What Happened Last Week and What It Means to You: June 12, 2023

Week Ending June 9, 2023

$4 Trillion More in Debt…Yikes!!!

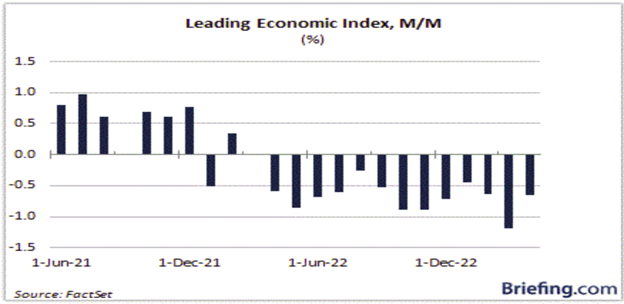

The Conference Board’s Leading Economic Index declined 0.6% in April… Marking the 13th consecutive decline in The Conference Board’s Leading Economic Index.

What does it mean – Not a good sign according to the Conference Board.

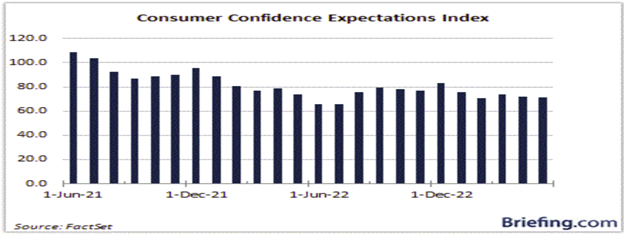

Consumer Confidence Index for May featured an Expectation Index that slipped to 71.5… Every month since February 2022, we have seen sub-80.0 readings except for December 2022.

What does it mean – According to the Conference Board, reading below 80.0 is associated with a recession in the next year.

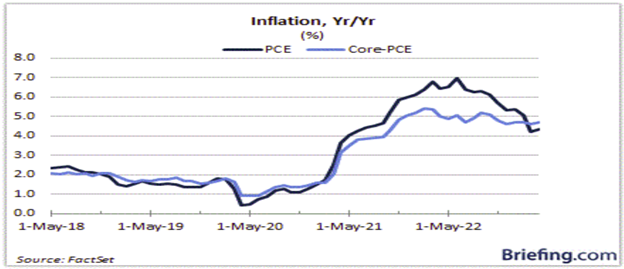

While slowing, inflation continues to move in the wrong direction…Using the Fed’s preferred measure of inflation, The core-PCE Price Index, which excludes food and energy, increased to 4.7% year-over-year from 4.6%. No matter how the Fed wants to measure it. Even they are realizing it is not transitory and has everything to do with money supply. And your elected officials just gave them $4 Trillion new ways to create more inflation and bigger government.

May payroll report topped expectations…Better than expected numbers for May. Yet, unemployment goes up to 3.7%.

What does it mean – The Bureau of Labor Statistics continues to cause confusion. One has to ask; how does a great jobs report turn into more unemployment? The payroll survey shows an increase of 339,000 jobs, but an increase in unemployment to 3.7%. Yet, the household survey shows a decrease of 310,000 jobs. The rise in unemployment and the decline in jobs in the household survey suggest that maybe jobs actually declined. Hmmm.

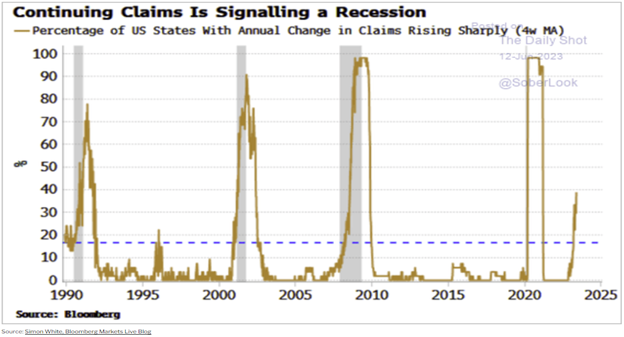

More States report an increase in jobless claims… According to Bloomberg, a growing number of states are reporting an increase in continuing jobless claims.

What does it mean – Big cities and states like CA, NJ, NY, IL, MI and nearly every big city in those states and others refuse to acknowledge their policies are undermining the ability for responsible and productive citizens to grow and prosper. These cities and states are slowly collapsing into a financial debacle because they continue to harbor and facilitate crime, act as a sanctuary city to illegal immigrants, and refuse to prosecute shoplifters, drug dealers, criminals and thugs while promoting social welfare without accountability. The American taxpayer and business owner is stuck with the bill while chaos emerges from the halls of leadership at the city, state, and federal levels.

NYC Office vacancy rates are up 70% in 2023 according to the NY Times…And getting worse every day.

What does it mean –As office property values collapse, and owners of buildings default on their mortgages, this will lead to less property tax revenue for cities like NY, LA, SF, Chicago, Houston, etc., desperate to provide a socialist panacea. Soon, even civil servants will have to face reality as the very people they are supposed to serve and who actually pay all of the income taxes in these cities like NYC are leaving in droves.

Three lessons from NYC… An example of “The socialist Utopia” coming home to roost.

Crime – Compounding the problem in NYC is a massive crime wave taking over public transportation and wreaking havoc on retail stores. This has led to a huge amount of retail and restaurant closures, fewer jobs, and less sales tax and no income tax from the people who worked in those retail and restaurant locations now out of business.

While writing this on Friday, I found myself reflecting on Alex de Tocqueville’s quote about America’s greatness. In Alex de Tocqueville’s Democracy in America, he said, “I sought for the greatness and genius of America in her commodious harbors and her ample rivers—and it was not there … in her fertile fields and boundless forests—and it was not there … in her rich mines and her vast world commerce—and it was not there … in her democratic Congress and her matchless Constitution—and it was not there. Not until I went into the churches of America and heard her pulpits flame with righteousness did I understand the secret of her genius and power. America is great because she is good, and if America ever ceases to be good, America will cease to be great.”

The real consequences of being a sanctuary city – At the same time, NYC is spending over $1 billion on illegal aliens, and that is aside from the social and crime cost. Not to mention, our President and Homeland Security “Cartel” claims the border is secure. The squeeze on finances is just going to get to the point very soon that NYC will be in financial problems and services will decline.

With no accountability to the American citizen flipping the bill, no consequences for petty crime and massive illegal immigration, the crime problem will just continue, with shoplifting and drug abuse getting worse.

No matter how you slice or dice the NYC economy, every direction and every sliver show a rapidly declining source of income for the city, while its costs go up and interest rates take more of the budget.

NYC rent control – Rent stabilization which limits rent increases on a certain group of buildings, and market rate rents, which were exactly that for higher end units. Now desperate to appease more voters to maintain power and control of their failing utopia, the state legislature is considering rent control on market rate units. If that happens you can kiss NYC real estate goodbye. The whole commercial residential property market will slowly collapse. This will have a ripple effect throughout the Nation.

George Orwell said it best. “The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.”

― George Orwell, 1984

Like the Mayors of Chicago, LA, SF, Houston, Detroit, DC, and the Governor of NY, CA, IL, NJ, MI, and PA, the mayor of NYC Eric Adams and the Governor of NY, Kathy Hoekul are drowning in deceit and struggling to justify crazy. They are in way over their heads.

Hilton Hotel and the Park Suites went into default…Wow. One borrower hands over the keys to the bank on $735 million in defaulted loans.

What does it mean – According to the borrower, the Socialist Utopia is not working in SF and they see no change in sight. They made a calculated decision to walk.

In contrast, Miami and Tampa are thriving. This has nothing to do with Global Warming or good weather. But everything to do with good fiscal and crime policies, and good management by responsible elected officials that are held accountable. And just to top it off, NY state is now mandating no more natural gas hook up for heating, creating another big blow to landlords. There is a major financial and social crisis unfolding in all the major cities now run by left-leaning administrations. This is not going to end well.

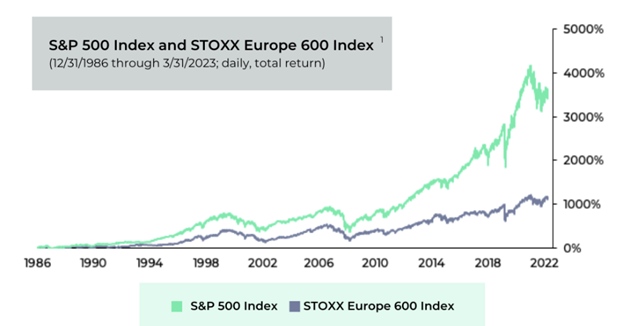

What is stakeholder capital… Nearly 50 years ago Milton Freidman led the charge against the European style of Stakeholder Capital and convinced America to rededicate itself to shareholder capital.

What does it mean – Today CEO’s of Target, Nike, Bank of America, Chase and most of corporate America are falling for the trap of stakeholder capital. Unaware or afraid to call out its evil. History shows the destruction of stakeholder capital and the push towards DEI by the very people hired to protect and grow shareholder value. Stakeholder capital also destroys capitalism, wealth, opportunity, ingenuity, creativity, ownership, meritocracy, and most importantly FREEDOM just like socialism.

While America protected shareholder rights prior to the popularity of ESG and DEI initiatives at the corporate level, there’s also mounting pressure from BlackRock, Vanguard and the likes of Bank of America and Chase for the popularity of a European style oligarchy. I guess they loved the idea of the protection of “too big to fail.”

Despite all the data and that supports shareholders and the “Ownership Mentality” that built this country, 181 CEO’s that make up the Business Roundtable, yet most never risked a dime to start the very companies thy run, voted to “redefine the purpose of a corporation and explicitly rejects shareholder primacy.” Here is the article. It is a must read by all.

A picture is worth a Thousand Words!!! The below chart says it all. The European Oligarchy and Big Government ideology continues to destroy creativity and capital creation and ultimately leads to less freedom. Unfortunately, virtue signaling through catchy terms like, “Stakeholder Capital, ESG, and DEI” are at the root of the problem and continue to plague the board room.

It is time to bend the trend of Big Government!!!

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.