What Happened Last Week and What It Means to You: March 7, 2023

Week Ending March 3, 2023

SUPERCORE INFLATION…I am from the government and inflation is not that bad – “Honestly, let me show you.” The government is now telling us we need to measure inflation using the supercalifragilisticexpialidocious, totally cool new method called, Supercore!!

What does it mean – Prior to the use of substitution in the 90’s, headline inflation measured all the components of the economy. Government changed the way we counted inflation because it believed, “you” would eat hotdogs instead of steak if the price went up too much on steak, but you still consumed meat. Hmmm, maybe. Economist then focused and reported on CPI, but then the government liked Core CPI. And now, when you are a bureaucrat, and need to create new measures of inflation to justify the growth of government programs, justify mass spending and need for government social programs or even worse a fascination and desire for control. Or, maybe you just can’t count, the math is evil, the facts hurt your feelings and wrecks your reality, so you resort to the power of the Government and create a new measure to save the day. You call it “SUPERCORE INFLATION!!!”

What is Supercore inflation? Supercore inflation is an economic measurement that strips away volatile items from the traditional Consumer Price Index (CPI), such as food, energy, and housing. The very back pocket items that hit the American citizens wallet every day. Some say it, “gives a more accurate snapshot of underlying price pressure.” These geniuses must be super humans. Never eat, drive a car or heat, or cool their homes. But in reality, it is us taxpayers that get the privilege and benefit from highly skilled interns who will order pizzas, retrieve their laundry and order them an uber XL to deliver them to and from their office in DC to provide us with numbers that support a new method to justify their insanity.

Manufacturing continues to slow…The slump in manufacturing production accelerated.

What does it mean – Currently manufactures do not have the visibility nor inclination to meet current demand when the uncertainty caused by government over regulation and continued attacks on energy, steel, transportation and inflation and now the CHIPS Act are front and center. Rising energy costs including diesel and fuel lead to rising prices on all commodities and transportation. The risk is too great. Ask Target, Walmart and other retailers that had to unload tons of inventory when manufactures tried to catch up to the demand created by “COVID bucks”.

Mortgage applications continue to hit multi-year lows…Rising interest rates and way too much federal spending are driving inflation and will continue to hit the housing market as mortgage rates continue to rise.

What does it mean – As the 30-year mortgage rate nears 7% again. Expect rates to continue up. The government is still redistributing way too much of your wealth far too fast. Government may be convinced that free “stuff” is better than hard work and ownership when it comes to winning elections, but the average American is now feeling the pinch and worried about being priced out of the housing markets by rising rates and institutional buyers. The DC nobility has forgotten its role and it is not a charity They might want to ask how that worked out for Marie Antoinette? Cake just isn’t the same as the pride of ownership.

Residential construction spending down…As rates rise demand is falling.

What does it mean – Interest rates driven by bad fiscal and monetary policy due to COVID and the forced shutdown of our economy by our government is coming home to roost. The housing market is a massive part of our economy and spills over into many industries. Some would call this a trickle-down effect.

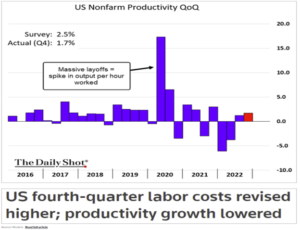

The Q4 unit labor costs were revised higher…While productivity growth was downgraded.

What does it mean – Mandatory minimum wage increases and too much government spending on social programs creating an even larger and massive social net trapping people that should be working and becoming productive members of society. Business owners are forced to raise wages. The cost to maintain the lower end of the work force has not increased productivity in line with the increase of wages. This is inflationary and why minimum wage will force automation and be the destruction of the low income and even the middle class.

Big companies love it because they can afford to get a robot to cook your $12 hamburger, fill your $3 coke, and make you pay with a credit card, so they do not have to count change. We warned you years ago about this…Now your kids may never learn the value of hard work and Taco Bell may become a delicacy. Yikes!!

CIPS Act…What was the great hope to bring back chip manufacturing to the US has quickly been taken over by bureaucrats, the unions, and lobbyists in DC.

What does it mean – Pass the bill and then create the rules after it passes. Typical Washington DC. Completely leaving out the American Citizen and the American Entrepreneur, forsaking any relevance to the ownership mentality that built and protected this country.

Right when you thought this administration would do the right thing to promote the economic safety and guard against the Communist Chinese, who continually steal our technology. We find out that buried in the laws created after the passage of this bill on August 9, 2022, that only companies that comply with DEI and massive woke regulations will be allowed to participate in the CHIPS act.

According to my good friend Joel Ross, expect costs of chips in the US to go up 60% from here for companies that are forced to participate in this bill. Here are some of the regulations a recipient of the subsidies must comply with.

- Childcare for all construction workers building the facility plus for all plant workers in an area where there are likely only a couple of such childcare workers. The childcare must be in tandem with the “stakeholders” meaning local community groups.

- Union wages and union work rules. States where the plant gets built must change their labor laws to comply with the new union dictated rules if they want a subsidy.

- “Family sustaining benefits”, including paid leave, must be paid -whatever that means, but you know it means a lot of cost.

- Companies must provide an essay on how they provide “wrap around” support to underserved communities, such as adult care, transit assistance, and housing assistance.

- Companies must share profits with the government. We call this Communism!!! And by the way that is already done through taxes. I guess Biden learned this from Ukraine.

- No stock buybacks for 5 years. Great let’s punish investors and the markets because government knows best.

What is amazing none of the people that wrote this bill, and only a few that voted for it have ever hired anyone or started a company in the private sector. Yet, your elected and unelected officials somehow know better than the companies who have flourished for years building our economy by working with employees and potential employees developing compensation packages that hire, reward, and promote the very best employees. It is called, meritocracy.

From what I have read, and the folks Joel and I have spoken to, none want to get in bed with the government that will force them to raise prices that will ultimately make their cost of production increase by close to 60%. This is another example of government overreach and the protection of foreign production of our most critical infrastructure. When will they get out of the way and let Americans, “Make America Great?” Unfortunately for us expect more of the same from both parties in DC. There is probably more regulations in this bill that has not come out yet. Reminds me of Obama Care. One does not have to look far to see how the left in DC makes a big deal that it is subsidizing chip manufacture, and then they put on terms that increase costs 60%, plus a lot of work and other rules that will increase risk to businesses, driving up the cost of capital, and making them reliant on government and ultimately become a huge source for future HR lawsuits.

Reach out to your elected representatives in DC and demand that they strip these laws from the CHIP Act and truly free the American entrepreneur and manufacturer. If we do not, this will become a precedent for many industries including your health care, food, defense, and others. This is pure communism at its truest form and government overreach at a minimum. Demand accountability and go to American Made Promise.

Policy matters!! If we do not understand how it matters, we face massive risk to our economy, your investments, and economic freedom.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.