What Happened Last Week and What It Means to You: Week Ending January 12, 2024

Late Friday the Federal Reserve quietly releases massive loss – “Too big to fail” is now hitting the Federal Reserve.

What does it mean – I have been harping on this for several years. When rates were low, no one cared that our elected officials passed a law to make sure banks had liquidity during the financial crisis. This law went into effect in 2009 and now that rates are over 5%, you, the taxpayer, are on the hook for the losses and the continued payments to the banks. This destroys competition, increases the cost of capital, and reduces the availability of capital as small and mid-sized banks have been destroyed by this program.

According to Reuters, losses at the end of September were over $100 billion for the year. As of yearend, the Fed has tacked on an additional $14 billion in losses totaling $114.3 billion for 2023. According to the Federal Reserve’s own numbers, its balance sheet has ballooned from just over $0.8 Trillion during the financial crisis in 2008/09 to pushing $8 trillion today.

The Federal Reserve report released late Friday, shows the 2023 sum of expenses exceeded estimated earnings by $114.3 billion.

- Interest income on securities acquired through open market operations totaled $163.8 billion in 2023, a decrease of $6.2 billion from 2022 interest income of $170.0 billion.

- Total interest expense of $281.1 billion increased $178.7 billion from 2022. Much of this expense is the amount taxpayers are subsidizing the banks with by allowing the Federal Reserve to pay them interest on bank reserves held with the Federal Reserve. No wonder the CEOs of JP Morgan Chase, Goldman, Bank of America, etc. look like geniuses as their companies rake in billions earned and unearned.

US consumer credit hits record $5 Trillion…Credit card debt rose sharply in November, exceeding $5 trillion for the first time in history.

What does it mean – With interest rates at nearly 25-year highs, consumers are hitting the credit cards hard without fear of what interest rates will do to their balance sheet. I guess they are taking their lesson from the Federal Reserve and the U.S. Government.

With the added expense of inflation, many are now carrying large balances. Yet, our government says inflation is down. If honest, the government should be telling you that the trajectory of inflation is lower than what it was, but still rising faster than expected. The Fed’s target is 2%.

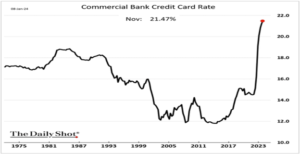

Credit card rates hit a record high…These rates are now higher than the highest rates we saw in the early 80’s.

What does it mean – Inflation is real. Interest rates are high. The consumer is walking on thin ice.

The Producer Price Index (PPI) declined 0.1% in December…Coming in below the consensus expected +0.1%.

What does it mean – For the second month in a row PPI declined. Down 0.1% in November and December should help with the inflation numbers. While there is good news for the consumer and the PPI number should help with inflation, other areas of the economy are still signaling that it may be too soon to declare victory over inflation.

Consumer Price Index (CPI) bucks the PPI trend as reported above…Total CPI was up 0.3% month-over-month in December following an unrevised 0.1% increase in November.

What does it mean – The shelter and housing index jumped 0.5% and accounted for over half of the monthly increase in total CPI. Core CPI, which excludes food and energy, was also up 0.3% month-over-month. Fore the year CPI was up 3.9% year-over-year.

While improved, the key takeaway from the report is that inflation has lost some of its downward momentum. This report just released will make it difficult for the Fed to lower rates and I don’t think the Fed will be able to justify lowering rates as fast as it once signaled.

Europe’s largest economy is shrinking…Germany is in a recession, and many will tell you, so is Europe.

What does it mean – Along with the Green New Deal that was supposed to save Germany and Europe from Russian energy, it is proving to fail in Europe just like here in America.

It was only a couple of years ago that the International Monetary Fund (IMF) held up Germany as an example of how to transition to clean energy. Today, Germany is the worst performing developed economy in the world and dragging down the European Union.

After losing less expensive and a dependable stream of Russian oil and Gas due to the Ukrainian war and our current administration reversing course on supplying Europe with natural gas and increasing regulations on federal land, the German manufacturing and energy intensive industries must pay higher natural gas prices and depend on green energy that according to many will likely never meet the energy demands by manufacturing alone. In fact, Germany is looking to retool coal energy plants and looking towards nuclear. These energy initiatives and the war in Ukraine has created huge inflation and increases costs for German manufacturing and deterred many consumers from spending.

Meanwhile higher interest rates from the European Central Bank aimed at quelling inflation have crimped construction of new apartments and offices throughout Germany and Europe.

Home sales down…The median sales price declined 6.0% yr/yr to $434,700 while the average sales price declined 7.3% to $488,900.

What does it mean – November marked the eighth straight month of a year-over-year decline in the median selling price.

Per the chart below, the key takeaway from the report is that new home sales continue to get hit. The largest region for new home sales (the South), where prices are generally more affordable, is also seeing a falloff in sales. The housing report speaks to supply constraints for lower-priced homes and general affordability constraints created by high mortgage rates and high prices relative to median prices for existing homes.

More pressure on the American worker… According to the new Senate proposal, the Senate is busy making a deal with the White House to make it more difficult for American citizens to compete for jobs in our own country and will put more pressure on wages across the board.

What does it mean – Here is a look at the proposed border bill coming out of the Senate backed by Schumer and Lankford and echoed by McConnel.

Border deal would:

1) Increase green cards by 50,000/year – This means more workers competing with US Citizens.

2) Work permits for adult children of H-1B holders – This means more foreign competition for U.S. children graduating from college with degrees.

3) Immediate work permits to every illegal alien released from custody – This means the government will drive down wages for all US Citizens and those working here legally.

4) Taxpayer funded lawyers to certain UACs and mentally incompetent aliens. – I have no idea what this means. Congress, please Explain.

5) Expulsion authority for a limited number of days ONLY if encounters exceed 5k/day over a seven-day period. – This means if the first thing you did that day was to break the American immigration law and you illegally entered the US and where number 1 to 5,000 caught that day you won the “Thank God for idiots in congress award.”

6) Restricts parole for those who enter without authorization between ports of entry. This Means if the U.S. Government can’t find you where you said you would be or doing what you told them you would be doing and you do not show up at your immigration hearing and a certain amount of time goes by, then we (U.S. Citizens represented by our government) is restricted in upholding the law unless the illegal alien committed a violent crime (definition continuing to change depending on statistics of the perp). How is that working out for us now? Another example of putting illegal immigrants in front of taxpaying legal law-abiding U.S. Citizens.

More regulations and destruction of small businesses…In a 1,700-page document, the EPA issued a plethora of regulations not voted on by your representatives but passed by this President through executive order.

What does this mean – According to the EPA’s own Joseph Goffman, who is the principal deputy assistant administrator for the EPA’s Office of Air and Radiation, repeatedly insisted that the EPA had consulted with industry members when constructing the methane regulations.

Rep. August Pfluger pushed Goffman on that claim. Asking him to name just two or three of the companies that his department at the EPA had spoken with. Goffman could not — or didn’t want to. Rep. Pfluger went on to say, “I’m not sure that anybody at a small, independent level was consulted. Maybe Exxon was, but I’m not sure that the industry [was].”

Here is what a few of the small producers had to say:

Drew Martin, the managing member and director of finance at Miller Energy, testified that the EPA’s regulations would add an estimated over $8 million in additional expenses. Last year, the company’s total operating budget was $11.1 million.

Marin went on to say, “That’s over 70 percent cost to my bottom line,” Martin said. “I can’t survive that. I don’t believe many of my peers in Michigan producing marginal wells can survive that.”

Patrick Montalban, who is chairman and CEO of his family oil and gas business in Montana, similarly testified that the “dozens of new EPA reporting requirements alone would be enough to put his small company out of business due to the time and manpower that would be needed to comply.”

Small producers across America like Miller Energy and Montalban Oil and Gas Operations are facing eradication by the EPA. Across the nation, independent producers will be forced to close their doors and abandon productive wells, leaving hardworking Americans jobless. Consumers will face less competition and higher costs due to the onslaught of regulation.

The EPA Breaks their promise. They really do not care. Prior to Martin’s and Montalban’s testimonies about the unworkable burdens of the EPA’s new regulations, the very same EPA administrator Joseph Goffman, who gave testimony and repeatedly insisted that the EPA had consulted with industry members when constructing the methane regulations yet could not name them was asked by Rep. Pfluger whether Goffman would commit to staying and listening to the panel of small producers, Martin and Montalban among them. Goffman immediately committed to listening to their testimony. But as soon as his testimony ended, Goffman and his entire staff of EPA underlings stood up and exited the room. Another example of Government exceptionalism.

Men and woman like Goffman, who are appointed to or hired by the administrative state have one goal. While they will say one thing and do another, they are bound by the law of nature to grow their power as they do not have a product to sell or an idea to promote and live to regulate and control an outcome that they have little to no control over in the long run. History is filled with failed states that have regulated themselves into self-destruction. We often call this communism and socialism. Sounds great until your utopian ideas run into reality and out of other people’s money.

Unfortunately for you and me, these folks like Goffman get to sit in Washington or Sacramento paid for by you and dream about their utopian green energy revolution. Meanwhile, across America, hardworking men and women are all but powerless against the encroachments of an administrative state bent on destroying their livelihood. Today, small to mid-sized oil and gas producers are in the crosshairs. Today the unelected administrative state further drove a multitude of nails into the coffin of small and midsize independent oil companies that hire thousands of Americans across the country. What industry is next? Will it be your industry?

Car rental Co. Hertz announces it will sell all of its electric car fleet…According to Reuters, Hertz announced that it will shed its electric car fleet for more efficient gas-powered cars.

What does it mean – Hailed as a game changer by the Biden administration, less than two years later, Hertz is reversing course due to the cost of insuring and maintaining its electric fleet.

Consumers and investors are catching wind of reality. Without massive government support and tax incentives electric vehicles are very expensive to purchase and even more to maintain. China is finding this out the hard way and starting to dump its production on the global market taking huge loses or hoping to buy the market through lower costs. Ultimately the consumer will decide.

Like the Hertz case, the economics just don’t make sense for most Americans let alone most of the world. Will technology eventually catch up to the hopes and dreams of politicians and consumers who want to drive electric cars? Yes, someday. The problem is it must be at a price point and overall cost that makes the consumer recognize the benefits of making that change and give a reason for manufacturers without government subsidies want to produce them.

Unlike socialism or a communist run economy where the government dictates what is produced, what you can buy and is often subsidized by the government; capitalism is driven by the consumer. Companies that succeed solve the problems or needs of their customers or clients. When those costs come down through free markets that foster and promote competition, that new technology or service is adopted by the masses. The markets are efficient. And those who are not, they fail.

2024, Just one more year of scare tactics – Government shutdown. Elected officials are threatening again to shut things down if we don’t spend trillions on stuff we do not need, want or is constitutional. The last one, constitutional, is the most important.

What does it mean…Newly minted Speaker of the House, Johnson, may be in over his head. With help from the left and the idea that somehow compromise is good and will help get things done has been a disaster for the American citizen and grown government faster than the economy.

When it comes to non-defense spending (entitlements like Social Security), here is what compromise looks like:

- 10% of GDP in the 1960s

- 14.8% of GDP in 2001

- 15.2% of GDP in 2007

- 17.8% of GDP in 2019

- And now, projected at roughly 22% of GDP over the next 5 years, after peaking at 27.7% in 2020 due to massive spending for COVID.

Simply put, non-defense spending now consumes more than twice as much GDP every year as it did 60 years ago. According to First Trust, its share of GDP is up 45% from just before the Great Recession, and it’s up 24% from the year before COVID. Government continues to take more and more of what the private sector produces, and it is heading for annual deficits of about $2 trillion. One only has to ask themselves, “what would the economy look and produce if those funds remained in the private sector solving the issues people care about?”

We have seen the results of giving it to the government. It picks winners and losers. Lacks efficiency and panders to ideology regardless of reality or ability to deliver a product or service it promised at the price it promised.

During this time our national debt has skyrocketed and is out of control due to the lunacy of Washington. Interest expense alone has more than doubled from $332 billion in 2020 to over $740 billion in 2023.

I often hear from many that all we need to do is raise taxes. History suggests otherwise. Look at CA, NY, NJ, IL, and MI where these states are addicted to tax and spend strategies, they have witnessed the great exodus. Well over 5 million people have fled high tax states for economic freedom.

The last time the budget was balanced was between 1998 and 2001. During those years, tax receipts averaged an all-time record of 19.4% of GDP, while total spending averaged just 18%. Credit Reagan and with the help of the Contract With America, Bill Clinton. During most of the 1980’s and from 1998 to 2001, Government spending fell as a share of GDP. These facts only validate what the prior 200 years proved. That the less the government spends, the more there is left for private sector growth.

This also validated that the more the economy grew, the more the government brought in through taxes. I have always said money flows to the area of least resistance.

Last year’s Congressional Budget Office (CBO) budget forecast further proves the point. The CBO overestimated tax receipts by 11%, and underestimated spending by 9%. The bigger the government gets, the more likely this happens year after year. Back in the 1980s and 1990s, when the US was cutting spending, real GDP grew an average of 3.2% per year. In the past two years, in spite of historically large Keynesian deficits, real GDP has averaged just 1.7%.

What’s the solution. Hold your elected officials accountable. Who cares what letter is behind their name or how long they have been there or if they are nice to look at or say nice things. Make them do their job. Your country, no, your children, grandchildren and their grandchildren depend on it.

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.