What Happened Last Week and What It Means to You: May 30, 2023

Week Ending May 26, 2023

Q1 GDP was revised up to 1.3%…And Government spending increased 5.2%.

What does it mean – Government added 0.89 percentage points to Q1 GDP growth or better said, your government made up 68.46% of our growth in the first quarter. All, while this administration remains unchecked by both houses of Congress. Somehow, this administration and our elected officials believes the more they spend on social programs, the war in Ukraine, free phones and gift cards for illegal immigrants flooding our country, the more American citizens will forget that everyone of us owes roughly $100,000 per citizen to keep this financial façade up. Bottom line, we are stealing from our future, entrapping this generation and our children and grandchildren in a future laden with bureaucracy and government regulation that will stifle and destroy opportunity start businesses and create capital and own our own destiny because we are not willing to say, “No More!!!”

Initial claims by 4,000 to 229,000…Even with the slight increase we continue to see a tight labor market nationwide.

What does it mean – The key takeaway from the report is that initial jobless claims are nowhere near recession levels.

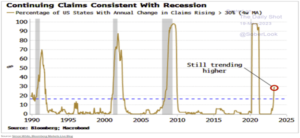

Yet, policy matters. And unfortunately, for the large states such as CA, MI, IL, NY, NJ, PA, and a few others, bad policy has added to their demise. The chart below shows an increase in the percentage of states with annual change in claims. Currently 15 states account for most of the rise in claims. Policy matters!!

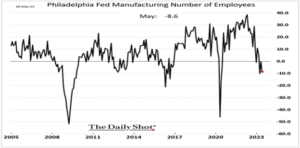

Factories continue to shed jobs…US manufacturing continues to get hit by needless government intervention and bad policy.

What does it mean – Along with increasing government regulations and cost of energy, the manufacturing sector is struggling to regain its pre-covid numbers and struggling in a very difficult global economy.

Leading Indicator show weakness…Conference Board’s leading indicator suggests that wage growth will slow sharply.

What does it mean – We spoke about stealing from our future in the previous charts. It looks like the massive increase in wages might be starting to reverse course. The question that may be on your mind will this reverse inflation or only slow the growth of inflation? Will my cash flow keep up with inflation and the rising debt levels that will surely bring on more taxes and bureaucracy? The current policy under this administration would tell you that inflation is more likely to continue at a slower rate than previous as no one in DC wants to deal with reality.

Inflation…Big Government and the Fed still can’t get it right. When you include food and energy, inflation continues to grow at relatively the same rate after interest rates have gone from .25% to 5.25% and rising. HMMM…Not so transitory.

What does it mean – What would you expect when the government bails out the banks, buy phones for illegals and give them gift cards through government NGO’s, increase spending on social programs, no cash bail and run-away crime, competes with employers for labor by giving away money and services most of us have to pay for. And not to mention, the Biden administration and environmentalists demanding we go electric and mandate all military vehicles become electric. All while they told us inflation is transitory but continue to compete for resources with the private sector and every citizen. Yep, you get inflation and more competition in the form of government.

Could it be the wrong philosophy compounded by bad policy by this administration and Federal Reserve. The current trend of compromise at all costs, bad fiscal, and monetary policy has facilitated more government programs that have led to more government dependency and the current economic chaos we are in and not seen since the Carter administration.

Time to Bend the Trend… In our May 5th letter, we discussed an old saying on Wall Street by Ed Seykota “the trend is your friend until it bends.”

What does it mean – As with most sayings, there is a bit of truth, folklore, or history behind their relevance. In the case of, “don’t fight the fed” and “the trends is your friend”, the American economy has benefited from the uncontrollable trend of government spending and the Fed accommodating that spending spree with cheap money and a balance sheet that went from roughly $800 billion in 2008 to almost $9 trillion today according to chart below and the Board of Governors of the Federal Reserve.

As you can see the “Fed” and the “trend” have lived up to their hype.

Deal or no Deal…Have you ever wondered why we have accepted the idea of compromise when it comes to government spending and the growth of government?

What does it mean – Both sides are willing to compromise their convictions to kick the can down the road and hope someone else will deal with it. Unfortunately, until we hold DC accountable, this attitude will continue to prevail and remain a fixture in DC.

After reading the 90 pages of BS, the best thing I can say about this so-called deal is it is not 1,400 pages and saved a bunch of trees. It is vague and with out any teeth to hold this administration accountable.

Both sides need a gut check. Both sides lack conviction and the willpower to discuss the facts. They both will claim victory while the American people pay the price for further enslavement to government bureaucracy and ever rising debt.

Bottom line, Joe Biden got his bigger government and McCarthy got back a little bit of what fiscal conservatives’ loss to the “art of the compromise” for the last 50 years. The fact is that both sides are just a bit more committed to their reelection than to the wellbeing of this country. Sad!!!

It does not take a rocket scientist to see why DC is in this situation. While discussing the debt situation on the House floor this week, Congress woman Alexandria Ocasio-Cortez, asked, “When was the last time you heard government does too much for you?” And went on to ask, “think about the last time anyone heard or seen that?”

I did. I asked myself what programs cost too much and do too little or have hurt the culture and security of this nation.

Too big to fail – Did you know that you, the taxpayer, pays the banks on their reserves? The Federal Reserve, that is controlled by the 12 most influential banks, started collecting coupons from the Federal Reserve in 2009. Through a vote of congress and recommendation by Fed Chairman Bernanke, the Federal Reserve started paying banks on their reserves for doing nothing. Yep, nothing!!! They make billions while our country goes further into debt. Currently, this is costing the American taxpayer over $170 billion a year and will continue until you demand the government stop this.

Department of Energy – Why did the government create a Department of Energy in 1977? They tell us it was to ensure energy independence, yet today, it regulates U.S. energy producers at levels that make us almost unable to compete and has forced us from energy independence to energy dependence.

Department of Education founded in 1979 – This department inherited the greatest education system in the world and turned it into a disaster. You get the drift. Without the government, we we’re #1. With the government, on average, our kids can’t read or do math at grade level.

Just a couple of ideas that cost close to a $ trillion a year to manage or lead to massive regulations and costs that we could save and benefit from overnight if we actually had a government that focused on our constitution instead of growing its power, control and financial appetite.

For many of our elected officials, this current budget fight has nothing to do with your financial security but everything to do with theirs.

“Consent of the governed” …This refers to the idea that a government’s legitimacy and moral right to use state power is justified and lawful only when consented to by the people.

Apathy is everywhere. At this moment in time our elected officials fear you speaking out against their path to power more than they fear the looming threat to our economic security, our border, peace in the middle east, Russia, and China. In fact, the Biden administration spent $47 million through the DHS to go after American organizations that question the government. Yep, you just can’t make this stuff up. They hired universities to compile a list of domestic threats. First, why universities? Second, isn’t that the job of the FBI? Third, if it is the job of the FBI, why did the taxpayer pay $47 million to a bunch of university think tanks? One has to wonder why universities continue to shut down free speech throughout America? I guess you now have the answer.

Apathy has taken control of the American voter and investor. It is eroding your individual liberty. Opportunity for wealth creation and undermining capitalism. Many citizens are unwilling to speak up or just do not care.

$4 trillion more in debt in two years if this bill passes and not much to show for it…While trying to make sense of the lack of courage by our elected leadership to face the demons of an out-of-control government, hell-bent on growing bigger and more powerful undermining and further eroding the power of the governed. You, the people.

What does it mean – Our Debt is up over $11 Trillion dollars in less than 2 years and about to go up by an additional $4 Trillion in two more years. The lack of commitment by our elected leaders and the apathy by the American public and complete disregard or lack of willingness to report the truth to the American people by the media has left our country more divided and would rather focus on gender and social issues instead of the fundamentals of what government is supposed to do. Protect our nation and our individual liberties.

While writing this on Friday, I found myself reflecting on Alex de Tocqueville’s quote about America’s greatness. In Alex de Tocqueville’s Democracy in America, he said, “I sought for the greatness and genius of America in her commodious harbors and her ample rivers—and it was not there … in her fertile fields and boundless forests—and it was not there … in her rich mines and her vast world commerce—and it was not there … in her democratic Congress and her matchless Constitution—and it was not there. Not until I went into the churches of America and heard her pulpits flame with righteousness did I understand the secret of her genius and power. America is great because she is good, and if America ever ceases to be good, America will cease to be great.”

At church on Sunday, we went over Deuteronomy Chapter 4 vs. 7-10. It could not have been more fitting for this letter or the timing of this week as we as a nation prepared to remember our fallen heroes on Memorial Day.

As we read from Deuteronomy vs. 7-10. 7 What other nation is so great as to have their gods near them the way the Lord our God is near us whenever we pray to him? 8 And what other nation is so great as to have such righteous decrees and laws as this body of laws I am setting before you today?

9 Only be careful, and watch yourselves closely so that you do not forget the things your eyes have seen or let them fade from your heart as long as you live. Teach them to your children and to their children after them. 10 Remember the day you stood before the Lord your God at Horeb, when he said to me, “Assemble the people before me to hear my words so that they may learn to revere me as long as they live in the land and may teach them to their children.”

This is what Alex de Tocqueville meant by the greatness of America. We taught our children who we were. We focused on righteousness, virtues, morality, and natural law. It is where the community flourished.

While we are living in tough times, we are a blessed nation. While not perfect, we continue to strive to be better. As a nation we need to stop focusing on what we did not do and focus on the greatness of what we have done and will continue to do as we celebrate our success. We need to unite and refocus our efforts on our inalienable rights, liberty, and the pursuit of happiness. Ensure and protect the rights and reinforce what it means to be a responsible productive citizen of the greatest nation on earth. Celebrate and protect the Constitution that gives you the right to your words and inventions, freeing more people from economic slavery and creating more wealth and patents than all countries combined since our founding. Remember that we defeated tyranny in WWI and WWII, destroying slavery and uniting a country divided. Giving woman the right to vote. Destroying communism for the first time and freeing half of Europe and the world from socialism. We have so much to celebrate and be proud of as a nation. Yet, we have become complacent.

Over the last 30 years or so we have let down our guard, we went along to get along. We compromised. And now we struggle through the confusion of globalism, envy, and personal interest over personal responsibility and self-determination. All we hear is how bad we are. It is no wonder our youngest Americans are confused and have a lower opinion of our country and who we are as a nation than that of communist thugs in China and throughout the world in Africa, Latin America, and Asia.

Folks, we have plenty of revenue to pay our debts and if you believe in limited government and the idea that the government governs by the consent of the governed, then our leaders need to hear you roar. Wake up America!! You were born for this moment!!!

It is time to bend the trend of Big Government!!!

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.