a living and learn from their first job, and small businesses with massive wage inflation forced by many of our elected politicians whose only expertise is running their mouths and pandering to emotional tyranny.

For those politicians who do not know what they are doing, The APA or American Psychological Association and Author Vincent Waldron defines emotional tyranny as suppressing moral emotions. A strategic ploy of an individual bent on acquiring or maintaining power. At other times it is a collective exercise, perpetrated by a cast of cooperating organization members. But emotional tyranny also emerges as an unintended consequence of organizational structures, values, and practices. Hmmm sounds like “Big Government” to me.

The National Federation of Independent Business (NFIB) reported that the Small Business Optimism Index decreased again for the 26th consecutive Month to 89.4…For the 10,000 small business owners who took part in this survey and represent every industry across our economy, their pain highlights the dark reality of the economy and the policies this administration has forced down the throats of the very people who provide nearly 70% of the jobs in the private sector. This administration is crippling their ability to perform.

What does it mean – Small businesses make up nearly 50% of GDP and yet, according to the NFIB survey 43% of all small business owners in the U.S.A. either could not pay their rent in full or could not pay their rent at all in the month of April 2024.

Adding insult to injury… The Biden administration on Tuesday announced a new rule that will make millions of salaried workers eligible for overtime pay.

What does it mean – Watch out below!!! Wages are going to adjust for those over the minimum wage as employers waste valuable time re-evaluating their workforce and job classifications to be in line with this complicated mandate from this administrations department of labor.

According to Afredo Ortiz, CEO of Job Creators Network. “The Biden administration’s new overtime rule is the latest Democrat attack on American small businesses whose profit margins are already being squeezed by overregulation, inflation, and high credit costs,” he said in a statement. “What’s more, the rule hurts hardworking employees trying to climb the corporate ladder who will find themselves demoted back to hourly positions so employers can avoid associated overtime costs. This especially hurts those who depend on work ethic rather than fancy educations. The next Republican administration should make it a top priority to reverse this new overtime standard.”

Call your congressman and chew there “you know what” out. Tell them to stop abdicating their duty to an unelected bureaucracy or allowing executive orders to override their duty and start acting like the “equal” branch of government that they were elected to serve and protect.

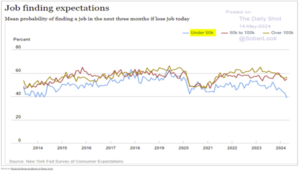

Lower-income Americans are increasingly worried about finding work if they lose their job…This should be a resounding cry to defend small businesses, reduce regulations, and remove unneeded bureaucracies from the halls of Washington. And most importantly, protect the American Citizen and all working Americans from the fallacies pf government overreach.

What does it mean- It has not been this bad since 2014 when we last pushed “big government” solutions like Obama Care, allowed mass illegal immigration, increased taxes, and added layers of government bureaucracy and regulations on small and medium size businesses.

When I saw the chart above, I could not help but investigate why it was so low in 2014. Looking back at history (10 years), not much has changed.

According to a Gallup article written by Lydia Saad, titled, “Cluster of Concerns Vie for Top U.S. Problems in 2014.” Here is what the American people said back in 2014.

The four issues that generated enough public concern are not much different than today. According to the article several issues stood out for enough months for at least 10% of Americans, on average, to identify each of the issues as the nation’s most important problem.

The number one and still may be number one today is the “complaints about government leadership — including President Barack Obama and the Republican Congress (I am assuming this also included the senate) and general political conflict — led the list, at 18%. Second was mentions of the economy in general (17%), unemployment or jobs (15%) and healthcare (10%). By 2014 Obama Care actually sent costs soaring not down. The working class and employers got stuck subsidizing and still subsidizing medical care while watching their own medical care erode.

Beyond the top four issues, 8% of Americans named immigration as the country’s most important problem as mentions of immigration spiked in July to 17% as thousands of undocumented children from Central and South America created a crisis at the southern U.S. border. While 6% mentioned the federal budget deficit or debt and 5% cited ethical or moral decline.

You might be asking what this has to do with the economy…Everything if you believe in free markets and capitalism. Very little if you do not value the consumers’ choice or would rather depend on the government to choose for you.

Our complacency as a nation leads me to this quote by Henry David Thoreau. He wrote, “The path of least resistance leads to crooked rivers and crooked men”.

Tal Gur from Elevate provides a great description. He says, “This metaphor is brilliant and paints a vivid picture of the consequences of choosing the easy route in life.” Thoreau makes the choice simple. At its core, it suggests that opting for the most effortless or convenient path often results in moral and ethical compromises, leading to a distortion of character and integrity. The imagery of “crooked men” suggests that the choices made along the path of least resistance can corrupt one’s character. As individuals compromise their beliefs and values to avoid hardship or conflict, they become morally and ethically compromised, losing sight of what is right and just. And when weak men “compromise” their morals to get a deal done or pass a law or regulation, this distortion of character not only affects the individual but also has broader implications for society as a whole.

It can easily be said that our elected officials have taken the easy road or convenient path of “kicking the can down the road” and “compromising” our economy built on capitalism and free markets towards a pathway of socialism more bureaucracy and regulations, further distracting from truth and more reliant on government.

Maybe it’s time we stop letting Congress compromise our freedoms for the perception of safety. Teach our children the Constitution. What their Inalienable Rights are. Who grants their Liberty. Teach U.S. History – good and bad. Identify and teach the difference between capitalism and the evil and destruction that comes from socialism and leads to communism. Stop grooming our children and allowing boys to go into the girl’s bathroom and locker rooms or compete as a girl or woman. Let’s promote meritocracy and stop vilifying success.

If we do just half of the above, I’ll bet prosperity and freedom make an awesome comeback, followed by peace and economic security, more innovation and a clear path to a safer and more prosperous world.

Let’s roll America!!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.