What Happened Last Week and What It Means to You: March 13, 2023

Week Ending March 10, 2023

Initial jobless claims jumped last week…Jobless claims have been pretty stable up until this past couple of weeks.

What does it mean – The number of unemployment applications has now surpassed the average of 2018, 2019, and 2022 levels. With higher inflation and cost of employment rising faster than incomes expect companies to adjust as they try to stay in front of the consumer.

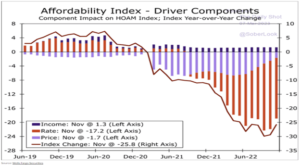

Housing affordability remains near record lows…On the heels of last weeks letter I found these two charts.

What does it mean – The first clearly shows the drivers of housing affordability, according to Wells Fargo. The second from Goldman Sachs shows the affordability index going back to 1998. The second graph speaks volumes as you can see it is an extreme low level. Expect the effects of government mandating rent control in states like CA and pushing more housing programs to drive down the cost of housing.

The February ADP private payrolls index topped expectations…While dated and is behind the numbers above it is leaving the fed in a bit of a pickle.

What does it mean – When you look at the weekly jobless claims and then get the monthly numbers from ADP it puts the Fed in a difficult position of determining the proper trend to follow. The good news is that February numbers provided a nice jump.

Silicon Valley Bank fails…Fed takes over. Who is next?

What does it mean – In our February 24th letter to you, I discussed the idea of “Too Big to Fail” through an unholy alliance between big government and big business. Unfortunately, our politicians have set a terrible precedent. When in trouble, “Big Government” will step in to protect “Big Business” and print tons of money to cover up their mistakes. But don’t worry, it won’t cost the taxpayer a dime.

We are about to witness the third wave of destruction caused by the repeal of the Glass-Steagall Act in 1999 by President Clinton. Clinton believed that the limitations the Glass-Steagall Act imposed on the banking sector were unhealthy and that allowing banks to diversify would actually reduce risk. Instead, it led to less competition across all financial sectors. It sparked a massive roll up of smaller banks by the very largest and a consolidation in power that has corrupted DC and ultimately weakened the resolve and credibility of the entire banking sector. Competition was virtually destroyed as big banks got bigger as they purchased smaller banks, insurance companies, and investment banks. This led to just a few massive banks controlling the majority of the float, investment banking, and tied to insurance companies. Remember the housing crisis from 2006 to 2011? Government stepped in and that is where we first heard the term “Too Big to Fail.” Government literally removed the risk for bad bankers and businesses and put it on the back of the American taxpayer. You!!!

In 2006 I railed against the 1999 decision to repeal of the Glass-Stegall act as we began to see the effects come to fruition. It started first in the investment banking sector and the “tech wreck” of 2000 and then bled into the housing market in 2006. This led to the bail outs of large banks including Goldman Sachs and led to the destruction of Bear Sterns and AIG and the need for massive government bailouts that stepped in front of investors at the benefit of the government. Shame on DC and the week kneed politicians that sought power over principal.

Well, here we are again. This time its Crypto currency and investment banking causing the very destruction that would have been prevented had we not seen the repeal of the Glass-Steagall act in 1999 by then President Clinton. Another case of the very banking structure that was set up to protect the American citizens and our banking structure was dismantled by globalists out of greed is about to send a shockwave through our markets.

Let me be clear. I do not know the dollar amounts or the size of the liability and I hope it does not happen. But what I do know, is this, “Too Big to Fail” has led to relaxed requirements. It has also led to shoddy business practices and these banks are like sheep they rarely stray from the flock and often are prone to group think as they are in deep need of continued reassurance by their peers. If Silicon Valley Bank, Signature Bank and First Republic have problems, you can bet Bank of America, Goldman Sachs, Black Rock, JP Morgan, Chase, UBS, etc. also have a problem.

The solution?…Glass-Steagall. Bring it back!!! Separate investment banking form commercial banking. This will stop the continuous need for the government to provide ongoing bail outs to bad bankers and prevent a lot of the fear and potential run on the banks. This alone will separate investment banking and the potential for bad investments affecting your savings and checking accounts.

What is the Glass-Steagall Act – During the 1929 stock market crash and the lead up to the Great Depression, Congress was concerned that commercial banking operations and the payments system were incurring losses from volatile equity markets much like we are seeing today. While the repeal did put into place a number of regulations to prevent issues like we are seeing, nothing makes up for the complete separation of commercial banks from investment banks and insurance companies. When combined the risk is layered in and unavoidable like we experienced in during the Great Depression, The Tech Wreck, and the Housing Meltdown. According to Julia Maues, Federal Reserve Bank of St. Louis, “an important motivation for the act was the desire to restrict the use of bank credit for speculation and to direct bank credit into what Glass and others thought to be more productive uses, such as industry, commerce, and agriculture.”

The Banking Act of 1933 effectively separated commercial banking from investment banking. Senator Glass was the driving force behind this provision. Basically, commercial banks, which took in deposits and made loans, were no longer allowed to underwrite or deal in securities, while investment banks, which underwrote and dealt in securities, were no longer allowed to have close connections to commercial banks, such as overlapping directorships or common ownership.

Following the passage of the act, institutions were given a year to decide whether they would specialize in commercial or investment banking. Only 10 percent of commercial banks’ total income could stem from securities; however, an exception allowed commercial banks to underwrite government-issued bonds. The separation of commercial and investment banking was not controversial in 1933. There was a broad belief that separation would lead to a healthier financial system.

With the passage of the Gramm–Leach–Bliley Act in 1999 and signed into law by President Clinton, this act essentially unwound all the protection put in to place by the Banking Act of 1933 and the Glass-Steagall Act. Commercial banks, investment banks, securities firms, and insurance companies were now allowed to consolidate. Furthermore, it failed to give to the SEC or any other financial regulatory agency the authority to regulate large investment bank holding companies. No wonder we see congress continually passing laws to fiddle with the minutia instead of dealing with reality.

Neither side of the aisle will want to go back, but this would be the very best thing for our country’s financial health and sovereignty. It actually will take the politics out of choosing winners and losers. Investment Bankers will have to quantify risk and not shelter it in a bloated balance sheet that the regulators can’t figure out.

The Fed’s Response…The Fed has put in place a new facility, the Bank Term Funding Program (BTFP). This funding mechanism offers “loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging U.S. Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par.” Got to love when the government creates new programs for problems they caused and tells you it “won’t cost the tax payer a dime”, according to President Biden.

What does it mean – It is estimated that BTFP could shield banks from $620 billion in paper losses. Yet, the original size of the Troubled Assets Relief Program (TARP) was $787 billion.

If this does not work the Fed can reverse field and start lowering rates again. This new program also allows the Fed to use their balance sheet and make changes to their quantitative tightening (QT) program if deemed appropriate. In my opinion, all of this would have been unnecessary if we kept in place the Glass-Steagall Act.

87,000 new IRA agents…That’s what President Biden wanted to hire over the next decade to conduct tax enforcement on billionaires and the wealthy.

What does it mean – Treasury Department Secretary Janet Yellen acknowledged on Friday, March 10th, that 90 percent of IRS audits will be conducted on small businesses and families, not billionaires.

Comrade, “one must only destroy the dream and the wealthy will fall in line.” I am sure someone had to have said that.

Biden proposes $6.8 trillion budget…But will only raise your taxes by approximately $5 trillion.

What does it mean – I am pretty sure this isn’t going anywhere. My prediction is that Congress will vote and pass a Continued Resolution (CR) and pretend it is a victory for the American people.

What is a CR? It allows the congress to not do its job and still fund the government. CRs generally continue the level of funding from the prior year’s appropriations or the previously approved CR from the current year. The key word is level. It keeps spending the same. But the joke is on you. Congress will sell this as a win for the American people will tell you that Congress saved the American people “10% to 25%” since they did not increase spending at the rate of inflation or agree to the massive budget increase by President Biden. The problem is the issues that need spending and attention from our elected officials get no new spending at all. For instance how do you protect the border if there is nothing in the budget to do so? Little to nothing is still little to nothing. Yet why do we want to continue to fund NGO’s like with massive welfare to support, house, feed and provide health care for over 5 million illegal aliens at a cost that is far more than what it would take to protect our border. Yet those organizations will continue to be funded at the cost of your safety. The CR is Not a good a deal for our country or your business.

The noise is everywhere and the media awash with all the soundbites but very little facts or understanding of how we got here and why. Their silence is deafening. Or, is there an even more concerning question for us all? Are we going to be content to be told what to think, how to behave, and what to say? Or are we afraid of what we are seeing, frozen in disbelief? When you are truly free, you can live fearlessly. Our founding fathers gave us our constitution to protect our freedoms. Do not give them away for the perception of safety or the convenience of a hand out.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.