What Happened Last Week and What It Means to You: Week Ending August 15, 2025

Continuing Jobless claims decreased…Continuing Jobless claims decrease by 15,000 to 1.953 million for the week ending 8/2/25.

What does it mean – If the BLS is right, layoffs are low, but finding a new job, if laid off, is taking longer.

The Conference Board’s Consumer Confidence Index rose to 97.2 in July…While the consensus was 95.5, it was revised up from 93.0 in June.

What does it mean – While not exuding confidence, the consumer is on the bubble but still spending.

Demand PPI up 3.3% year-over-year…With the index for final demand is up 3.3% year-over-year, versus 2.4% in June shows remarkable growth.

What does it mean – The overall economy is on the move with very little inflation as fuel and energy down and food back in line with expectations and demand.

Total CPI increased 0.2% month-over-month…The food index was flat month-over-month and was up 2.9% year-over-year. Much better than the previous few years.

What does it mean – The one outlier was footwear. Blame it on MAHA. People must be walking more. The footwear index rose +1.4% month-over-month following a 0.7% increase in June. Both readings in the last couple of months are higher than normal.

Light truck domestic truck sales increased 8.9% to 9.72 million… Sales are up 6.8% above a year ago according to first quarter numbers.

What does it mean – In football it is often said when a player flat out runs through or over the opposition, you could hear the announcer, or the crowd go wild with exclamations and excitement that their player just “trucked” the other guy. It is synonyms with action and grit. The light truck market has often been a signal of middle-class expansion and optimism. Historically a spike in light truck sales was a prelude to more manufacturing, construction, and overall business in America. Always a great statistic showing the power and excitement of an iconic American standard. The Truck!!

Homes on the market going up significantly…Nevada leads the way as it has seen a 52.9 percent year-over-year increase in the number of homes on the market.

What does it mean – According to Realtor.com, sellers in Nevada are now more willing to negotiate prices, as luxury homes are sitting longer at a median of 64 days on the market. “At the very top of the market, prices for homes at the $6 million-plus range are down 15.21 percent, compared with the 6.78 percent national decrease,” the report states.

Across the nation, California ranked fourth on the inventory list, with almost 78,000 active listings this July compared to 57,148 in July 2024. The state’s median home price was $750,000.

According to this same report and the data from California Association of Realtors, it shows that only about 13 percent of the people in the Los Angeles metro area can actually afford to buy a home here in Los Angeles.

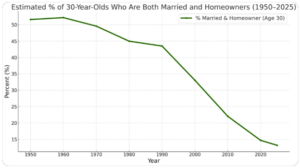

Record low!! Both married and home ownership at age 30 at record low…According to data from the U.S. Census Bureau, the below chart estimated the percentage of 30-Year-Olds Who Are Both Married and Homeowners from 1950-2025. The analysis is based on data from the U.S. Census Bureau, academic reports, and social media insights, conducted as of August 4, 2025.

What does it mean – While human behavior is consistent it can be influenced. Marriage, home ownership, children, all happen under natural desires and conditions. Yet, as economic pressures and bap policy mounted we begin to witness the slowdown in family formation with generation X. It was put on steroids with the millennials and now generation Z is realizing the fallacy they have been sold by society and media.

Historically we watched generation after generation mary in their mid 20’s, buy their first home in their late 20’s, have children, be in more debt as a percentage of income in their 30’s and consume more junk food as a household in their late 30’s and early 40’s than at any other time in life as they fill their children with Doritos, soda, and fast food. They upgrade to their largest home in their 40’s and as they reach their 50’s they go through their mid-life crisis get their biggest raise as the kids start to go off to form their own families and the cycle starts over for the next generation.

Yet, this current trend and over 2,000 years of history and studies from the ancient Greeks to the current professors and experts throughout our country have witnessed family formation shifting dramatically due to economic constraints, government policy, and societal norms that have pushed the boundary of behavior. Most importantly the last 60 plus years have torn at the thread of society leaving our economy and society in a dangerous place.

One could show that over 60 years of failed government policy has created the unintended consequences that have dramatically led to the slowing of family formation and undermining of home ownership and stunting the economic wellbeing of an entire generation and possible two or three. The massive decline in home ownership has paralyzed the millennial generation and many of generation Z. It is affecting the overall economy, personal and social stability, the rule of law, and psychological wellbeing of our children, their children and possibly generations to come. Below is a chart and the numbers. You can extrapolate the cause and what you think may have caused this.

- 1950: Approximately 50%.

- 1960: Stable around 50-52%, with a slight peak.

- 1970: Begins to decline to around 48%.

- 1980: Drops to approximately 45%.

- 1990: Stabilizes briefly at 43-44%.

- 2000: Notable drop to around 35%.

- 2010: Further decline to 28-30%.

- 2020: Falls to about 15%.

- 2025: Projected to decline to around 12% (based on social media posts).

Fear leads to more bad policy…State Capitalism has destroyed every sector it has touched. Just look above and what it has done to home ownership. Will the government increase its exposure to corporate ownership and increase its already large stranglehold on our economy and free markets?

What does it mean – U.S. Government signals possible purchase of 10% to 20% of chip maker Intel and others along with wanting equity in companies that benefited from the CHIP’s Act.

While investors will love it in the short term it is sure to destroy competition, allow the government to pick winners and losers, stifle innovation and creativity, reduce capital creation in that sector and the overall economy. Got to ask yourself, are you willing to invest in a company competing against a competitor that has unlimited resources that are backed by the government?

While I like what Howard Lutnick and Scott Bessent have been doing and no one can argue the deals that they have done that have led to massive investments in America.

Yet, if you recall when President Biden signed the CHIP’s Act, I commented in this letter it amounted to corporate welfare to some of the richest companies in the world with no teeth or accountability. While Lutnick and Bessent are trying to reign in the money and make the biggest of these beneficiaries accountable to the corporate welfare the previous administration gave them.

Two wrongs do not make a right. The CHIP’s act was sold as in investment in technology but had nothing in place to protect the American taxpayer. It was a technology handout to chip companies hoping they would invest in manufacturing here at home. Yet, the last thing we can afford is more government and to go further down the path of State Capitalism. I am strongly against this. This misguided path to accountability and creating a value for the taxpayer must be re-examined. The taxpayer already is partnered with corporate America through the ongoing stream of taxes in the form of income taxes, payroll taxes, Medicare, Social Security etc. Not to mention many government pension plans already own the stock and can vote for or against the board already.

Lutnick and Bessent claim that the U.S. Government, that granted nearly $10 billion to Intel through the CHIP’s Act signed by Biden, should be followed up with government ownership as management at Intel has failed to deliver what was promised under that Chip’s act. Further, an investment of an additional $10 billion would righten the ship at Intel and that investment should come in the form of equity.

Intel has a lot to answer for, and the board and its CEO are far from exemplary citizens or good stewards. Yes, accountability is right and needed and not to mention the new CEO has massive ties to China. That alone should have been a massive red flag for the Biden administration but that is another issue we can discuss later.

At the same time, I find it interesting. The CHIP’s act gave out record amounts of money that amounted to record corporate welfare to these companies including Taiwan Semi-Conductor, to only watch this administration come in and get massive investments from companies like Taiwan Semi-Conductor that the previous administration gave $billions to without any accountability and did little to increase investments under the previous administration. One may conclude that the real value to Taiwan Semi-Conductor and other companies around the world is not what we give them but what they get access to and what they may lose if they do not play by the rules. Tariffs brought them to the table as it threatened access to the U.S. consumer and economy. The lesson we have learned and may need to reinforce with some, is the American consumer is the engine of the world and innovation; creativity and demand start in the USA. Companies don’t need a handout but a reason to stay. To invest, manufacture, create, innovate, hire and compete to solve the consumer needs and demands here in the USA.

America’s not so good history of State-run Agencies and government intervention. America has been flirting with State Run Capitalism, also known as Socialism, since the 1930’s. Since the 1930s, our government has paid farmers not to farm or to farm certain crops.

During the 1970’s in desperation to right a wrong the government caused this by going off the Gold Standard and putting the printing press in overdrive. The U.S. ushered in and instituted price controls. Compounding government control they double and triple down on more government control as they differentiated between industries and even individual companies within industries. At the very same time, the US government capped oil prices, restricted branching by Savings and Loans and would not let banks pay interest on checking accounts. Talk about massive government overreach. The 70’s made the squad and swamp creatures in DC look like raging capitalists. Unfortunately, it’s the same BS but with way better marketing and a lot of folks who have never studied our constitution or civics.

For decades the government set up and financially backed and operated Government Sponsored Enterprises (GSEs), like Fannie Mae and Freddie Mac. Thes GSE’s run by the government are responsible in part for holding mortgage rates artificially low which distorted the housing market. These agencies allowed people and corporations to bid up the price people were/are willing to pay for the existing homes due to artificially low rates, while many state and local governments make it difficult to build new housing.

Another GSE is Sallie Mae. This organization has taken over the entire student loan origination process and manages most of the payment process at a massive cost to the American taxpayer and student. Sure, it guaranteed anyone who can breathe could get a student loan including illegal aliens at the expense of the American citizen. No wonder the price of tuition at a UC school has doubled since the takeover under Obama in 2010. Not to mention that average student graduated in 2024 with $37,850 in student loans. Prior to the takeover by the government in 2010 the average student graduated from college with $20,470 in debt according to the study by the Education Data Initiative. And let’s not forget the last administration ran on forgiving over a $ trillion in student loans.

State capitalism is not new. History is littered with well-intentioned ideas, unfortunately government is not in a position nor capable of running, managing, and unable to be accountable to the success or failure of these programs. When it is in charge, it often picks winners and losers trying to influence society like we saw during the mortgage crisis in 2008 and 09.

Here is a quick look at some long-standing interferences in the market by government. Ethanol subsidies and gas mileage requirements (which, contrary to the narrative about Trump were recently watered down by the Big Beautiful Bill. The Biden Administration allocated green energy subsidies to favored firms under the Inflation Reduction Act, the CHIPS Act favored semiconductor production in the US, and the Nippon-US Steel takeover was originally blocked for political reasons.

The last administration saw an aggressive EPA and an overbearing government constantly looking for a reason to expand its control. They forced manufacturers to change lightbulbs, stoves, dishwashers, toilets, washing machines, and dryers. None of this is new. Yet should we tolerate it? What are the unintended consequences? Has the reality of those unintended consequences proven to be worse than the short-term fear?

While this interference in markets began long ago, it was George W. Bush who provided the perfect opening for socialism and communism during the Financial Panic of 2008-09. President George W. Bush bizarrely announced that he had to violate free market principles to save free markets. What???

2008 led to mark-to-market accounting procedures. It turned a manageable loss in housing values into a once-in-a-century financial panic. Yet, instead of adjusting those accounting practices because it would hit the poorly managed banks that made loans to people who could not afford them due to pressure from the Equal Lending Act and numerous other government programs that oversaw lending standards and regulated banks. These very same policymakers set up TARP to bail out the Big Banks. These are the very bureaucrats and elected officials that actually provided the banking guidelines and regulations that allowed for the largest economic collapse in our lifetimes. Their rules and regulations set the stage for this to happen. At that same time the very same regulators, elected officials and bureaucrats also designed an auto bankruptcy (remember GM) that bailed out Big Labor and launched multiple rounds of Quantitative Easing.”

Due to the massive harm inflicted by the policy reaction to the 2008-09 crisis. Government leaders then and over the last 50 years have paved the way for a bigger, more intrusive government. It will take a massive attitude shift to stop both sides from justifying the government owning corporations. The unintended consequences are numerous, and the outcome will be no different than what every other country has experienced around the globe. From Nazi Germany to Tojo’s Japan, to Russia to South Africa, Zimbabwe, China, Brazil, Venezuela, the list goes on and on. Socialism, communism and planned economies have never worked nor have government owned enterprises.

Why would this be any different? Rules for thee but not for me. Will our government demand a seat at the board table? Will an elected official be placed on a board making a huge board salary to buy his votes to protect a failing project or policy? Government officials are famous for passing laws but never enforcing them on the ruling class. I.E. insider trading and mortgage fraus to name a few.

Regardless of side, we now have one coin. And both sides are seeking the same solution through two different arguments.

Heads, one side argues that the government deserves equity in a company because Congress and President voted to give money to a company to protect Americas financial and security interest. That the money given deserves a return to satisfy the taxpayers and ensure that the company lives up to its obligations. Who wouldn’t want a return on their investment and encourage corporate leaders to be good stewards and protect Americas interests?

Tails, we get an emotional plea urging equality and redistribution of the country’s wealth. Without the government regulating, controlling, and having an interest in the company it would create division and unfair outcomes for the underserved in society. That with governments help, we can preserve our future and protect Americas interest by creating a partnership that benefits all citizens. Yet, that partnership exists in spades. No matter what that company makes in income after expenses, the company has a partner that has never put in one penny, risked capital or had to make payroll. That partnership is forced through taxes on profits, employment taxes, forced benefit packages etc.

While different sides of the coin with different reasoning to justify the same outcome, neither side is on solid ground. If the American people allow congress to flip this coin, we will get the same outcome. It is dangerous and will lead us closer to a state-run socialist economy and will only compound the disaster we inherited from the 2008 crisis.

I would rather face the tough reality of failure and bankruptcy and live in a country that protects and promotes the individual’s pursuit of happiness, protects private ownership and limits government and promotes individual liberty and free markets. It is what built this country and made it the Greatest Nation the World has ever seen.

I have all the confidence in our citizens under a limited government protected by our Constitution. Remember a government big enough to give it is also big enough to take it away. Let’s reward success, encourage doers, never stop trying and let failures fail. The lessons learned are worth the journey.

As for national security, our elected officials should do everything they can to make it so rewarding and prosperous for businesses and entrepreneurs that there is no other place they would want to be. They will go to the ends of the earth to protect that freedom and opportunity. And by the way, it already exists, and it is protected by the Constitution of the United States of America. And we are blessed we call it home.

As the famous astronaut and future CEO of Eastern Airlines Frank Borman once said, “Capitalism without bankruptcy is like Christianity without hell.”

The future will challenge us, and we will face tough times. Yet, with nearly 250 years of history and our constitution in hand, we are well prepared and have roadmap to guide us through the next 250 years.

Let’s roll America!!

Doug De Groote, CFP®, MBA, CTC

Managing Director

De Groote Financial Group, LLC is a federally registered investment adviser that maintains a principal office in the State of California. The information contained in this message is confidential, protected from disclosure and may be legally privileged. If the reader of this message is not the intended recipient or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that any disclosure, distribution, copying, or any action taken or action omitted in reliance on it, is strictly prohibited and may be unlawful. If you have received this communication in error, please notify us immediately by replying to this message and destroy the material in its entirety, whether in electronic or hard copy format.