What Happened Last Week and What It Means to You: Week Ending March 1, 2024

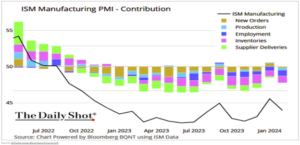

The ISM manufacturing PMI unexpectedly moved deeper into contraction territory last month…Dragged lower by inventories and employment.

What does it mean – While we saw a slight lift in January and saw the reading come in close to 50, which would reflect growth (above 50 represents expansion or growth in the sector) for the first time in over a year. Yet, the trend reversed as inventory buildup continues to plague manufacturing and slowdown in hiring in the manufacturing sector. Here is a look at a couple of key charts.

‘

‘

It’s hard to see a strong recovery when inventories outstrip new orders further slowing employment in the manufacturing sector.

Manufacturing…It’s all about China. Or China’s lack of respect for patent laws and the rule of law.

What does it mean – While China has been the biggest benefactor of the U.S companies offshoring manufacturing for the last 30 plus years, its lack of integrity and forced IP sharing is now coming home to roost. Large multi nationals are struggling as they have finally figured out they have been duped by the Chinese. They literally funded their competition and willfully handed over their intellectual property. Trading their shareholders value for the promise of access to the Chinese markets.

Small manufacturing benefitting…Small and midsized manufacturing benefiting from companies looking to move away from the China risk.

What does it mean – Small and mid-size manufacturing firms here in the U.S. are seeing new orders while the large firms struggle with dependence on China. Why such a disconnect? The ISM data tends to concentrate on larger multinationals, while S&P Global surveys encompass a more representative mix of companies across various sizes.

Amid slower growth in China and Europe, large multinationals are encountering more obstacles compared to domestic industrial companies. Shares of small- and mid-cap industrials have outpaced both their benchmarks and larger-cap counterparts. The ISM manufacturing PMI weakness, therefore, is not representative of the broader US economic activity as small manufacturers are benefiting from the continued relationship large companies are dealing with inside of China. Until they can disconnect or eliminate much of the dependency on China mid and small manufacturing companies will gain more traction. China’s global initiatives and policies have ultimately wreaked havoc on manufacturing here and abroad.

It would not be a Friday…Without the Department of Energy (DOE) and this administration issuing another rule or regulation to squeeze the American taxpayer and consumer.

What does it mean – Biden administration finalized regulations for residential clothes washers and dryers on Thursday. O.H. Skinner, the executive director of the Alliance for Consumers, is quoted as saying, “Another day, another regulation from the Biden administration to remove products from the shelves and limit what people can buy in the name of their ideological goals. At this point, consumers have gotten the message: if it moves or has a motor and it is in your house, Biden would like it to cost more and probably be less effective.”

Get ready folks. If these policies continue to stand, and congress continues to allow an unelected bureaucracy to create, implement, and oversee regulations, your cost of government will continue to grow unchecked, and you will be subsidizing the world as no other country is doing more to transfer wealth and punishing the consumer and taxpayer like this administration. It will hurt business from the manufacturer, distributor, maintenance company, and the ultimate user, you. This is inflationary!!!

Durable goods orders drop…Durable goods orders dropped sharply in January.

What does it mean – Transportation, or more specifically the aircraft orders saw the largest decline. Excluding transportation orders, the overall numbers still came in negative. Moreover, capital goods orders are now lagging shipments, signaling weaker demand.

Inflation…In the latest PCE inflation report we saw the CPI and PPI increase and accelerate in January.

What does it mean – Like we have been saying for months. Don’t bet on a rate cut anytime soon. The experts are now saying it may come at the end of June. While the government “bean counters” think they have it right, the reality is that the longer that rates stay the same, go higher, or fall at a slower pace than they want, the cost to carry the massive U.S. debt becomes more expensive and will be like an anvil tied to the neck of a deep-sea diver. The diver only has so much oxygen in the tank. Margaret Thatcher was right, “The problem with socialism is that you eventually run out of other people’s money.”

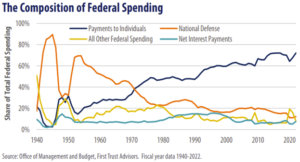

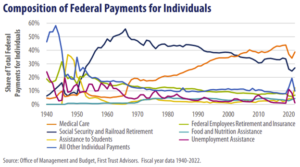

Yet, with numbers like this and the massive spending bills and continued executive orders to transfer your taxes and our nation’s wealth to illegal aliens and folks residing in massive homeless shelters reflecting the 2020’s version of the “Great Depression”, government or socialism is growing out of control. If we as a nation stay on the same tract, you can expect more inflation, more debt and less of your hard-earned money in your account as our fiscal policy has evolved in one that values transfer payments (wealth redistribution) over wealth creation.

The reality is the federal government spending is way too high. Our elected officials and our citizenry do not seem to care or are addicted to the “free handouts” and false sense of security that a bigger government will solve more problems and cost you less. Nothing is free.

Unfortunately, apathy and lack of knowledge by our citizens of what governments responsibility is and is not have allowed bureaucracy to run amuck while our elected officials are fixated on the next election instead of protecting your constitutional rights.

What amazes me is the strides in new technologies like Artificial Intelligence (AI), that is raising productivity and creating new frontiers and advances in many industries, yet we allow the pundits to vilify or belittle the success of those who take the risk to invest in these technologies. Yet, history has shown that a huge and ever-growing government acts like a ball and chain on the very benefits that private industry and private investors create, develop, maintain and inspire.

Below are two great charts by First Trust highlighting the issue and the sheer size and growth of transfer payments otherwise known as welfare and social spending.

At the moment, the markets are ignoring several massive head winds that include the following: the compounding and increasing American and global debt, massive government spending, constantly growing bureaucracies, and increased regulations that lead to higher costs of capital and ultimately slower growth. The markets and industry experts are assuming a soft landing with lower interest rates. Yet, as valuable economic growth is undermined by the above issues, the less likely we will see the necessary growth to reverse the trend or lower rates due to massive government spending and the sheer increase in government regulations and cost of capital.

As Smokey the Bear use to say, “Only you can prevent wildfires.” Get informed and stop the insanity.

Here is the great news. We are a constitutional republic. Our constitution works when we have a well informed and educated and motivated citizenry. If you would like a copy of our constitution, I will get you one. Make sure your elected officials adhere to the very government they swore to protect. Their power is on loan by, us, “we the people”. Make them earn it every election.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.