What Happened Last Week and What It Means to You: February 2, 2023

Week Ending February 2, 2023

Federal Reserve raises rates…As expected the Fed raised rates by .25%

What does it mean – The Fed also signaled that it would continue to raise rates until inflation returned to its target of 2%. Someone needs to hit the Fed and this administration over the head with a good dose of reality. Record spending continues to exceed both quantitative tightening and record job growth at the government level. This rate hike is not going to get inflation under control. See Chart below.

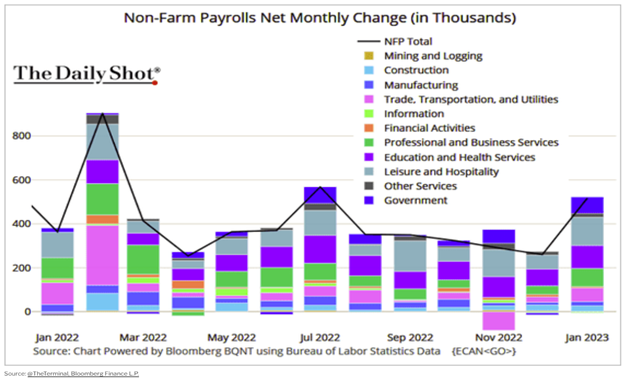

Job growth hits 517,000…Incredible numbers across the board considering over 100,000 layoffs in the tech industry since December.

What does it mean – The biggest gains came in leisure and hospitality, education and health services followed by the government. It is also geographically concentrated in states that are gaining population like FL, TN, TX, NV, AZ, the Carolinas, and other low-tax, small-government states. CA, NY, NJ, IL, and MI continue to lose citizens but are being replenished with large illegal immigrant populations.

Fed Chair Jerome Powell said inflation would not return to 2%…Fed is looking for more balance in the labor markets.

What does it mean – Balance? Not sure what that comment really means. History shows us that there are always sectors of the economy that are doing better than others. Yet, the latest readings do not suggest the Fed won’t raise rates at its next meeting in late March. Leading economic data released last week showed continued contraction in manufacturing, housing, tech, and now moving towards biotech as capital becomes more expensive. So far 256 out of the S&P 500 companies have reported that profits are down 3.1% from a year ago as of 2/3/2023.

Housing permits down year over year for January…Hard to have a recovery when over 20% of your economy is down.

What does it mean – The change in single-unit permits by region: Northeast (-5.9%); Midwest (0.0%); South (-3.4%); and West (-10.3%). Multi-unit starts were down 18.9% month-over-month and multi-unit permits were down 3.4% month-over-month. There is a direct correlation between interest rates and the housing and construction industry.

The ISM for January hit its lowest level since May 2020…A sub 50.0% reflects a contraction in our economy yet employment gained 517,000 jobs.

What does it mean – The January ISM Manufacturing Index dropped to 47.4% according to Briefing.com from 48.4% in December. While the job numbers increased significantly and yet many of the largest companies in the world shed over 100,000 jobs, something is off.

Philadelphia Fed’s own numbers questions the integrity of the Federal Bureau of Labor Statistics (BLS)…Recent report by the Philadelphia Fed finds that using data on 33 states plus the District of Columbia from the Quarterly Census on Employment and Wages show that the Philly Fed believes the payroll gains that were officially reported in Q2 were significantly overstated. Instead of 1.05 million jobs, the US only added 10,500. That’s a downward revision of 99%! One must ask, how is this possible?

What does it mean – If true, it is another example of Big Government, also known as the “Swamp”, utilizing a government agency that is supposed to be non-political, is in fact being used to sway public opinion and shield itself from public accountability. I’m not sure what’s worse: a politically motivated Federal Bureau of Labor Statistics trying to hide the real numbers, or an outright incompetent Bureau incapable of measuring and reporting the real figures.

If true, this is not good for America. It is, in fact, detrimental to our free markets, capitalism, freedom, free speech, and our Republic. Unfortunately, it is hardly unprecedented. Just look at the FDA, CDC, NIH, FBI, CIA, IRS, DOD, and DOJ. Just a few of the federal agencies that released information during the pandemic that has hurt or benefited certain citizens or organizations over others. In the case of the IRS, FBI, and DOJ it goes back a lot further, and these agencies have been weaponized to attack citizens based on their political as well as religious beliefs. This violates our “First Freedom,” jeopardizes the well-being of our country, and puts at risk the credibility of the very agencies we are funding to protect and run our government.

Abraham Lincoln, perhaps this country’s most visionary president, saw the nation’s future through the lens of liberty. While credited with this quote “America will never be destroyed from the outside. If we lose our freedoms, it will be because we have destroyed ourselves from within. Lincoln’s actual quote was from his speech to the Young Men’s Lyceum of Springfield, Illinois on Jan. 27, 1838. Discussing “the perpetuation of our political institutions”, he said: “At what point then is the approach of danger to be expected? I answer, if it ever reach us, it must spring up amongst us. It cannot come from abroad. If destruction be our lot, we must ourselves be its author and finisher. As a nation of freemen, we must live through all time, or die by suicide.”

Remember, these agencies and the unelected government employees work on behalf of the citizenry. Our elected officials serve at the pleasure of the people. This repetitive behavior by government employees is exactly what President Abraham Lincoln warned us in his speech in 1837. You have heard me say it before, “the freer the country the more prosperous and secure the people.” Our prosperity and security depend on us, the citizenry holding our elected and unelected officials accountable. Check out www.americanmadepromise.com – sign it and pass it on.

In one of our country’s best-known speeches, The Gettysburg Address, President Lincoln said it best:

“that this nation, under God, shall have a new birth of freedom and that government of the people, by the people, for the people, shall not perish from the earth”

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.