What Happened Last Week and What It Means to You: December 6st, 2022

Week Ending December 2nd, 2022

Initial jobless claims fall to 225,000…Labor market seems solid.

What does it mean – The key takeaway from the report is that the low level of initial claims remains indicative of an otherwise solid labor market. The Fed is caught in a quandary. Wage growth continues as job market is still a bit tight. And continuing claims continue to go up. The number of people already collecting jobless benefits rose by 57,000 to 1.61 million. That’s the highest level since February. This could be the reason the participation rate has not budged. Still fewer folks working than before the Chinese virus shut down the economy.

Productivity decreases and labor costs continue to rise…Cost per unit continues to go up and job creators are paying far more to produce much less.

What does it mean – It is the first time since 1982 that there have been three consecutive declines in productivity. For the third consecutive quarter, the decrease in productivity and increase in wages means we saw per unit cost across the economy go up by 4.1%. Just one more issue adding to inflation.

Consumer credit increased by $25 billion in September…It was revised up to $30.1 billion (from $23.8 billion) in August.

What does it mean – More Americans than ever are living paycheck to paycheck already, and many more are living off their credit cards thanks to inflation outpacing wage gains. Those excess funds from the government transfer programs are drying up and more and more Americans are using credit cards just to get by.

Existing home sales down across all regions…Northeast (-6.6%); Midwest (-5.3%); South (-4.8%); and West (-9.1%).

What does it mean – Interest rates are driving prices down. Higher mortgage rates are taking a bite out of existing home sales, having created affordability pressures for prospective buyers and deferred listing decisions for potential sellers who see an expensive repurchase proposition.

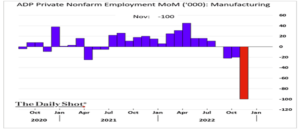

Manufacturing down…Manufacturing activity contracted for the first time since May 2020.

What does it mean – Interest rate hikes, uncertainty, and increase in government regulation provide the trifecta that is adversely impacting manufacturing demand across the globe. The two charts below illustrate the dramatic slow down in manufacturing and the resulting layoffs. The Midwest has been shedding jobs for nearly 5 months.

Rent crisis breaks record…According to a survey by Alignable, 44% of Americans small businesses could not pay rent this month.

What does this mean – Small businesses are the backbone of our economy. Government regulation, the shut down, rising cost of capital, direct competition from government via wealth transfer programs, and rising minimum wage are just a few issues that are strangling small businesses across the country.

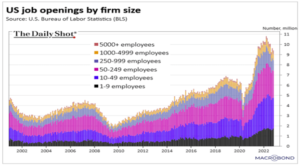

The Pareto Principal…In the below chart is another look at reality, one you are probably not seeing from the mainstream press or our government. Yet, it is the real backbone of our economy. It is made up of the men and woman who are willing to risk it all and who are struggling the most under the current policies that have led to this economy.

What does it mean – In this time of massive disruption, ever increasing regulations, higher taxes, rising fuel and energy prices, and record inflation, the spirit of the entrepreneur dominates the job-creation market.

Per the chart below, roughly 75% of all new jobs created are from businesses that employ less than 249 people and over 90% from companies employing less than 1,000 people. Both could be considered small businesses. This is the incredible story of our republic and capitalism. From King Solomon who said, “there is nothing new under the sun.” (Ecclesiastes 1:9), to Pareto’s famous “80/20” principle, to the modern entrepreneur willing to risk all, human behavior is relatively unchanged.

Big business layoffs…Money manager Charlie Bilello posted a list recently, and the numbers are stunning:

- Twitter is cutting 50 percent of its workforce (about 3,700 jobs).

- Facebook is cutting 11,000 jobs–its largest round of layoffs ever.

- Snap is cutting 20 percent of its workforce (1,200 jobs).

- Shopify is cutting 10 percent of its workforce (1,000 jobs).

- Netflix cut 450 jobs.

- Microsoft and Salesforceare each cutting 1,000 jobs.

- Robinhood is cutting 31 percent of its workforce.

- Tesla is cutting 10 percent of salaried workers.

- Lyftis cutting 13 percent of its workforce (700 jobs).

- Redfin is cutting 13 percent of its workforce.

- Coinbase is cutting 18 percent of its workforce (1,100 jobs).

- Stripe is cutting 14 percent of its workforce (1,000 jobs).

What does it mean – Along with massive layoffs in the manufacturing sector, corporate America is catching up to the reality that rising wages, lower productivity, more uncertainty, increasing global issues, new green deal, rising energy prices, increasing global threats from China and Russia, border invasions from illegal immigrants from around the world in the USA, and Europe, rising taxes and increased government control are all leading to companies to take defensive positions. It never fails, everyone but the government gets to pay for the chaos created by our elected official.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

805.230.0111 main

805.230.0061 fax

2660 Townsgate Rd Suite 450

Westlake Village, CA 91361

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.