What Happened Last Week and What It Means to You: March 22, 2023

Week Ending March 17, 2023

Fed bails out Silicon Valley Bank (SVB) and Signature Bank…In SVB’s case, it was a highly concentrated banks with more than 85% of its deposits uninsured.

What does it mean – To heck with moral hazard!!! Big Government to the rescue. The good news for those who would have lost a portion of their savings they don’t have to worry. The Fed’s action definitely settled down the markets but created a precedent and a road map thick with moral hazard and a path towards a national bank and the destruction of capitalism. Fewer banks mean fewer opportunities, less competition, and more expensive capital. Just look at Europe.

Many of the recipients of the bail out are well connected and large contributors to the current administration in DC. Even worse, we are bailing out China. Over the last few days, it has been reported that possibly 30% of the bail out will go to Chinese companies and Chinese citizens with strong ties to the CCP. SVB was one of the few banks allowed to bank in China. Talk about a trojan horse.

As reported in both cases, management and the boards seemed to care more about pushing diversity, equity, and inclusion (DEI) and teaching their staff about how to properly discover and use their pronouns. Instead of doing their job, they wasted shareholder money and put at risk its client’s savings and checking accounts and now are dependent on you, the taxpayer.

SVB, the 16th largest bank donated $73 million to BLM, mandated diversity training and promised $5 billion to sustainable financing for ESG initiatives instead of managing risk at the bank and making sure they managed the rising interest rates we all are facing. This is the very definition of moral hazard. I will bet shareholders, investors, and clients did not sign up to support programs that would distract management and employees from doing their job or cost shareholders millions and billions if left alone, but opened accounts and invested in a bank that was supposed to manage their accounts in a safe way that provided them access to their money when needed.

The President, through the Treasury Department and FDIC board are acting unilaterally without following the rule of law or the procedures put in place by Congress and the very agency that is supposed to oversee the banks? This action violates long standing laws and banking regulations by not letting the free markets take over. It destroys faith in the system, in capitalism, and puts government in charge of picking winners and losers. According to Janet Yellen, her five FDIC board members now get to decide what banks will get help and which ones will not. Since when did our country allow unelected bureaucrats the ability to rewrite precedent and act unilaterally without Congress and the Presidents approval? This is crony capitalism and downright socialism and goes against everything that made America the most prosperous nation in the world.

SVB could have been purchased but the Biden administration did not like or agree with the politics of the potential suitors willing to buy SVB. Instead of following the process, this administration and Janet Yellen shut it down and put you, the taxpayers and all banks on the hook for a bail out that was favorable to their political ideology. What happened to letting the markets work it out? Instead of letting potential buyers work out a price for the bank, you got stuck with the bill. Another moral hazard violating the FDIC and banking regulations that have been in place since the Great Depression. We can not allow the government to pick winners or losers.

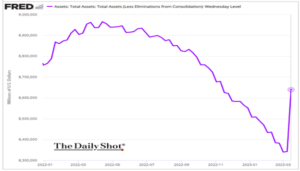

The Fed’s balance sheet surged…In one week the Fed’s balance sheet reverses four months of quantitative tightening.

What does it mean – Banks have borrowed $165 billion from the Fed in one week. But don’t worry, According to President Biden and his economic council made up of economic dwarfs have said, “It won’t cost taxpayers one dime.”

Check out this chart and ask yourself, “Is this inflationary?” Remember these are the same people that told us, “inflation was transitory.”

Before the Panic of 2008 the Fed had total assets of about $875 billion…As of Wednesday last week, its assets were around $8.6 trillion. That’s with a “T”!!!

What does it mean – Since 2008 the Fed increased its balance sheet by buying Treasury debt, which allowed government spending to soar. The Fed also held interest rates artificially low, making that increased spending cost less. According to First Trust, “when rates where at .25%, it didn’t mean much; after all, banks were only earning 0.25% per year on the reserves.” Yet, still costing taxpayers billions. “Now that banks are earnings 4.65%, it’s a much bigger deal. In fact, given the increase in short-term rates in the past fifteen months, the Fed is now paying banks more in interest than it earns on its bonds. Banks own about $3 trillion in reserves on which the Fed pays interest. So, if short-term rates reach 5%, banks could earn about $150 billion per year,” of your taxpayer dollars. And what do the banks have to do to earn that money? Not a darn thing!! They literally do nothing. Just sit around, keep the reserves on their books, and collect “rent.”

Think how the public and lawmakers will react when that becomes more widely understood. Call your congressman now and send them this letter. Demand real change. Ask yourself, “are you willing to sacrifice your future, your children’s future or your grand children’s future over pronouns and woke policies that do nothing to secure, build, or create wealth, or insure life, liberty, and pursuit of happiness for all Americans?”

We, the people, better focus on the big things that keep us free. Wake up!!!

Buried in the news.

The Conference Board’s Consumer Confidence Index for February was down again…Coming in at 102.9 vs. a consensus of 108.4.

What does it mean – The monthly decrease was driven entirely by consumers’ short-term outlook, which entailed becoming considerably less upbeat about their short-term income prospects. Consumers see income down as inflation invades the paycheck making it worth a lot less. Getting less for more. It is the Governments core competency.

Business inventories are creeping up…Inventories are starting to creep up.

What does that mean – Look for sales. If manufacturers can’t move products look for them to cut deals or lower financing costs. For the first time in a long time, I saw Ford and Nissan advertise 0% financing.

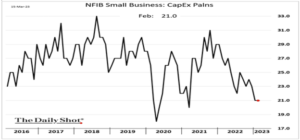

CapEx spending remain subdued…Corporate America is signaling a slowdown in equipment investing.

What does it mean – As the government tries to push and tweak the levers of the economy, corporations are not buying it. This chart says a lot.

Who wants to go back to the 1970’s?…Only if we get the 1980’s.

What does it mean – When we lack a strong and prudent fiscal policy from our elected officials, the Federal Reserve is forced to overcompensate with a strong monetary policy. History has shown this over and over. Hopefully for our sake we will realize the lack of fiscal policy coming from this administration and focus on leadership that drives economic policy that reduces bureaucracy, creates capital, protects freedom, and intellectual property. The below chart from Bloomberg says it all.

“Go West young man.” Horace Greely’s famous quote about DC says it best. “Washington D.C. is not a place to live in. The rents are high, the food is bad, the dust is disgusting, and the morals are deplorable. Go West, young man, go West and grow up with the country. There is health in the country, and room away from our crowds of idlers and imbeciles.” DC has not changed a bit other than some great restaurants.

What Greely was referring to, was the American Expansion or Manifest Destiny. So, in that spirit of expansion and freedom, rid yourself of the chains of socialism and entrapments and entanglement of a government scheme promising an equal outcome. Seek your fortune and relish in the excitement and thrill of your adventure. Seek and protects a land that protects your thoughts, your words, and your inventions. Nothing ventured, nothing gained.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.