What Happened Last Week and What It Means to You: March 2, 2023

Week Ending February 24, 2023

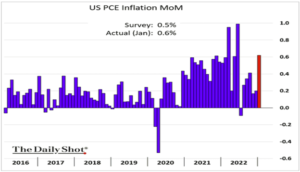

The January PCE inflation measure topped expectations…particularly the core index. US inflation continues to run hot.

What does it mean – With food and energy continuing to hit consumers wallets, inflation rates are not nearly low enough to suggest the Fed would even be thinking about cutting rates this year. Food index increased 0.5% month-over-month and was up 10.1% year-over-year. The energy index increased 2.0% month-over-month and was up 8.7% year-over-year.

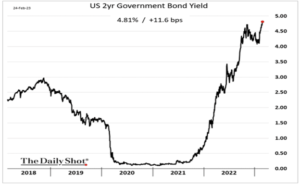

Treasury yields jumped…Check this chart out.

What does it mean – Due to the inflation numbers expect rates to rise and a bit more pain in the bond market.

New home sales decrease…According to the census bureau the median sales price of new homes decreased 0.7% yr/yr to $427,500 while the average sales price dropped 5.4% to $474,400.

What does it mean – By region, month-over-month/year-over-year volume gets crushed out west. The only positive is the South…hmmm. Northeast (-19.4%/-13.8%);

Midwest (-6.9%/-34.3%); South (+17.1%/-2.2%); and West (-7.3%/-46.9%).

Manufacturing activity contracted in January…For the third straight month manufacturing contracted.

What does it mean – The cumulative effect of rate hikes around the globe is adversely impacting demand, evidenced by the fifth straight contraction in the new orders index.

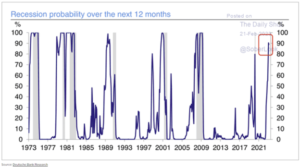

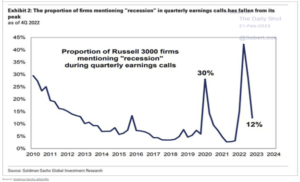

Deutsche Bank’s model shows a 90% chance of recession over the next 12 months…However, only 12% of the Russel 3000 companies have mentioned “recession” on earnings calls. This is down from its peak in Q4 of 2022.

What does it mean – The silence is deafening. According to Deutch Bank, the possibility of a recession is up to 90%. I guess if you don’t say the “R” word, it won’t happen. Or is there a possibility that companies are seeing something that the Fed and Wall Street do not see? Or, has corporate America learned that big government needs big business and corporate America has learned that with a bit of pain it can rely heavily on its partner in dependency – the government. I believe “Big Business expects Big Government” to do whatever it takes to protect their mutual interests. And that is not always the taxpayer or the American entrepreneur. Remember “TO BIG TO FAIL.”

Labor Secretary Marty Walsh resigned…The day after the jobs number was released the Labor Secretary, Marty Walsh, resigned and decided the NHL labor union was safer than the swamp.

What does it mean – Remember three weeks ago (2/3/23) we reported that the Philadelphia Fed’s own numbers questioned the integrity of the Federal Bureau of Labor Statistics (BLS). That the Philadelphia Fed found that using data on 33 states plus the District of Columbia from the Quarterly Census on Employment and Wages show that payroll gains were officially reported in Q2 were significantly overstated. Instead of 1.05 million jobs, the US only added 10,500. That’s a downward revision of 99%. This week Moody’s says the real numbers just released is less than half what was reported. No wonder Marty Walsh resigned. How long can you keep telling the American people to stop believing their lying eyes?

Is there any integrity in DC? Along with the myriad of other issues misreported or labeled misinformation, including China and the latest information confirming the origin of COVID, Vaccines and the hiding of data by big pharma, CDC, NIH, and the FDA, business closures, the border, illegal immigration, and the many reports from government agencies, it is no wonder the trust in government is at an all-time low. The numbers do not jive with what you are seeing. Inflation is out of control, we give billions to Ukraine and let our own citizens suffer in East Palestine, Ohio. It is now crystal clear why President Biden went to Ukraine right after he authorizes a blank check for $500 million and three days later Janet Yellen takes a trip to Ukraine and promises an additional $10 billion for pension plans and infrastructure. I doubt Russia is quaking in their boots while President Biden wastes your tax dollars funding Ukrainian pensions. Hold them accountable at www.americanmadepromise.com

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.