What Happened Last Week and What It Means to You: April 12, 2023

Week Ending April 7, 2023

Initial jobless claims jump amid methodology revision…Why does the government seek to revise how official numbers are counted. I guess the math is the same even when you try to revise the method of how you count. 2 + 2 = 4.

What does it mean – No matter how the Bureau of Labor Statistics tries to count the initial claims. One person filing is still one person filing.

The key takeaway from the report is that it featured a revision to the seasonal adjustment factor, which resulted in big upward revisions to figures from recent weeks. The higher level of claims will invite some to questions the strength of the labor market after last week’s release of the Job Openings and Labor Turnover survey for February showed a big drop in openings.

Industrial Production softens…Year-over-year decline in total production and capacity utilization point to continued softening.

What does it mean – Year-over-year decline in total production and capacity utilization rate is near its lowest level since September 2021. Manufacturing continues to be hampered by fiscal policy and overbearing government regulation like the CHIPS Act. Per our letter dated March 3, 2023, here is a look at just a few of regulations buried in a bill that was supposed to bring back manufacturing to the US.

- Childcare for all construction workers building the facility plus for all plant workers in an area where there are likely only a couple of such childcare workers. The childcare must be in tandem with the “stakeholders” meaning local community groups.

- Union wages and union work rules. States where the plant gets built must change their labor laws to comply with the new union dictated rules if they want a subsidy.

- “Family sustaining benefits”, including paid leave, must be paid -whatever that means, but you know it means a lot of cost.

- Companies must provide an essay on how they provide “wrap around” support to underserved communities, such as adult care, transit assistance, and housing assistance.

- Companies must share profits with the government. We call this Communism!!! And by the way that is already done through taxes.

- No stock buybacks for 5 years. Great let’s punish investors and the markets because government knows best.

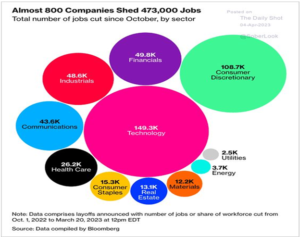

Below is a chart dated April 4, 2023, showing nearly 800 companies that have shed 473,000 jobs since October 2022. The CHIPS act was passed in 2021and technology companies have shed the most jobs since. Policy matters.

Consumer credit increases…Consumers continue to tap credit cards and sources of revolving credit at record pace.

What does it mean – Revolving credit increased by $11.2 billion to $1.215 trillion. Nonrevolving credit increased by $3.6 billion to $3.581 trillion. Revolving and nonrevolving credit is now over Consumer credit increased at a seasonally adjusted annual rate of 3.7% in January. Revolving credit is now over $4.796 trillion.

According to the Certified Financial Planner Board, 89% of Americans worry about the Cost of living…63% of people are concerned about their ability to purchase necessities such as food and clothing.

What does it mean – Most Americans struggle with out-of-control inflation. Over half the population is now more worried about basic necessities. This is the worst we have seen since the Great depression. Seems like the more we turn to government the worse the problem becomes.

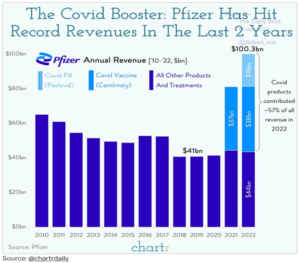

Your tax dollars hard at work…Does this mean every American taxpayer should get a dividend.

What does it mean – Big government begets Big Business. Wow – government tries to mandate a vaccine policy funded by the American taxpayer and the largest benefactor is Pfizer and the national media getting paid to advertise the vaccine funded by you the American taxpayer.

From the looks of things, COVID has been one heck of an investment for Pfizer. Problem is it really has not done much for the American taxpayer or preventing the spread of COVID.

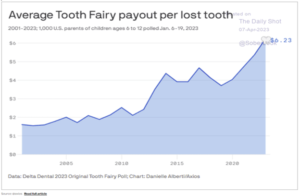

Speaking of the Tooth Fairy, payouts are on the rise…Even the Tooth Fairy is struggling with out-of-control inflation.

What does it mean – Between the Easter Bunny and the rising cost of eggs, traditions are becoming more and more expensive. Policy matters and our children matter more.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.