What Happened Last Week and What It Means to You: Week Ending January 19, 2024

Consumer sentiment up big…The preliminary reading for the University of Michigan Consumer Sentiment Index up big for January came in at 78.8.

What does it mean – The consumer thinks inflation is going to be less of an issue going forward. The key takeaway from the University of Michigan report is that it coincides with the National Championship and the fact that Michigan now has the number one Football Team in the Nation. Not to mention the increase in sentiment was accompanied by another drop in year-ahead inflation expectations, which have returned to a level not seen in three years. Still rooting for my Ducks.

December was a good month for retail sales…Total retail sales increased 0.6% month-over-month in December.

What does it mean – Consumer spending remained healthy in the final month of 2023. With numbers like this it will make the Fed think twice about an imminent start cutting interest rates.

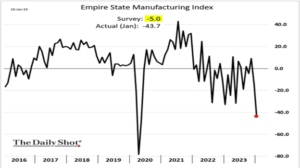

NY Fed manufacturing index falls…Manufacturing continues to get hit as demand deteriorates.

What does it mean – The Bureau of Labor Statistics (BLS) diffusion index for future general activity, which fell to its lowest level (to 19.1 from 21.8) since February 2016, suggesting there is some fading optimism in future business activity. The diffusion indexes measure the breadth of employment changes across industries, which is helpful in assessing the overall state of the economy. The indexes also serve as a potential leading indicator of manufacturing employment levels. Here is a look at the Empire State Manufacturing Index and new orders. New Orders are the lowest they have been since the forced shutdown.

The Philly Fed’s manufacturing index confirms what we are seeing in NY and other parts of the country…US factory activity continues to slow and looks to extend into 2024.

What does it mean – Like NY the Philly Fed sees a fall in manufacturing well below expectations and new orders are down over 17%. Its hard to see how the Fed will lower rates when manufacturing is still struggling. This marks 18 out of the last 20 months of a negative print.

Home sales the lowest in 30 years…According to the National Association of Realtors and reported by the Wall Street Journal, existing-home sales slid 19% in 2023 from the prior year to 4.09 million. “That total was lower than during the subprime crisis and the lowest full-year level since 1995.”

What does it mean – Higher mortgage rates and massive printing of money during COVID increased the prices of homes dramatically and the mortgage rates make it almost impossible for the average American to buy their current home.

Student loan forgiveness…In a new wave of student loan forgiveness, the Biden administration is canceling an additional $5 billion in debt for 74,000 borrowers.

What does it mean – In December the administration issued an executive order to forgive $4.8 billion of loans for people with loans of less than $12,000 owed to the federal government. Nearly 88,000 people benefited. One month later, this administration issued another executive order to forgive $5 billion in student loans to over 74,000 borrowers. 44,000 happen to work for you, the taxpayer. Not a bad raise for government employees at the cost of the taxpayer.

What is even more disturbing – Despite the Supreme Court ruling that this is illegal and that it takes Congress to approve the forgiveness of debt by the government, this administration is rolling out executive order after order to forgive people of their student debt regardless on the rule of law or the terrible precedence this sets. This policy not only picks winners and losers but violates many laws. When the Obama administration took away the ability for banks to issue student loans in 2010, it also took away personal accountability and responsibility. Lessons that need to be learned and reinforced in a civil society.

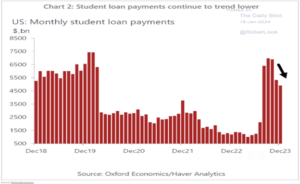

Student loan repayments drop precipitously…As expected. Same crazy policy equals same crazy results…costing you, the taxpayer, and resulting in more inflation.

What does it mean – Following an initial spike after the payment holiday ended, student loan payments are rapidly trending lower again. Exactly at the time this administration violates the law and starts to cherry pick who gets relief and flood the system little by little, borrowers decide to stop paying their loans back.

One must ask, how is this good for future loans and what will it do to the cost of money? How is this good for the rule of law? How is this good for the economy?

I would like to stop paying my taxes. Maybe if we all did that then the government would not have any money to give away to people who legally owe it and are breaking the law by violating the contract that they freely signed with the government when they took those loans out.

In-N-Out burger closes location in Oakland CA…Despite being profitable, In-n-Out is closing the Oakland location.

What does it mean – Due to the massive increase in car burglaries, car jackings, armed robbery, and assault on staff and customers, In-N-Out has determined that it is too dangerous for its employees and customers to keep this location open. In-N-Out executives go on to say, “It is extremely dangerous to work or live in a city that does not uphold the rule of law”. Unfortunately, this is the all-too-common reality of removing accountability and penalties for bad behavior. We need to go back to the old saying, “you do the crime, you do the time”. Below is the sign outside of the Oakland In-n-Out.

If you can’t see it, you can’t believe it. Let’s make 2024 the year of accountability and relish in the ownership mentality. Take control and own your destiny.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.