What Happened Last Week and What It Means to You: Week Ending March 15, 2024

And the crowd goes wild…CNBC, and the media continues to ignore reality.

What does it mean – From 30,000 feet it looks like our stupidity is only matched by our absurdity. Eleven out of the last thirteen job reports released by the Bureau of Labor Statistics (BLS) have been revised down.

While the markets cheered the 275,000 new reported by the BLS and beat the census of 200,000. They completely overlooked that the January nonfarm payrolls were revised down to 229,000 from 353,000. That is down to 124,000 in January and the December nonfarm payrolls revised to 290,000 from 333,000 down 43,000.

Taking a deeper look at the data, it is akin to drinking milk that is 6 weeks past its expiration date. In no way am I suggesting a conspiracy by the unelected self-serving crowd of DC bureaucrats, but something just does not add up. We have witnessed the last 11 out of 13 job reports revised down by an average of over 30,000 jobs. It must be the “new math”.

After reviewing the report in its entirety, it is easy to see that the job market is not nearly as strong as the top line payroll readings suggest. Without going too deep, all you have to look at are the monthly revisions. According to the latest report, payrolls in December and January were revised down by a total of 167,000, meaning February was just 108,000 above the original January level. Subtract a bloated government, it was even worse in the private sector, where payroll gains were a paltry 19,000 for the month after netting out revisions for prior months. Remember folks, the government does not create wealth and relies on you, the taxpayer, to pay the bills.

The unemployment rate climbed last month to 3.9%…Another reason the job reports do not make sense. Every month the initial report cheers new jobs, but unemployment rate is flat or goes up.

What does it mean – Without the government the unemployment or the U3 unemployment rate would be closer to the U6 unemployment rate of 7.3%. The private sector is shrinking, and the taxpayer is on the hook for more government jobs and a bloated unaccountable government.

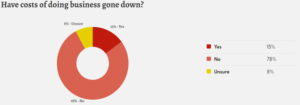

Fewer small business plan to hire more or increase wages…According to the NFIB fewer small businesses intending to hire or increase wages, reinforcing the trend of a softening labor market.

What does it mean – small businesses fear this administration’s attack on capital creation, increased regulations and out of control growth of government at the state, federal and local levels.

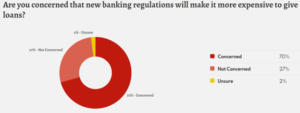

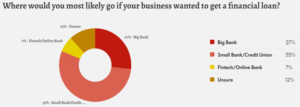

Job Creators Network (JCN) releases monthly poll…With over 550,000 small business members, JCN has a unique insight to American entrepreneurs and small and midsize business owners. Here is what they are saying.

What does it mean – Small business is under attack by bad policy pushed by big government. Here are a few charts and concerns from the engine of the American economy that creates nearly 70% of all new jobs.

I have been harping on increased regulations, too big to fail, the unholy alliance between big government and big business for years. We are now seeing what it means when a government big enough to give it to you is also big enough to take it away. Thank God for our constitution and the protection of your Unalienable Rights of Life, Liberty, and the Pursuit of Happiness.

The ownership mentality that made America the freest and most creative country in the world created more wealth and freed more people from tyranny and “big Government schemes like socialism and communism is under attack by the very bureaucracy and elected officials who fear the voice of the American dream…You. Over 90 million people are affected daily by the onslaught of regulation, big government, destruction of the rule of law and now a member of the supreme court, Justice Ketanji Brown, now questions free speech. The First Amendment is number one for a reason.

Let them hear you roar!!!

Let’s roll America!!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.