What Happened Last Week and What It Means to You: July 8th, 2022

Week Ending July 8th, 2022

Nonfarm payrolls…

Increased 372,000 in June. beating the consensus expected 265,000.

What does it mean – Overall, good news and really strong numbers for the economy. Payroll gains grew by 539,000 per month in Q1 and 375,000 per month in Q2. The big issue is the participation levels continue to fall.

Wage earners or the labor force dropped 353,000 in June…

While unemployment remains at 3.6%, we continue to see the participation rate fall.

What does it mean – Expect the trend to continue as more baby boomers start to retire and the gig economy (Uber, Lyft, Door Dash and Grub Hub) continues to struggle due to high gas prices. Unemployment remained at a low 3.6%, the participation rate (the share of adults who are either working or looking for work) slipped to 62.2% from a prior 62.3%.

Civilian employment declines…

Civilian employment, an alternative measure of jobs that includes small-business start-ups.

What does it mean – Down 315,000 in June. While not often spoken about, small business start ups are the life blood of our economy. Policy that helps or hurts risk takers ultimately finds its way into the economy.

Remember, big businesses love barriers to entry and while they will speak out against regulations, they often are backing regulations if it helps build a moat around their business. President Eisenhower warned us about the unholy alliance between government and big business when he delivered his speech about the military-industrial complex. He worried about, “The total influence — economic, political, even spiritual — is felt in every city, every state house, every office of the federal government. We recognize the imperative need for this development. Yet we must not fail to comprehend its grave implications. Our toil, resources and livelihood are all involved; so is the very structure of our society.”

It is that very behavior we are faced with in several other industries. A perfect example of this today is Facebook and Twitter going to Washington and asking for more regulation on free speech on the internet. Another would be the pharmaceutical industry. It takes $ hundreds of millions to get a drug to the market. Due to this high cost and rightfully so, many startups are acquired or fail before their product ever sees the market.

I am not against regulations. We need to protect our citizenry against the temptation that comes from a close relationship between government and private industry. I am merely pointing out the heavy hand of regulations and its cost on society. Free speech, healthcare, manufacturing, energy, etc. All are seeing the high cost associated with the increase of government intervention. And in some cases, like the drug industry, the very bureaucracies (CDC and FDA) and unelected employees of our government who are hired to safeguard society are being rewarded in sharing of the fees from patents in the drug industry. Our elected leaders influenced by K Street and the lobbyists. You might even call it bribery. We should all be asking ourselves, who actually has our best interest at hand? Simply put, is the fox guarding the hen house? Is there an unholy alliance between big business and government that is hurting business creation? Or are we a society that has matured and become apathetic and more risk adverse.

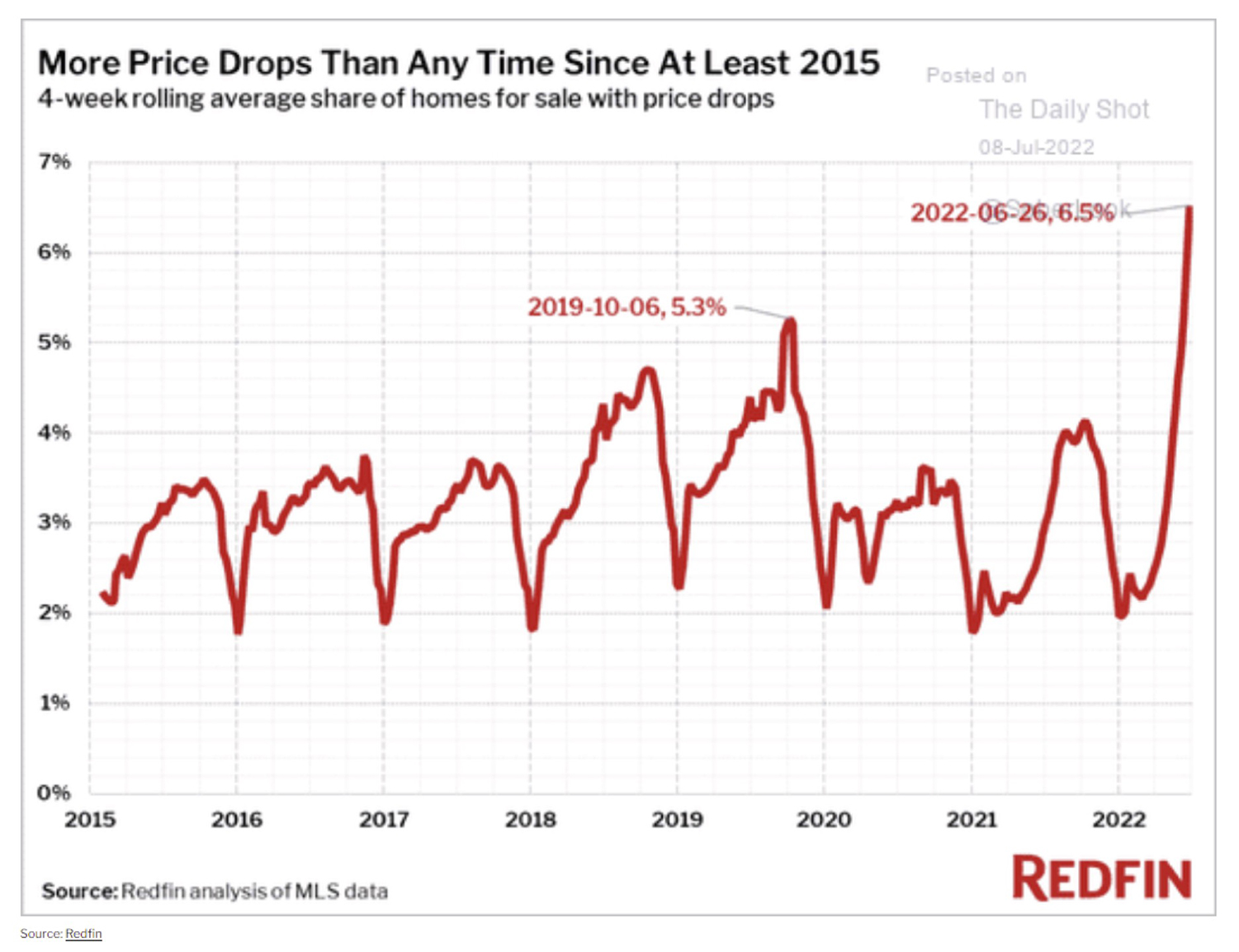

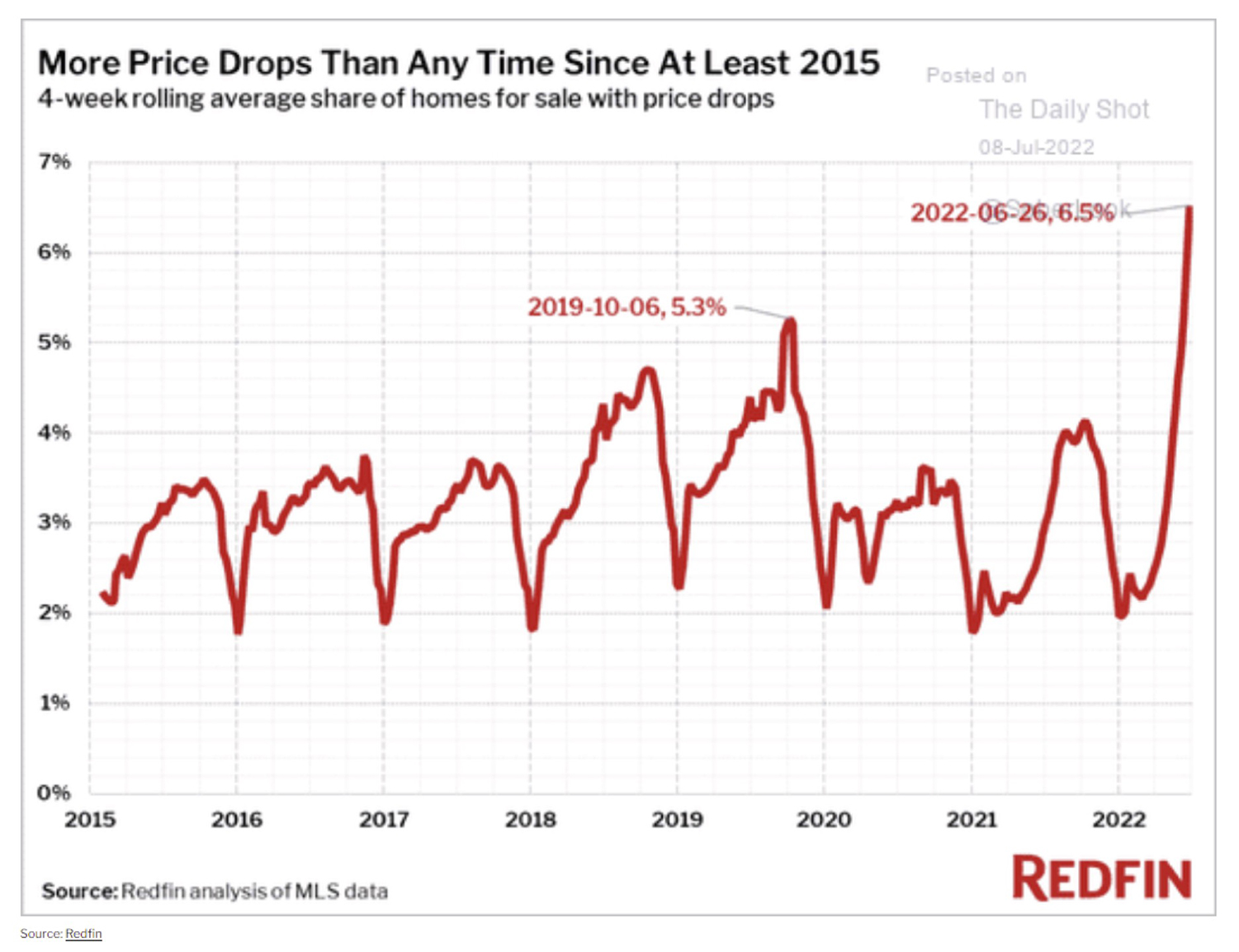

Housing…

Sellers start to drop prices

What does it mean – from the chart below, Redfin did not give us the data from 2008 to 2012, but I have to believe we are going to see similar data as the fed will continue to raise rates to fight of inflation which is eating folks out of house and home.

Welcome home…

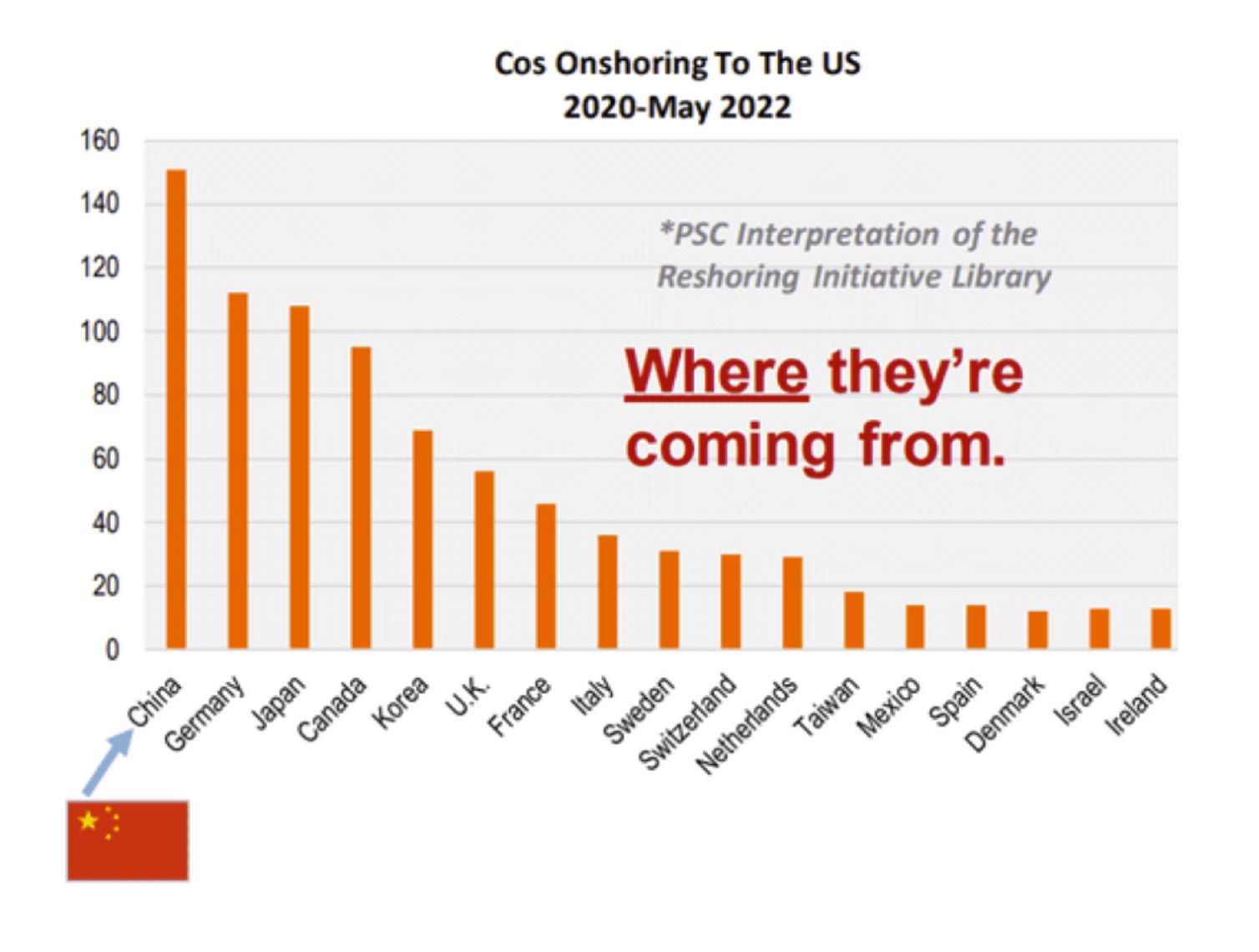

US continues to see more and more companies returning to America.

What does it mean – Check out the chart below. The American dream is real. Businesses recognize the value of the rule of law, intellectual property protection, a healthy job market and an at will employment vs. mandates. They are seeking talented, educated work force that is motivated. And finally, a low corporate tax rate.

If Governor Newsom helped businesses, lowered taxes in CA, reduced and eliminated burdensome regulation on everything businesses build, makes, or grows. Enforces the rule of law, he would not have to run silly adds in FL attacking a governor who gets it and is open for business. Poor CA. It was not long ago we were the envy of the nation.

Could you imagine seeing 150 companies come back to CA from FL and TX.

Reminds me of the old Beach Boys song, California Dreaming. Enjoy the song. Let’s keep making every day the very best.

https://www.youtube.com/watch?v=zBHz_V59RpM

Let’s roll America,

Doug De Groote, CFP®, MBA, CTC

Managing Director