What Happened Last Week and What It Means to You: Week Ending April 5, 2024

Week Ending April 5, 2024

Initial jobless claims for the week ending March 30 increased by 9,000…Jobless claims increased to 221,000 (Briefing.com consensus 214,000).

What does it mean – Jobless claims are still hinting that we are going to see a soft landing, yet long tern trends continue to go the wrong way. The total number of continued weeks claimed for benefits in all programs for the week ending March 16 was 2,038,116, an increase of 1,035 from the previous week. In the same week a year ago, there were 1,905,338 weekly claims filed for benefits in all programs. That is about a 7% increase from a year ago.

U.S. Employers add 303,000 new employees… March was on fire. The employment report was much better than expected.

What does it mean – New jobs point to solid growth. Nonfarm payrolls increased by 303,000, the unemployment rate dipped to 3.8%. We did see another revision to the downside for February. The private sector payrolls revised down by 16,000 jobs to 207,000 from 223,000 in February.

Part-time employment has surged…More and more people seeking full-time work are ending up with part-time jobs.

What does it mean – Small business owners in CA are the first to tell you that regulations and the rising cost of a mandated minimum wage of $20 per hour is forcing the backbone of the work force to convert to more part-time employment. I guess the unions have it wrong – flipping burgers is not a career. But when you unionize the fast-food industry and add the added expense of dealing with unions along with continued wage pressure by unions all contribute to higher costs and inflation. Keep reading. More on this to come.

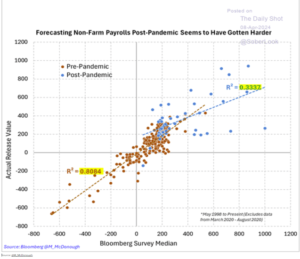

BLS Forecasters have faced challenges in accurately estimating job gains during the Post COVID/Biden era…Per our last email we highlighted the fact that 11 out of the last 13 job reports had been substantially revised downward.

What does it mean – I can only guess, but Bloomberg has provided a great graph to show us just how wide the margin of error has become over the last couple of years.

Cost of employment on the rise…Wages and salaries were up 0.9% and benefit costs increased 0.7%.

What does it mean – “You ain’t seen nothing yet”. Just wait for the numbers to kick in once we see the results of the mandated increase in minimum wage for fast food workers in CA. Expect CA to add to its lead in the unemployment rate and contribute nicely to reversing any trend of growth in the employment numbers as small businesses and even large ones struggle to maintain employees in the fast-food industry.

California is on fire…Not in a good way. It’s a dumpster fire. But a trend that is spreading to a large city near you. Minimum wage will go up over 25% this year. California is a petri dish for crazy politicians.

What does it mean – California’s minimum wage not only hurts CA, but employers who have operations outside of CA. If you have one fast food restaurant or franchise in CA but 59 outside of CA, you are subject to more business destroying regulations beyond what you are faced with by having just one restaurant in CA. According to AB 1228, the minimum wage law that took effect Monday 4/1/2024, guarantees $20-per-hour for workers at fast food restaurants and chains or franchises with at least 60 locations nationwide. That doesn’t include school food service workers, who, historically have some of the lowest-paid workers in public education.

You can’t make this up – AB 1228 authorizes the Fast Food Council to set fast-food restaurant standards for minimum wage, and develop proposals for other working conditions, including health and safety standards and training. Folks, it is your elected officials that are supposed to vote on laws and are required to make sure that they are followed. Not unelected bureaucrats or unions leaders. The unions have no right to legislate over job creators, employees, or the government. CA has entered into the world of George Orwell’s Animal Farm.

You should be asking who is the Fast Food Council? It is SEIU. This law gives complete authority to the SEIU union to mandate minimum wage in CA. These unelected union officials have bought themselves a seat at the table to mandate minimum wages and regulations that will destroy jobs and make it almost impossible for our young people to learn the value of having a part time job in the restaurant industry. It will destroy small businesses like your local pizza place, sandwich shop, etc.

I still remember my first job in high school working for “Tumble n’ Grocery and Deli” making sandwiches and working behind the cash register. I loved it. Put money in my pocket and gas in my tank. It was the first real sense of freedom and economic independence.

AB 1228 is already wreaking havoc amongst fast food workers and those that patron their restaurants. According to the Wall Street Journal, two large Pizza Hut franchisees laid off more than 1,200 delivery drivers. In San Jose, The Wall Street Journal reports that two small Vitality Bowls restaurants have cut their workforce in half. Restaurants like Jack in the Box are “testing fryer robots and automated drink dispensers” so they can fire more employees soon. Hours are being cut and of course, prices are going up too, across the board. Per above comment on

The New York Post reported, at one Los Angeles-area Burger King, prices for a Texas Double Whopper went from $15.09 on March 29 to $16.89 on April 1, once the law went into effect. That’s an increase of nearly $2 for the same exact — already horrifically overpriced — food in just two days. The Big Fish meal went up by $4, from $7.49 to $11.49. That’s the precise increase in hourly wage, passed directly onto customers. Several other menu items went up “anywhere from 25 cents to a dollar,” according to the New York Post.

What is even more disturbing is that the labor unions obtained a nondisclosure agreement (NDA) during the negotiations for the minimum wage bill. So, no one can talk about how exactly this bill came about. Not to mention, how did a big donor and friend of Gavin Newsom get his company Panera Bread exempt from this bill.

It’s a total head scratcher. How does the SEIU and the Unions demanded and received an NDA to be a part of negotiations of AB 1228 and leave out CA largest fast-food franchisees like Harsh Ghai, California’s largest Burger King Franchisee? CA continues to master the kind of naked corruption that one-party states/governments like Russia, China, Venezuela, and Zimbabwe are well known for. Thanks for making it clear Gavin.

This new law is flat out bribery by the unions. Proving our elected officials are more than happy to abdicate their responsibility to the voters when their “election benefits”, provided by unions, keep the funds flowing to their campaign coffers. Regardless of what side of the aisle you support, it is easy to see the conflict of interest and lack of concern for the voters, the workers, the people who patronize those restaurants and services, our communities, cities, and our state. This affects over 530,000 fast food workers in CA, and we all know that the workers will see only a portion of that increase in wages as $ millions will be funneled out of their paychecks through union dues and will be used to secure politicians that will promote more regulations and higher fees through supporting union policies so that union leadership stays funded, and their minions in office, stay in office. This has nothing to do with wages or safety or what is best for the American worker or our country. When asked about working conditions by the press, not even the Fast Food Council can cite specifics or describe what is wrong or how it is unsafe to work at a fast food restaurant, other than, “the ovens and fryers are hot and can burn you”. There are already about a gazillion laws that protect employees, mandate safety regulations, and protect against bad employers. A perfect reason these companies that can afford it are heading towards robots.

California adds insult to injury…Through the help of SEIU, Governor Newsom signed into law SB525 which mandated minimum wages for healthcare workers to go to $25 an hour starting this week.

What does it mean – Read the above one more time. This is not for nurses or clinical workers but everyone from the cleaning people, laundry, food services etc. Like the fast-food industry, unions went all out to unionize the medical industry and successfully did it in CA. This is inflationary and will drive up the cost of your “free government healthcare”. As voters we get what we deserve. As citizens read the Constitution. Understand it and do not take it for granted. The economy, your retirement, and the future of your children and our country depend on a well-informed citizenry. If you do not have one or would like a copy of the U.S. Constitution, please reach out to my office. We will send you one.

Let’s roll America!!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.