What Happened Last Week and What It Means to You: Week Ending July 25, 2025

Initial jobless claims for the week ending July 19 decreased by 4,000… Yet, if you are unemployed or a recent college graduate you may be finding it difficult to find a job.

What does it mean – Continuing jobless claims for the week ending July 12 increased by 4,000 to 1.955 million. The low level of initial jobless claims implies a relatively solid labor market. However, the elevated level of continuing jobless claims continues to frustrate folks seeking full time employment and is an added difficulty in finding a new job in the event one gets laid off by their employer. It looks like the employer is back in the driver’s seat after several years of watching employees switch from job to job seeking flexible work schedules and remote work.

Unemployment falls to 4.1%… The June Employment Situation Report featured a decline in the unemployment rate to 4.1% from 4.2% and a relatively solid 147,000 increase in nonfarm payrolls.

What does it mean – While the labor force participation rate decreased to 62.3% from 62.4%, overall, the numbers point to a strong labor market.

The median sales price decreased 2.9% yr/yr to $401,800… Yet the average sales price increased 1.1% yr/yr to $501,000.

What does it mean – At the current sales pace, the supply of new homes for sale stood at 9.8 months, versus 8.4 months in the year-ago period. From the data, it looks like buyers are getting squeezed. Rates are up and more of their paycheck is going to pay for the mortgage, insurance, and taxes than ever before. According to recent figures the average buyer is putting out over 46% of their monthly income to pay for their housing. Historically that number was roughly 1/3 of one’s household income.

The key takeaway from the report is that the pace of sales remained near the lowest level of the year with sharp decreases in sales in the Northeast and the West masking the gains in the Midwest and the South. There was quite a bit of pressure on the median selling price, as homes priced between $300,000 and $399,000 accounted for 35% of all sales (2025 high), up from 25% in May. Good luck trying to find a single family home in that range in Southern California.

Factory orders surged 8.2% month-over-month in May… After a tough April and all the fear of tariffs, factory orders are on a run.

What does it mean – The key takeaway from this report is that business spending picked up in May. US manufacturing saw much improved activity following the pause on reciprocal tariffs announced in April and the subsequent de-escalation in the U.S. tariffs.

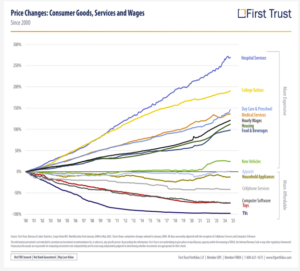

Is it inflation?… Or could it be massive government regulation and overreach and a fed a government that printed massive amount of money devaluing your $dollar?

What does it mean – When I saw the chart below and looked at the goods, services and wages that have seen the highest inflation and increase in costs and reduction in quality and could not help but to see governments hands all over it. Since 2000 we have seen a massive increase in the cost of services and goods the government has inserted itself in through more control, regulation and mandates.

• Hospital Care up nearly 275%

• College tuition is up 190%

• Day Care and Pre K care up 150%

• Medical and Health Care up 140%

• Hourly Wages up 125%

• Housing up $120%

• Food expenses up 100%

Since 2000 everything the government has injected itself into through increased regulations from healthcare, lending, hourly wages, food and housing has led to massive increases. While not the sole issue driving up costs, it is one of the main factors across goods and services highlighted below.

This is further proof that continued encroachment into the private sector by big government and the new version of communism trumpeted by AOC, Bernie, the squad, and now the candidate for Mayor in NY, also known as Democratic Socialism, will continue to lead us to inferior services, higher costs, and a slowing economy, hurting every citizen. Government run stores and housing is not the answer. It is theft. America, stop the steal!!

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.