What Happened Last Week and What It Means to You: Week Ending March 28, 2024

Week Ending March 28, 2024

New home sales decreased 0.3% month-over-month in February…Seasonally adjusted annual rate of 662,000 units.

What does it mean – On a year-over-year basis, new home sales were up 5.9%. Yet, the median sales price decreased 7.6% yr/yr to $400,500 while the average sales price fell 2.8% to $485,000. February marked the sixth consecutive month of a year-over-year decline in the median selling price.

Blackrock gets caught misleading investors on ESG investing…About time. We all know Blackrock, Vanguard, Fidelity, and others have been charging higher fees on specific funds and utilizing their overall revenue to push their political agenda through forced ESG and DEI departments. This is a cost that does hit every investor and affects your returns as investors in the funds as it is an added expense to maintain and hire ESG and DEI departments at every company they invest in. Blackrock has been caught red handed pushing policies that make it more difficult for small business creation that has led to massive regulation hurting entrepreneurs and American small businesses. Large companies are more willing to swallow the cost as it is other peoples money and while private companies see this as a massive expense and another hurdle to manage and a cost that deteriorates the value of meritocracy.

What does it mean – It is completely fine for investors to invest in ESG as long as the investor understands the higher fees and how this will affect long-term investing, increase the costs of every company that is forced to comply to create and manage ESG and DEI departments. By imposing higher costs on companies that you invest in, it ultimately will reduce the returns. We are now seeing corporate America divorce itself from these imposed policies by large investors like Blackrock and Vanguard. If an investor values social justice and redistribution, then have at it. This is “the land of the free”.

Yet, if you have been reading What Happened This Week and What It Means to You, I am sure you recognize that our interpretation of economic data or events that effect our economy and investing always circle back to the ideas of what made America the Greatest country in the world. We speak out against redistribution of wealth, bureaucracy, regulations, and the gross misuse of power that stifles entrepreneurism, creativity, and capitalism and the pursuit of life, liberty, and happiness. Successful or not, your inalienable rights and the opportunity to pursue your dreams are precious and deserve a voice. Our constitution protects that voice and your right to pursue those dreams. America is the fuel to the fire that lit the path to economic freedom for millions around the world and has freed more people from tyranny and the economic and spiritual bondage of socialism and communism than all countries and civilization combined. It is the one place where everyone comes to raise capital and dream of a brighter future. It is where capital is created, invested and provides the transparency to success by rewarding great ideas, that turn into great businesses and fantastic investments. Our country is based on the ideas of liberty, self-determination, meritocracy, capitalism, and the rule of law.

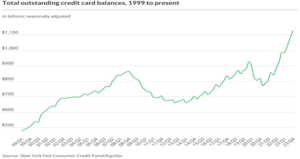

Consumer credit increased by $19.5 billion in January…Revolving credit increased by $8.4 billion in January to $1.328 trillion.

What does it mean – Taking its cue from the Federal Government, U.S. household debt Reaches $17.5 Trillion in fourth quarter along with delinquency rates. Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit. Credit card balances increased by $50 billion to $1.13 trillion over the quarter, while mortgage balances rose by $112 billion to $12.25 trillion. Auto loan balances rose by $12 billion to $1.61 trillion. Delinquency transition rates increased for all debt types other than student loans thanks to the Federal government picking winners and losers and the American taxpayer’s willingness to become a charity for student borrowers and universities.

Here is a look at U.S. credit card balances since 1999. According to the Fed, the average APR rate is now at 21.47%. This is the highest since tracking began in 1994. According to Lending Tree data, credit card APRs show the average new credit card is being offered at 24.66% with a range from 21.16 to 28.15% varying based on your creditworthiness.

“Say it ain’t so Joe”… Year-to-date federal deficit is $828.1 billion or 15% higher than the same period a year ago.

What does it mean – Don’t get me started. Bottom line congress has abdicated its responsibility and let executive orders from high and unelected bureaucrats running bloated agencies control our future and hamstring our freedom through an ever-growing central government determined to redistribute your wealth.

Setting records in all the wrong directions… The cost of federal regulations in 2022 was estimated to be $1.939 trillion.

What does it mean – To put this in perspective, according to the IRS, the total amount of individual income tax revenues for 2022 was $2.263 trillion. That means our government is spending 85% of individual tax revenue or nearly 40% of all tax revenue in 2022 ($4.44 trillion) to regulate you and I while crime and unaccountable bureaucrats pass laws further increasing the size of government while making shopping and driving to work more dangerous.

For example, many cities have de-funded the police to watch crime go up costing businesses billions, as stores are ransacked by gangs of thugs who go unpunished by DA’s in almost every big city run by certain ideologies. This has forced the shutting down of stores, the foreclosure of hotels, businesses and have left office buildings vacant and have accounted for massive losses in jobs and contributed to the shrinking of CA, NY, NJ, and others to see people literally flee for their lives to states that protect the rule of law.

These are the very states that offer sanctuary to illegal aliens whose first action in our country is breaking our immigration laws when they illegally cross our border. They then have the audacity to brag on social media about how they have squatters’ rights, get free healthcare, and EBT cards that are automatically loaded monthly to pay for housing and food. These criminals are put up in hotels, airports, our children’s schools and are displacing American citizens and sucking our treasury dry. According to an Illinois judge in one of the most restricted gun control cities and states in the country, he ruled that illegal immigrants are now able to own and carry guns for their own protection. Yet, you have to go through a background check and wait ten days and may be allowed to purchase but will not be allowed to carry in Illinois. The illegal immigrant enters our country with no background check and is now armed. Our silence is deafening, and we are paying for this planned chaos with your money and in many cases American lives.

These policies are destroying the fabric of American society. Do these elected and unelected government bureaucrats not realize that by not enforcing the law, this is destroying their ability to redistribute our (the taxpayers/citizens) wealth through taxes to the very people they think deserve it? That’s a question we should all be focused on.

Your government won’t shut down…President Biden signed a $1.2 trillion budget and nearly the same amount in new debt so that we can get through the election. HMMM.

What does it mean – Its loaded with pork and charity. Yes charity. According to this new budget passed by the folks who are supposed to watch out for our treasury and us, includes some $4 trillion more in spending and $5 trillion more in taxes on the American people. According to Congressman Bob Good, “This is an increase over last year’s budget, the congressman pointed out, which was already a record high budget.”

It’s your money and they love the thrill of giving it away…What I bet you did not know is that your government is giving your tax dollars to charitable organizations that you may or may not agree with.

What does it mean – An unholy alliance between government and nonprofits or NGO’s that have no interest in solving the issues society faces but are truly concerned about perpetuating their growth and existence on the backs of the U.S. Taxpayer.

Here are the numbers according to Zippia:

- There are 1.5 million nonprofit organizations in the United States.

- Nonprofits employ 10% of the U.S. workforce.

- Nonprofits employ 7.4% of the worldwide workforce.

- 70% of the staff at international nonprofits are paid workers, while 29% are volunteers.

- 5.7% of the United States GDP comes from nonprofits.

- The total U.S. nonprofit annual revenue is $2.62 trillion.

Now this is scary – Only about 10% of overall nonprofit total revenue comes from individual donations.

According to IRS filings and Zippia, 80 cents of every dollar that is contributed to nonprofit revenue in the United States comes from government grants or contracts. Roughly 4% comes from foundations.

As individuals we need to support these causes and concerns. It is why our tax code is set up to allow taxpayers to deduct contributions to charity. But it is not the job of the government to decide what causes to support with your tax dollars. How do they know what you care about?

There are three types of assets. First, the ones you get to keep and can count on your balance sheet. Second, the ones you have to give to society. The third are the values you pass on. Unfortunately, the second example of the ones you have to give to society are either taken by force and spent on programs you may or may not care about, or you can give to the causes or concerns you care about through charities that support those causes. I strongly suggest this way. It reduces government and focuses the use of your money in a much more efficient way to help causes you deem important.

This current budget passed this past week is so bloated with funding for NGO’s it reminds me of the story of Davey Crocket, the king of the wild frontier. It took the courage of a well-informed citizen who actually knows and value of the constitution to tell Davey Crocket that “our treasury” was not his or congresses to give.

“Not yours to give.”

Horatio Bunce to Davey Crocket, 1829

While Davey Crocket, king of the wild frontier, was out campaigning in 1829 he met up with Horatio Bunce. Who went on to say, “Not yours to give.”

Bunce pointed out that the Constitution does not authorize Congress to appropriate funds to help out needy people. He said that Crocket and other members of Congress should have used their own funds to help out the families. In other words, monies raised by taxes were “not yours to give.”

Bunce was an average citizen who fought for our freedom in the Revolutionary War who was well informed and unphased by the trappings of power or DC. He saw through the noise to recognize that, until you demand those that wield power must be held accountable by the very mechanism that that power is given, or it will rarely be given back freely by those who derive their power, success, and security by wielding such power on loan from you the citizen.

Fredrick Douglas knew this, He once said, “Power concedes nothing without a demand, it never did and it never well.”

Mr. Bunce went on to say Davey Crocket, “Well, Colonel, it is hardly worthwhile to waste time or words upon it. I do not see how it can be mended, but you gave a vote last winter which shows that either you have not capacity to understand the Constitution, or that you are wanting in the honesty and firmness to be guided by it. In either case you are not the man to represent me. But I beg your pardon for expressing it in that way. I did not intend to avail myself of the privilege of the constituent to speak plainly to a candidate for the purpose of insulting or wounding you. I intend by it only to say that your understanding of the Constitution is very different from mine; and I will say to you what, but for my rudeness, I should not have said, that I believe you to be honest. . . But an understanding of the Constitution different from mine I cannot overlook, because the Constitution, to be worth anything, must be held sacred, and rigidly observed in all its provisions. The man who wields power and misinterprets it is the more dangerous the more honest he is.”

America, let them hear you roar!!!

Let’s roll America!!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.