What Happened Last Week and What It Means to You: February 1, 2023

Week Ending January 27th, 2023

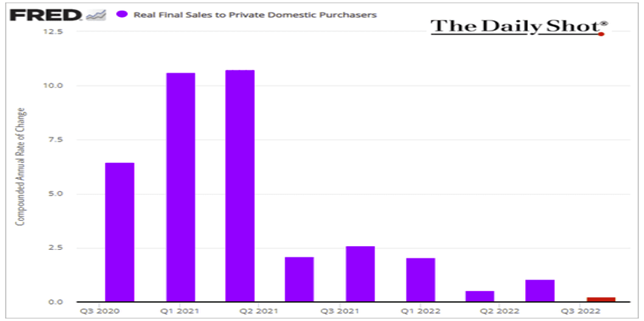

PCore GDP sees almost no growth…Real final sales to private domestic purchasers, also known as the “core GDP” shows almost no growth.

What does it mean – The headline numbers always seem to hide reality. GDP numbers grew largely due to inventory and imports. Durables grew only due to transport, mainly Boeing, and if you take that out, durables declined 1%. Final sales grew only .2%, and in December declined at the fastest rate all year. Here is a great chart that tells the picture.

Nonfarm business sector labor productivity decreases…Down 1.3% from the same quarter a year ago.

What does it mean – We have seen a massive number of layoffs from the tech sector, and it is starting to bleed into biotech, financial and manufacturing sectors. Yet, we hear the labor market is tight while we are near an all time low in labor participation rate. Just does not add up. COVID funds from the federal government are almost gone and companies specifically in the tech sector have realized they over hired when money was unrealistically cheap and cost of capital skewed reality. Now they are attacking what they can as the cost of doing business is accelerating due to massive inflation.

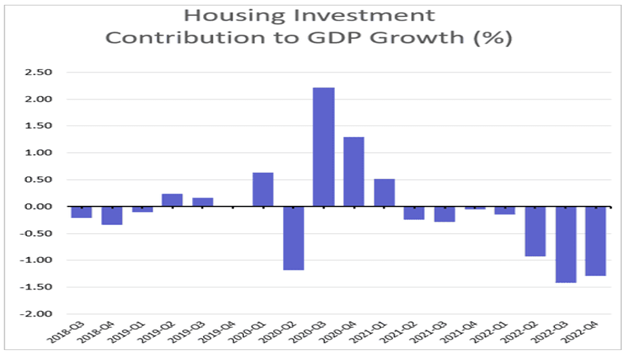

Existing home down…For the month of December, existing home sales were down 34.0% from a year ago.

What does it mean – Housing accounts for 20% of GDP and it is undoubtedly in a recession. For over a year we have highlighted the decline in housing. The fed is in a bad spot as the Treasury continues to print while they try to tighten through Quantitative Tightening or QT and the government continues its reckless spending. Rising interest rates will continue to eliminate potential buyers.

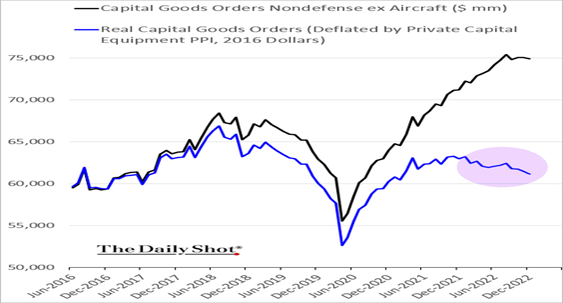

Real capital goods orders continue to sink…We continue to see slower business investment across multiple regions and sectors.

What does it mean – The chart below is looking backwards but the trend is not good.

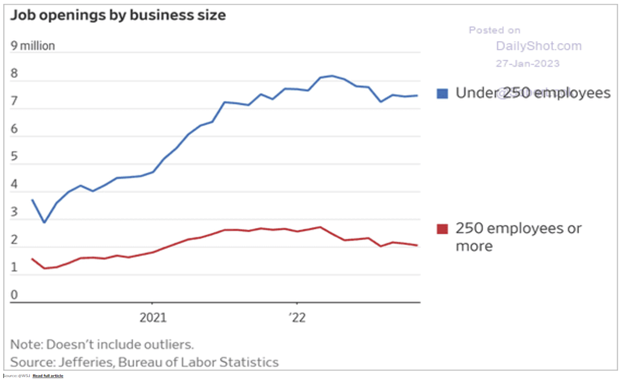

Small businesses are the “little engines that could”…Entrepreneurs are the risk-takers that drive the majority of the economy.

What does it mean – Small companies of less than 250 employees are hiring at a rate over 3 times that of larger companies. We should ask ourselves, why is this significant? Should we push for less regulation to let small businesses do their thing…?

World Economics Forum (WEF) declares war on capitalism…Klaus Schwab doubles down on The Great Reset. Game on.

What does it mean –The truth shall set you free. I am an optimist. I believe that free people will not give up their freedom for a false sense of security.That self-determination is more powerful than group think. That your unalienable rights of life, liberty and the pursuit of happiness are worth fighting for.

Article 1 Clause 8 is the reason why more things are created in the United States than anywhere in the world since the adoption of our Constitution. The idea that you own your own property, ideas and writings has led to more freedom and economic success in the history of the world. Bottom line, get the government and unions out of the way. Our elected representatives need to focus on removing the policies that increase regulations, create bureaucracy, and destroys the creation of capital and the ownership mentality that built this country which inspired millions of people to start their own companies and control their own destiny. Big business begets big government. It is currently in an unholy alliance with government that is in favor of more regulation that is limiting or reducing the ability for emerging competition in the private sector. In 2022 our government passed nearly 700 laws that they themselves cannot even follow.

Klaus Schwab, Xi, Larry Fink, Bill Gates, John Kerry, Al Gore, and the globalist who feel it is their right to decide your future are about to see their “Tower of Babel” come crumbling down.

The global leftist are so arrogant that in Davos, they speak freely of denying you free speech, the right to practice your religion, remove the borders of your country, stop eating meat and start eating bugs, and tell you that cooking with gas is now bad for the planet (I guess they forgot that natural gas, coal and oil is what makes electricity for nearly 87% of the planet according to the National Geographic survey. Not to mention the majority of restaurants in every hotel around the world cooks with gas and the majority of modern homes use gas to heat their water and cook their food. These are the very same fear mongers that want you to start eating bugs.

It goes beyond the environmental fear mongering they are spinning in Davos, Europe, and in DC. One only has to look at the strip mining and slave/forced labor that is happening in China, parts of Africa, and Latin America to mine precious metals to make the batteries for electric cars.

Read this article by Mark Mills. https://media4.manhattan-institute.org/sites/default/files/mines-minerals-green-energy-reality-checkMM.pdf

He lectures all over the world to CEO’s, government, and academics trying to get them to understand that the whole green energy push is virtually impossible to achieve. Once you read his piece, and his other works, you come to the clear conclusion the entire green energy push is a giant scam, and a great new way for many people to make a lot of money as consultants, pseudo scientists, blathering politicians and manufacturers and miners of the products. He actually uses simple math to explain how much mined material it would take, and the energy expended to mine and manufacture windmills, batteries and solar panels, all of which will create massive hard waste garbage in 20 years which will overwhelm any dump sites with toxic waste.

The true full cost in energy and dollars to produce one equal measure of energy power comparing oil generated compared to green energy is crazy. It does not add up. The world, academia, and corporations are racing against the boogie man. It is a false race that leads to less economic freedom and more government mandates. That is why they have our kids believing the world will end by 2025. Facts don’t matter when their agenda is about control. The people and businesses behind this massive “reset” are taking advantage of underprivileged in Africa, Latin America and destroying the local environments throughout the world where these mines are. This is total insanity run amok. Yet, now the environmentalists are at odds with each other as they think the building of windmills off the coast of New Jersey is leading to the deaths of protected whales.

Here is some history to ponder: 100 years ago, in 1923 the Nazis, and the global domination they sought, tried to overthrow the German government, and failed. That very same year the Germany introduced the Rentenmark, a new currency to fight inflation.

Today the WEF, the leader in Globalism is pushing the Great Reset. One must ask him or herself, what are we resetting and how do we reset? Doesn’t it imply that something is broken? And if it is not broken, why are we resetting? Citizens in the United States and some very bold people throughout Europe, Asian and China, are pushing back against there global agenda. The WEF and its leadership is on record for saying that it is the United States that stands in the way of a Global Reset. And yet, at the very same time, The United States is experimenting with a digital currency to fight inflation and control the flow of money…. HMMM, are our elected officials acting in our best interest?

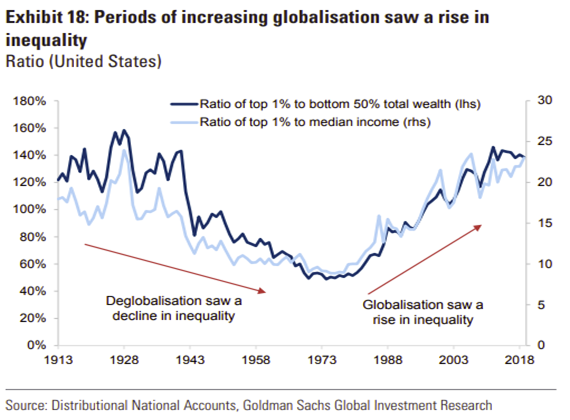

The chart below says it all. Yet, it is the left leaning globalist that preach about Diversity, Equity and inclusion, while their policies actually create more inequality and do more damage to diversity and inclusion. The ownership of one’s inventions, intellectual property and business and property and the freedom to pursue one’s life, liberty and happiness is the greatest equalizer of all.

National Rent control…There goes the neighborhood. While history has proven that you cannot have prosperity without ownership, this administration is living in denial and direct conflict with our constitution and your Bill of Rights.

What does it mean – In the face of rising rents due to free money passed out by this administration and previous ones, President Joe Biden is rolling out a “Renters Bill of Rights” in an effort to improve rent affordability and protections for tenants. If you are a landlord or own properties that generate revenue you may lose control of your ability to generate the needed income to maintain and grow your businesses, pass it on to your children and pay your bills. Sounds a lot like they want an equal outcome not equal opportunity.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

805.230.0111 main

805.230.0061 fax

2660 Townsgate Rd Suite 450

Westlake Village, CA 91361

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.