What Happened Last Week and What It Means to You: March 30, 2023

Week Ending March 30, 2023

What happens when business competes with government…Costs go through the roof!!!

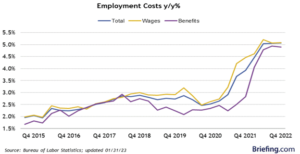

What does it mean – from 2015 to 2020 the average cost of employment went up roughly 2.5% per year. Since the Fauci Virus made in China, the cost of benefits and employment have increased by roughly 5% in 2022 and 4.7% in 2021. This is inflationary in every way and a big reason public companies are laying off in large numbers. The new CEO of Disney just announced another 7,000 people will be laid off to manage margins. What we need to see is a downsizing in government and the scraping of duplicate welfare policies that entangle and trap people to a system that is more addictive than crack cocaine.

Consumer credit increased by $14.8 billion in January…Consumers continue to swipe the credit card. Hard not to when even the government won’t take their own cash.

What does it mean – Like corporate America and many businesses that are now only taking credit cards, the Federal Government announced that many federal museums and parks will now only take credit cards and will not accept the very currency our government prints. You can expect people to continue to rely heavily on their credit card and for those who are not disciplined expect massive credit card issues going forward. Not to mention the unintended consequences of creating a cashless society. Look at China and the use of a social credit score. It is already being used to cut people off from their money and credit if they do not like what you say.

The shelter index was up 8.1% year-over-year…Cost of owning or renting a home is continuing to go up.

What does it mean – Inflation is not only hitting your back pocket but your rent, mortgage, insurance, and the bills that keep you in your home continue to rise at a record pace. Unfortunately, the Fed has lost control of even keeping close to its target of 2.0% inflation.

New home sales fall year over year…New home sales were down 19.0% from February to February.

What does it mean –New home sales month-over-month/year-over-year by region: Northeast (-40.0%; -55.3%); Midwest (-1.4%; -20.2%); South (+3.0%; -8.8%); and West (+8.1%; -33.2%). Other than the states with low taxes and less government oversight, new home sales throughout most of the country continue to fall.

Existing home sales increase for month of February…As prices fall existing home sales increase.

What does it mean – The key takeaway from this report is the understanding that the median selling price declined for the first time in 11 years. This underscores the affordability challenges that have been presented by rising mortgage rates and prospective buyers’ beliefs about potentially buying at a cyclical top in the housing market. While they may be seeing multiple offers, sellers are seeing offers below the ask.

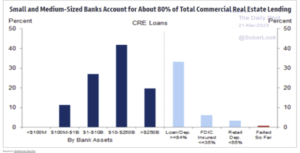

Small Banks account for about 80% of commercial real estate lending…Small banks know their clients and are much better suited to lend to the local economy.

What does it mean – If you want local growth, you need local banks. Bring back the Glass Steagall Act and urge your congressman or woman to repeal the repeal of the Glass Steagall Act.

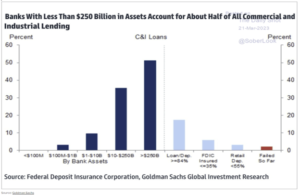

Commercial loans…Small and regional banks account for more than half of all commercial loans.

What does it mean – Banks with less than $250 billion in assets and serve a region or particular market typically know their clients better, have less turnover, and understand the local economy far better than large national institutions. Bring back the Glass Steagall Act and insist that your congressman or woman vote to repeal the repeal of the Glass Steagall Act.

Think globally and act locally…picking up litter and turning off the lights is a great way of keeping your local community and home a beautiful place to live. Not to mention meaningful to our country, our continent, and our planet.

What does it mean – Local banks know the community the best. They know you. They know the needs of the community and understand the economic risks, competition, cost structures and community issues that will hinder or help businesses start, grow, and maintain their ability to serve their community and expand throughout their region.

A banker, or risk management team from NY, SF, or assigned regionally by a national bank will not know you, the needs of the community, the local competition, or potential risks. Large banks will predominantly only understand your financial viability by your personal balance sheet, your demographics, and those of the community. They will not see or know your pride and dedication to your dream and your community. Sounds simple but it’s why small businesses still hire and provide nearly 70% of all jobs across this nation and account for more wealth than all the public companies combined. Big banks are not exactly great when the economic dynamics demand a deeper dive.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.