What Happened Last Week and What It Means to You: February 23, 2023

Week Ending February 17, 2023

Payroll Growth surprises to the upside…128,000 new jobs in leisure and hospitality, a 105,000 increase in private education and health services, and a 25,900 increase in temporary jobs, the unemployment rate of 3.4% was the lowest since 1969. We will go over in more detail below.

What does it mean – Seeing the recent news on FL and TX says it all. It does not take a lot of explanation to understand why there are so many job openings in FL and TX. Separate it all out and read through the reports, FL gained over a 1 million new residents and Texas over 700,000 last year and climbing. Low tax states are open for business while CA, loses over 300,000 employed people last year and over 700,000 in 2021 and 2022. NJ, NY, MI, and IL are also watching their citizens vote with their feet.

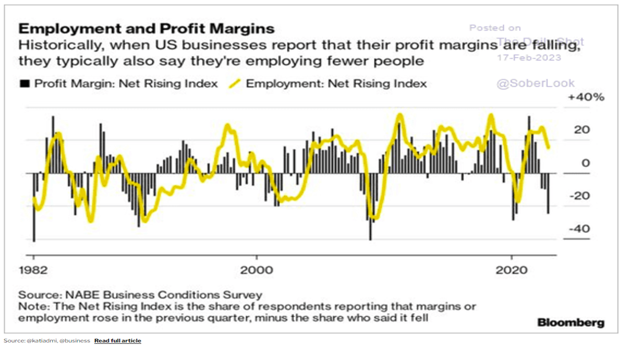

Weaker profit margins mean less hiring…But President Biden and the Government said we had record unemployment.

What does it mean – With unemployment at 3.4% and participation rate at 62.4% the numbers just don’t add up. How do we have almost full employment, but the participation rate is near record lows? Going back to the mid 90’s until 2008, the participation rate hovered around 66% to 67% participation. We also saw tax policy punish corporate America forcing more layoffs and a migration of manufacturing move overseas…HMMM.

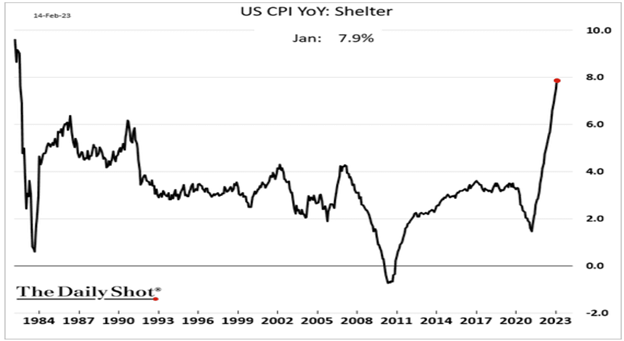

Year-over-year shelter inflation is nearing 8% for the first time since 1983…Your tax dollars are going to support illegal immigration. This is hurting your children and grandchildren.

What does it mean – American taxpayers are competing with our own government for housing and shelter. Through its actions, the federal government is pushing up the price of shelter by renting hotels, apartments, and houses for the nearly 5 million illegal immigrants that break our laws the moment they cross the border illegally or overstay their visa. The ability for our children and grandchildren to purchase a home or rent an apartment or home is being decimated by this policy and is pricing Americans out of the housing market.

What is even more frustrating is the New York Mayor Adams and other sanctuary cities are now willing to fly or bus illegal immigrants at the taxpayers’ expense to anywhere they would like to go. While we as tax payers stay home and work to pay for this disaster. I wonder if our incredibly generous (with your money) elected leaders recognize that what they are doing is increasing demand for scarce resources and driving inflation across all areas of society. Especially long-term and short-term shelter.

January service inflation up .5% in January and overall inflation up…Bureau of Labor Statistics (BLS) reported inflation at 6.4 percent YOY in January.

What does it mean – While down from 6.5 percent in December 2022, this was higher than economists expected. The Fed is now repositioning its message/stance on future rate hikes. Per the note above, the generosity of our elected officials and their policies to keep spending faster than the Fed can tighten the supply of money. Expect more of the same.

Food is still heading up…Where’s the beef? Food is up 10.4% YOY and if you want to eat beef instead of bugs like the World Economic Forum (WEF) wants you to eat, it is up a lot higher than 10.4%. My son’s egg business is soaring.

What does it mean – Greg’s Eggs are a hot item. The neighbors love the fresh organic eggs. Unfortunately, a dozen organic eggs in CA have gone from roughly $3 a carton to nearly $8 over the last year and half.

Revolving credit or credit card debt is over $1.196 Trillion…Consumers are hitting the credit cards hard.

What does it mean – As layoffs continue and inflation continues to hit us all, more and more Americans are living paycheck to paycheck. According to a CNBC study published on 1/31/23, over 64% of Americans are living paycheck to paycheck up from 42% in 2022.

Can’t Make this Up!!

How we got here. What happens to our economy when equity and an equal outcome is more important than equality and the protection of individual liberty.

It is often said that what is taught in colleges ends up as policy and in the board room 20 years later. DEI and ESG’s have been the rage on campus for the last 20 plus years. Defund Israel, reparations, the environment, gender studies, standardized tests are sexist and racist.

It is all coming back to haunt us. Our schools are focusing on emotions and the little things while our kids continue to fall behind China in math and science. Their kids dream of going to the moon and our children hideout in their room or parent’s basement playing video games. Heck, the average kid at a public-school in our greatest cities can’t read at his or her grade level.

To add insult to injury, our universities are using our tax dollars to separate and divide us by race. Welcome back to the 1950’s. According to Williams College, the students claim segregation will make Williams a “more welcoming, supportive and safe community for minoritized students.” Since when did we let entitled brats decide that racism is safe?

The article frim the National Review went on to say, “We at the National Association of Scholars (NAS) recently launched Separate but Equal, Again: Neo-Segregation in American Higher Education, a project examining racial segregation on college campuses such as Columbia University, Yale University, MIT, and others. Surveying 173 schools, we (NAS) found that 42 percent offer segregated residences, 46 percent offer segregated orientation programs, and 72 percent host segregated graduation ceremonies. We call this “neo-segregation”: the voluntary and institutionally sanctioned segregation of minority students in the post–Brown v. Board era. Based on the above definition, the NAS does not even know what neo means. Neo-segregation or new form of segregation is still segregation.

This is CRT or Critical Race Theory. This is South Africa 1994. If we follow this line of thinking, our children’s future is bleak and our social and economic future and way of life threatened. There is a reason the United States of America is the world’s last great hope for liberty and individual rights. It is why millions fight to enter legally and illegally. Read the constitution. Protect it. Or you may wake up one day wandering what happened and telling your children about what America once was if this continues.

Ask yourself, how are we going to be able to work and live together when our schools and government keep passing laws that take us back to segregation and allow taxpayer dollars to fund universities and colleges to promote policies and events that separate us? Why are we funding universities that teach hate and promote identity politics over science, math, english and American History (the good and the bad)? E Pluribus Unum.

Continuing these policies of forcing an equal outcome vs. protecting equal rights is only going to add to further and greater tension and a larger economic gap. It destroys the creation of wealth and ultimately ownership.

Your investments – your company – your job – our way of life. These policies derived in the classrooms have already leading to increasing corporate costs and are reducing shareholder value as companies are forced by activist boards to spend millions to hire Diversity, Equity and Inclusion (DEI) departments, teach employees about gender issues, hiring the right color or sex over the right person or best qualified. CEO’s are terrified to speak up against these issues and are only now seeing the devastation of these policies. Just read what Elon Musk said about DEI once he took over Twitter. It forced him to look at what was happening at TESLA. His courage is sparking more CEO’s to face the threat of DEI head on and the destruction it is causing within the companies they run. Even the US Military is dealing with the DEI issues in retention and recruitment of soldiers. These racist and sexist policies pushed by ESG investing, forcing boards to hire DEI racists to reinforce the idea that if you are of a certain race or sex you are inherently racist. These boards and their DEI policies are the epitome of racism and it is sick and disgusting.

DEI and ESG erodes capitalism and the free flow of capital. It increases risk to investors and makes capital more expensive. Investors want a return on their money and expect management and employees to be good citizens. There is a reason that we have the “Golden Rule”. This behavior or woke management erodes the trust between shareholders and management. Where does it lead. Look no further than Zimbabwe, South Africa, and CA (Mandated boards have been shot down in CA but are popping up again in Sacramento) as examples?

I have been writing this letter since 2006 and never in a thousand years would I ever think I would be writing a letter about business and the economic trends that would focus on issue that would purposely erode the protection of our constitution and equal rights.

It is your capital and my responsibility to inform you of the head winds your investments and way of life are facing. Unless we speak out, many of Americas best companies will fall farther behind by trying to fix perception and social injustices that are already protected by our constitution. The answer is not more laws or bureaucracy at the corporate and government level but more freedom. Yet, corporate America, government agencies and our military are dealing with and unfortunately losing and giving in to fear and emotion of a solution looking for a problem or wanting to hold on to an issue solved through our constitution. Instead of standing strong and leading and calling out what is wrong and highlighting what is moral and right, many CEO’s and companies fall victim daily to activist shareholders who are placed on boards for the sole purpose of injecting social change. They are not protecting shareholder value or increasing it. How can they when cost go up and the solutions, they are providing are in search for a problem they create and cannot solve.

One great example is how Black Rock utilized ESG funds to put activist shareholders on Exxon Mobil’s board. This vote reduced oil production by 20% after the previous board voted to increase production by 25% over 5 years. This not only hurt shareholders and investors but caused massive layoffs destroying high paying jobs and hurt our country and our oil independence. It is also an example of how government policy works to use the private sector to move its agenda. Click on this link to see the article highlighting how Black Rock used ESG’s to force a reduction of 20% in oil production at Exxon.

I have always believed that, left alone, people will make great decisions and chose to support companies that are ethical and have a moral compass. Unfortunately, the media, corporations (not all), many business schools, universities, and now the board rooms have been overrun by people who are focused on gender confusion and insist on equal outcome instead of performing their jobs. Their house is burning, and they are worrying about what they are going to put on their email signature line this month to celebrate some social issue that our Constitution has already solved and protects. Let’s get to work.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.