What Happened Last Week and What It Means to You: May 3, 2023

Real GDP increased at an annualized rate of 1.1%…According to the Bureau of Economic Analysis, the first quarter came in at 1.1% (Briefing.com consensus 2.0%) after increasing 2.6% in the fourth quarter.

What does it mean – While personal consumption expenditures accelerated in the first quarter to 3.7% from 1.0% in the fourth quarter with spending on goods up 6.5% and spending on services up 2.3%. The hit to GDP came from the change in private inventories.

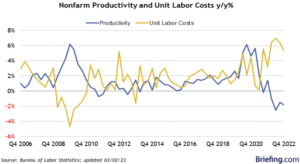

Q4 productivity was revised down to 1.7%…While labor costs were revised up to 3.2% from 1.1% according to the Bureau of Labor Statistics.

What does it mean – Unit labor costs were up 6.3% from the same quarter a year ago (which is when the Fed first started raising rates). Moreover, unit labor costs in the nonfarm business sector were up 6.5% in 2022, which is the largest annual increase since 1982. Below is an interesting chart that shows the last recession in 2008. It shows unit labor cost falling and productivity increasing. You should ask yourself why? Could it be that the government was not competing with employers through massive transfer payments. More on that topic to come.

Existing home sales declined 2.4% month-over-month in March…Existing home sales across regions: Northeast (unchanged); Midwest (-5.5%); South (-1.0%); and West (-3.5%).

What does it mean – No doubt rising interest rates and inflation continue to plague the housing market.

Residential construction spending was down 0.2% month-over-month and was down 9.8% year-over-year…While Nonresidential construction spending jumped 0.7% month-over-month and was up 18.8% year-over-year.

What does it mean – Single family construction sees little relief while non-residential made up for most of the downside in March.

Total retail sales declined 1.0% month-over-month in March…Non-store, or online, retail sales increased 1.9% month-over-month following a 1.3% increase in February.

What does it mean – Amazon, and other online businesses continue to pull sales from traditional retailers as consumers hit by massive inflation seek deals online. Expect traditional retail to struggle and more unemployment to follow as stores like Bed Bath and Beyond file for bankruptcy and start to liquidate inventory.

Bottom line, this report from the Census Bureau shows that sales declines were seen across most retail categories, reflecting weakness in consumer spending on goods. This should exacerbate concerns about an economic slowdown that cuts into corporate earnings.

Total Chaos…San Francisco is the epicenter for bad policy leading to moral decay and destruction of private property.

What does it mean – Soft-on-crime policies resulted in Whole Foods closing its downtown location after being open for less than a year. The reasons for the closure included safety concerns for staff and customers. Before deciding to close, the store had reduced hours and enforced bathroom rules after crack pipes and syringes were found inside them.

A Target location in San Francisco put all of its products on lockdown amid a shoplifting surge. Now, basic items, like toiletries, cosmetics, are protected behind lock and key. I guess, when you stop prosecuting theft and raise the minimum for theft from $500 to $1,000, it does embolden crooks and if you do not prosecute criminal behavior, you get more of it. Bad leadership = Bad policy. Don’t expect a change in LA, SF, Chicago, NY, Detroit, Minneapolis, New Orleans, etc. If these cities and states keep electing the same leaders who are supposed to protect your safety and businesses, then you will have neither safety nor business.

The Internal Revenue Service (IRS) just reported the Mass exodus of taxpayers from high-tax states continued from 2020 to 2021…California, New York, and Illinois again suffering some of the nation’s biggest losses of people and money.

What does it mean – Policy matters!! Democratic governors such as California’s Gavin Newsom and Illinois’ J.B. Pritzker slam responsible policies implemented by fiscally conservative states, while their residents are fleeing in droves for conservative states that ensure economic freedom and protect individual liberty.

The IRS migration data released late last week shows that California lost more residents than any other state, with a net loss of nearly 332,000 people and more than $29 billion in adjusted gross income in 2021. The state with the second largest population loss is New York, which saw a net loss of over 262,000 residents and $24.5 billion in income. Illinois, meanwhile, suffered a net loss of 105,000 people in 2021 and $10.8 billion in income.

On the winning side, Florida reaped the benefits of the wealth migration more than any other state, enjoying a net gain of $39.1 billion in gross income from 256,000 new residents. Texas, which gained $10.9 billion and 175,000 people, came in second. They were followed by Nevada ($4.6 billion), North Carolina ($4.5 billion), Arizona ($4.4 billion), South Carolina ($4.2 billion), and Tennessee ($4.1 billion).

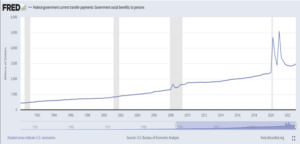

Transfer payments explode… What are transfer payments and why you need to be very concerned…Transfer payments are payments made by the government for which no good or service is exchanged.

What does it mean – A hand out not a hand up…Transfer payments from the U.S. Government are exploding under the Biden administration. Predictably, our response to the Chinese virus, known as COVID, exasperated the problem. It opened the door for more government spending and a plethora of new agencies and government handouts. Regardless of side, from Winston Churchill to Rham Emanuel, government has one job – to get bigger and neither side can ever, “let a good crisis go to waste.”

We are now on track to transfer $3 trillion this year. While Social Security makes up nearly 45% of the transfer payments (our retirees deserve every penny they paid-in and should be the first paid-out). Yet, the remainder of the transfer payments is our government mortgaging your future with programs that you and I cannot afford so that they can make a promise they have no ability to keep without taxing you to the poor house.

A great example is the utopia known as California. Bad policy and handouts forcing taxpayers to leave in droves. Cities imploding, crime at record levels, the state is a refugee magnet for our nation’s homelessness and a sanctuary state illegal aliens.

State legislatures are passing policies that destroy businesses and allow criminals to run wild if all they steal is $1,000 or less in merchandise. In California the environment has become a religion. They are “hell bent” on passing unrealistic, unsustainable, and unnecessary environmental policies that will make our businesses less competitive, further driving business away from California and turning what was once the greatest state in the union into a diabolical experiment on humanity. In fact, these newfound environmentalists in state and federal government are more worried about reducing Carbon Monoxide, than cleaning up their own messes like the streets of San Francisco, Los Angeles, and the homeless problems plaguing every large city in California. Last week the House of Representatives brought in experts to tell them that Carbon Monoxide made up 6% to 8% of the atmosphere only to be proven wrong by a cattle farmer using Google to prove it was only .04% of our atmosphere. While up from .034% over the last 50 years, only about 30% of the .04% or .012% is man made. Fear mongering is normal for those who have nothing to fear but the fear of actually going to work and producing something someone is willing to pay for. But it does not explain why they want to stop cows from farting. You just can’t make this stuff up.

As for quality of life in this utopia known as California, suicide amongst our children is at the highest levels, schools are failing our children and the taxpayers across the state, most students unable to read or do math at their grade level. Our state universities and colleges no longer require SAT tests for college entrance and further divide us by offering black only dorms and graduations. It’s no wonder California is seeing young families flee the chaos of our schools and homeschooling exploding in areas where people can afford it. There is no free lunch, free Obama phone, free health care, or free education. Yet, if you are a politician, keep telling the masses it is free. You will surely win over the uninformed, blind, and deaf. Heck, who does not love the promise of a free lunch or big government program that promises you the world and costs you “nothing.”

Taxpayers and businesses need to be laser focused as government programs are growing out of control and are threatening our freedom, future growth, and prosperity. Massive government spending will not drive revenue or the economy. If that worked, Cuba and Russia would be the wealthiest countries in the world and there would be no slave labor in China. Here is the chart showing your government is transferring $3 trillion we do not have.

Beginning May 1st…Upfront fees for loans backed by Fannie Mae and Freddie Mac will be adjusted because of changes in the Loan Level Price Adjustments (LLPAs) thanks to another bloated government agency setting the rules and bypassing our constitution.

What does it mean – It’s all about ESG. “Equitable and sustainable access to homeownership” according to the Federal Housing Finance Agency (FHFA).

According to Realtor.com chief economist Danielle Hale told ABC News. “The Biden administration’s stated purpose behind making these changes is to help make it easier for borrowers who have historically been disadvantaged and have had a hard time accessing credit.” Hmmm.

Former Home Depot CEO Bob Nardelli told ABC News, “It’s another subsidy to try to buy votes.”

Like the previous government programs that encouraged or even forced banks to participate, this program, could lead to another wave of bad loans to people who cannot afford them, further ruining their chances to achieve the American dream and financial independence.

Much like the results of what sounded like a great idea resulted in the devastation of the housing market and our economy in recession of 2008-09. The implementation of the 1993 Community Reinvestment Act (CRA) promoted and packaged loans to people that could not afford those loans resulting in the loss of homes and destruction of poor communities as foreclosures accelerated into 2008 and 09.

With the passing of the Community Reinvestment Act by the Clinton Administration, in January 1993, the new CRA housing bill required Fannie and Freddie to make 30% of their mortgage purchases affordable-housing loans. The quota was raised to 40% in 1996, 42% in 1997, and in 2000 the Department of Housing and Urban Development ordered the quota raised to 50%.

Bank regulators began to pressure banks to make subprime loans. Guidelines became mandates as each bank was assigned a letter grade on CRA loans. Banks could not even open ATMs or branches, much less acquire another bank, without a passing grade—and getting a passing grade was no longer about meeting local credit needs. As then-Federal Reserve Chairman Alan Greenspan testified to Congress in 2008, “the early stages of the subprime mortgage market . . . essentially emerged out of the CRA.”

What is equal is not fair and what is fair is not equal.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.